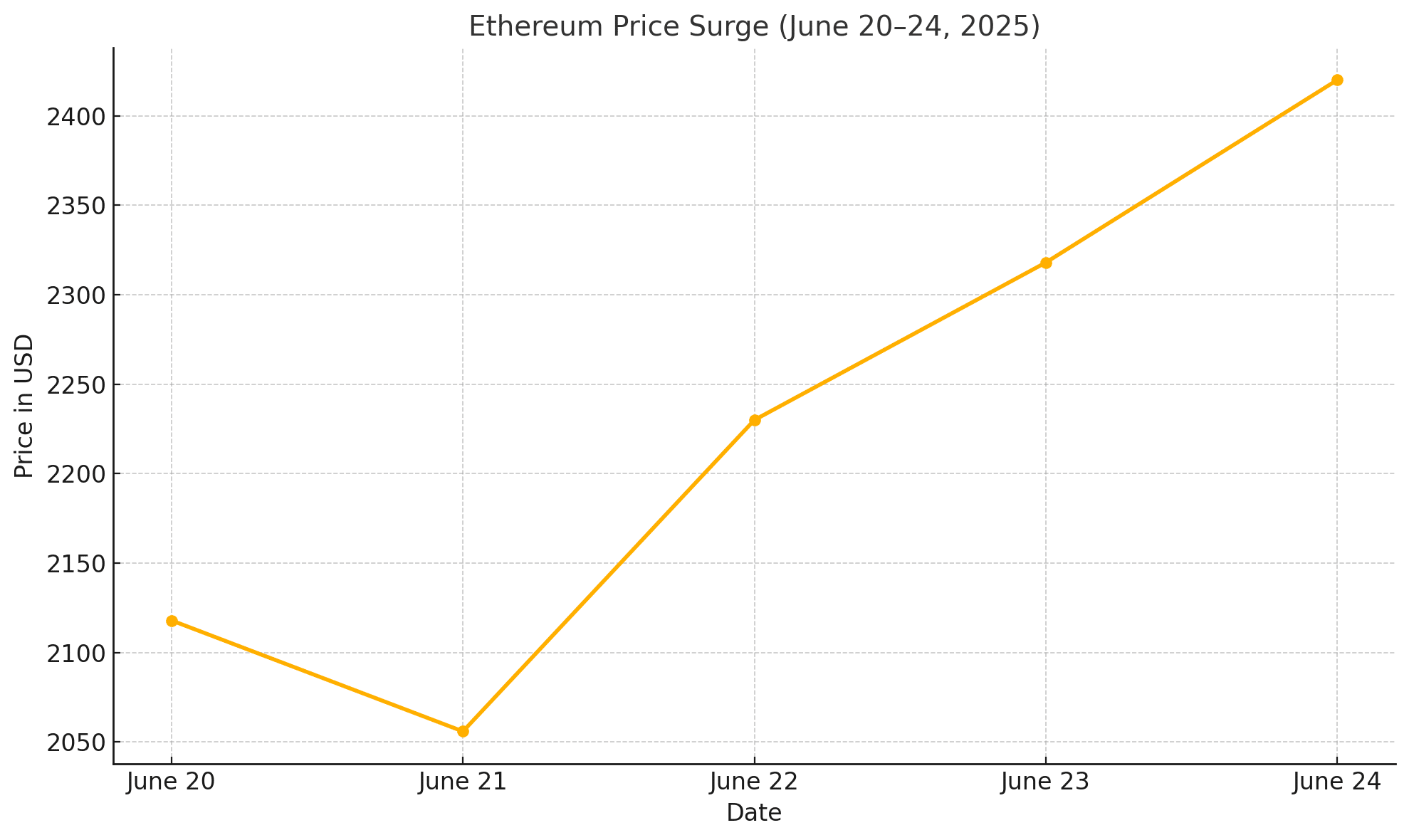

he Ethereum price surged by 9% on June 24, 2025, as former U.S. President Donald Trump announced a breakthrough ceasefire deal between Israel and Iran. This geopolitical move instantly triggered a market-wide risk-on reaction, with Ethereum leading the crypto rebound.

From an intraday low of $2,202, the Ethereum price climbed to a high of $2,429 before settling slightly below $2,420. The surge was further bolstered by strong whale activity, record-breaking new address creation, and renewed investor confidence in the digital asset market.

Ethereum Price Table

| Date | Open Price | Close Price | % Change | Volume (24h) |

|---|---|---|---|---|

| June 20 | $2,072 | $2,118 | +2.22% | $18.1B |

| June 21 | $2,118 | $2,056 | -2.93% | $17.6B |

| June 22 | $2,056 | $2,230 | +8.45% | $21.4B |

| June 23 | $2,230 | $2,318 | +3.94% | $24.3B |

| June 24 | $2,318 | $2,420 | +4.4% | $28.7B |

Ethereum Whale Accumulation and On-Chain Growth

The spike in the Ethereum price was not merely speculative. Blockchain data shows that over $265 million worth of ETH was accumulated by whale wallets within 24 hours. Meanwhile, the Ethereum network is witnessing a 50% year-over-year increase in new addresses, now averaging over 1 million additions per week.

This combination of whale support and network growth reinforces the sustainability of the recent rally. On-chain indicators suggest a renewed uptrend rather than a short-lived pump.

Technical Indicators Signal More Upside

Multiple technical indicators back the bullish case for the Ethereum price:

The 200-day moving average has been reclaimed after three weeks below.

The Relative Strength Index (RSI) is climbing but remains below overbought territory at 68.

MACD has turned bullish for the first time in two months.

Analysts now eye $2,500 as the immediate resistance level. A break above could set the Ethereum price on a path toward $2,650–$2,800 in July, barring any fresh macro shocks.

Trump’s Announcement and Crypto Sentiment

Trump’s ceasefire deal acted as a macro risk reset. Traders across equities, FX, and crypto poured back into risk assets. The dollar weakened, and safe-haven flows reversed, creating room for digital assets like Ethereum to surge.

According to Reuters, Trump’s announcement reduced immediate Middle East tensions, improving global investor sentiment. This reflects how Ethereum price is increasingly influenced by macro geopolitics, not just network updates or ETF rumors.

Social Buzz: Is It Real or Just Hype?

While some traders celebrated the bounce, others remained skeptical. One Reddit comment summed up the cautious optimism:

“It’s just greed again. Feels like a bull trap. But if it sticks, we may finally see ETH past $2,500.”

Still, when combined with strong technicals and fundamentals, many believe this Ethereum price breakout could be the start of a bigger move.

Ethereum Price Outlook: What to Watch

If the current momentum continues, traders should watch:

$2,500 Resistance: Crucial psychological and technical level.

$2,650–$2,800: Next key breakout zone if strength sustains.

Federal Reserve and Economic Data: Inflation or rate shifts may challenge current bullish momentum.

Whale Wallet Monitoring: Continued accumulation signals trust from deep-pocketed investors.

What Investors Should DO

For investors, this Ethereum rally is more than just a news-driven spike, it’s a convergence of positive fundamentals and macro triggers. With whales accumulating over $265 million in ETH and the network gaining 1 million new users weekly, Ethereum’s utility and long-term value continue to grow.

If you are considering a strategic entry point, monitor the $2,500 level closely. A confirmed breakout above it could signal the start of a more extended upward cycle in the Ethereum price.

Final Thoughts

The Ethereum price has once again proven its sensitivity to global headlines. Trump’s ceasefire announcement didn’t just cool geopolitical tension; it ignited a broad rally in risk assets, with Ethereum at the forefront.

Backed by strong on-chain fundamentals, whale buying, and bullish technicals, the Ethereum price now looks poised to challenge $2,500 in the coming sessions. Whether it can sustain above that level will depend on macro developments and continued market enthusiasm.

Short Summary

The Ethereum price jumped 9% following former President Trump’s announcement of a ceasefire between Israel and Iran. This geopolitical relief sparked a broad crypto rally, with Ethereum leading due to strong whale accumulation and network growth.

Technical indicators point to further upside, with $2,500 as the next major resistance. Analysts view this as a potentially sustainable move, bolstered by improved market sentiment and macro clarity. The Ethereum price is now closely watched by both institutional and retail investors.

FAQs

Why did the Ethereum price rise suddenly?

The Ethereum price jumped due to Donald Trump’s ceasefire announcement, reducing geopolitical risk and driving investor confidence.

What are Ethereum’s key resistance levels now?

Ethereum faces resistance at $2,500, with higher targets at $2,650 and $2,800 if momentum continues.

Is this rally sustainable?

Given whale accumulation and strong technical indicators, the rally shows signs of sustainability, barring macroeconomic shifts.

Glossary of Key Terms

Ethereum Price: The current market value of one unit of Ether (ETH), Ethereum’s native cryptocurrency.

Whale Wallets: Large crypto holders or institutions that can influence prices through high-volume transactions.

Ceasefire Rally: A surge in asset prices triggered by geopolitical peace announcements.

RSI (Relative Strength Index): A technical indicator used to gauge whether an asset is overbought or oversold.

MACD (Moving Average Convergence Divergence): A momentum indicator that shows trend direction and duration.

On-Chain Metrics: Blockchain-based data such as transaction volume, wallet creation, or token holding patterns.

Risk-On Sentiment: A market condition where investors favor riskier assets due to increased confidence or reduced global threats.