Ethereum price remains steady, consolidating near a key resistance level. Despite this, whales and institutional investors are taking advantage of the dip to accumulate significant amounts of ETH. This shows growing bullish sentiment in the market.

Major Ethereum Accumulation by Whales and Institutions

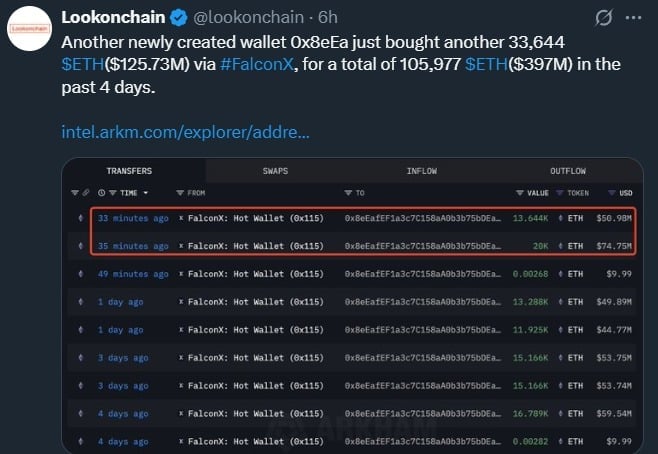

In the past 24 hours, blockchain trackers like Lookonchain and Onchain Lens reported significant accumulation. A new wallet, 0x8eEa, has acquired 33,644 ETH, valued at $125.73 million. This raised the wallet’s total holdings to 105,977 ETH, worth $397 million.

Another new wallet bought 32,640 ETH worth $122.18 million through OTC deals. Its total holdings now stand at 43,787 ETH, valued at $163 million.

SharpLink Gaming, a publicly listed company, also joined the buying spree. It purchased 79,949 ETH last week, raising its total holdings to 360,807 ETH. This marks a 29% increase from the previous week.

Ethereum Price Holds Steady Amid Accumulation

Despite these massive purchases, Ethereum’s price has barely moved. ETH is currently at $3,682, showing a modest 0.90% increase in the last 24 hours. However, trading volume has dropped by 17%, suggesting lower market participation.

AMBCrypto’s analysis reveals that ETH’s price is in an uptrend. However, after a 35% gain, it is now facing profit-taking. The price began to consolidate when ETH neared the key resistance level of $4,000. Still, ETH has not seen a major drop.

The Role of Key Support Levels

Ethereum has repeatedly found support at $3,586. This level has become crucial for both investors and traders. If the price falls below this point, ETH may see an 8% decline, potentially reaching $3,300.

However, if the price holds above $3,586, Ethereum price could rally to retest the $4,000 level. The market sentiment will play a key role in the asset’s next move.

Liquidation Levels and Bearish Sentiment

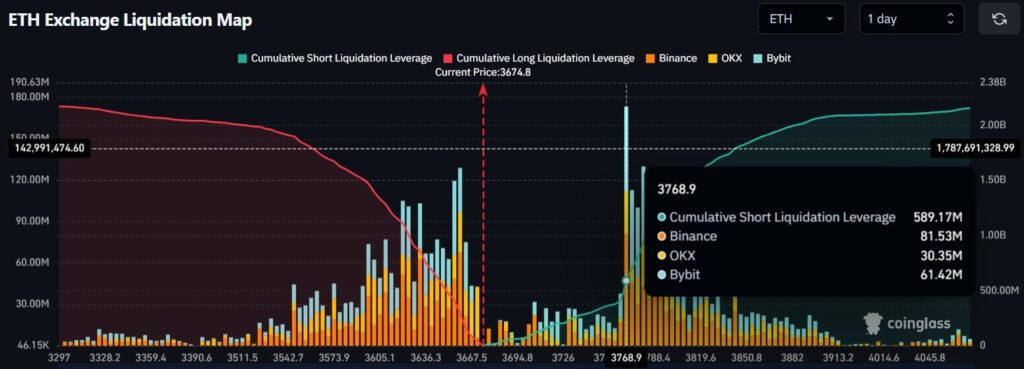

On-chain data from CoinGlass shows major liquidation levels. At $3,359.7, traders hold $290 million in long positions. On the higher end, at $3,768.9, $589.17 million in short positions are built. This suggests a bearish outlook, as traders expect ETH to struggle to break past the $3,768.9 resistance in the near term.

Ethereum Outperforms Bitcoin

Ethereum has significantly outperformed Bitcoin (BTC) over the past few months. The ETH/BTC ratio has risen by 72% since April, from 0.018 to 0.031. This is the highest level since January 2025. Ethereum price performance suggests a shift in investor sentiment, favoring ETH over Bitcoin.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jul 2025 | $ 3,576.71 | $ 3,927.25 | $ 4,300.67 | 18.30% |

| Aug 2025 | $ 3,767.72 | $ 4,529.08 | $ 5,439.02 | 49.61% |

| Sep 2025 | $ 4,879.33 | $ 5,626.17 | $ 5,957.30 | 63.87% |

| Oct 2025 | $ 5,167.11 | $ 5,999.26 | $ 6,720.93 | 84.87% |

| Nov 2025 | $ 5,134.61 | $ 5,542.62 | $ 6,022.35 | 65.66% |

| Dec 2025 | $ 4,968.01 | $ 5,181.23 | $ 5,496.53 | 51.19% |

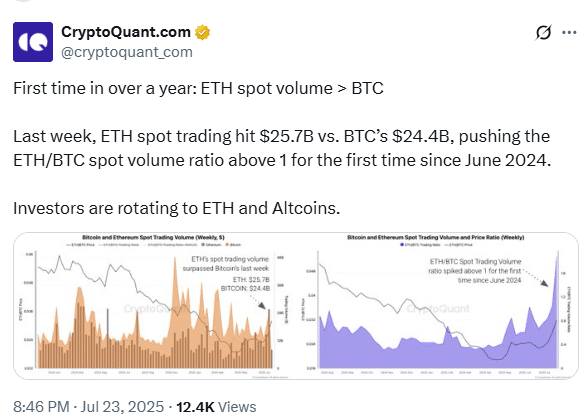

ETH also recently overtook Bitcoin in weekly spot trading volume. ETH saw $25.7 billion in volume last week, slightly surpassing Bitcoin’s $24.4 billion. This marks the first time since June 2024 that Ethereum has led in spot volume, signaling a major shift in market dynamics.

Ethereum ETFs and Institutional Inflows

Ethereum’s growing institutional appeal is clear. The ETH/BTC ETF holding ratio has increased from 0.05 to 0.12. This indicates that institutions are increasingly favoring Ethereum price. Ethereum ETFs have seen 15 consecutive days of inflows, while Bitcoin ETFs are experiencing outflows.

On-chain flows confirm this trend. Fewer ETH are moving onto exchanges compared to Bitcoin, indicating lower sell pressure on Ethereum price. This creates room for continued growth, provided demand remains strong.

Declining Bitcoin Dominance and Increased Altcoin Activity

Bitcoin dominance continues to slip. Glassnode data shows that Bitcoin’s market share has dropped from 63.76% to 60.78% in just one week. This sharp 2.98% decline highlights a growing shift toward altcoins, particularly Ethereum. As capital rotates out of Bitcoin, Ethereum is seeing increased interest from investors.

This shift in market dynamics is a positive sign for Ethereum price future. With more traders and institutions turning to Ethereum, the asset is poised for further growth.

Conclusion

The consolidation of the price of Ethereum is a significant step in its price trend. The asset has a good potential as whales and institutions are strong accumulators in the long term. The outperformance of Ethereum over Bitcoin and the increased institutional interest is all indicative of a great future of ETH.

Ethereum has already gained excellent support and may experience additional rises in case of its arrival, overcoming resistance. The change in the dynamics of the market, where the dominance of Bitcoin is getting weaker and the interest in altcoins is rising, is also favoring the Ethereum price. Ethereum will also rise in the months ahead as it is already cementing itself in the market.

Also read Ethereum ETFs Soar with $534M Inflow.

Summary

The Ethereum price is consolidating around an important resistance after weeks of sustained bullish momentum. Nonetheless, both whales and institutional investors have been acquiring ETH but in large volumes as revealed by blockchain trackers.

The new wallet acquired 33,644 ETH with a market value of $125.73 million and increased holders to 105,977 ETH. Ether has done better than Bitcoin over the past months, and ETH ETF inflows are going up higher.

Frequently Asked Questions (FAQ)

1- Why is Ethereum price consolidating?

Ethereum’s price is consolidating after experiencing strong upward momentum, with market participants eyeing key resistance levels at $4,000 and key support at $3,586.

2- Are institutional investors still accumulating Ethereum?

Yes, institutional investors, including companies like SharpLink Gaming, have been accumulating Ethereum in large quantities, further driving up demand.

3- What are the key support and resistance levels for Ethereum?

The key support level for Ethereum is currently at $3,586, while the critical resistance level lies at $4,000. A price shift beyond these levels could influence Ethereum’s next move.

4- How has Ethereum performed compared to Bitcoin?

Ethereum has significantly outperformed Bitcoin, with the ETH/BTC ratio increasing by 72% since April, marking a shift in Ethereum’s favor.

Appendix: Glossary of Key Terms

ETH (Ethereum): A decentralized, open-source blockchain system that enables smart contracts and decentralized applications (dApps) to run without interference from third parties.

Whales: Large investors or entities that hold significant amounts of cryptocurrency, often capable of influencing market trends due to their sizable holdings.

OTC (Over-the-Counter): A method of trading financial assets directly between two parties without using an exchange, often for large volumes of assets.

Resistance Level: A price level at which an asset tends to face selling pressure, preventing it from moving higher. Traders often use this as an indicator of potential price reversal.

Support Level: A price level where an asset tends to find buying interest, preventing it from falling further. It is seen as a floor beneath the asset’s price.

Institutional Investors: Large organizations, such as hedge funds, mutual funds, and pension funds, that invest in financial markets.

ETF (Exchange-Traded Fund): A type of investment fund traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or cryptocurrencies.

References

AMB Crypto – ambcrypto.com

Crypto News – crypto.news