Ethereum price has been rather volatile in the recent time frames and oscillations around the key resistance levels. This has led to a series of challenges to its upward trend, and its price has somehow struggled to break through $2,750 in the short term. Although social media activity seems to indicate the opposite and exchange balances have also seen sizable gains, the overall sentiment remains more optimistic for Ethereum.

Key Developments in Ethereum’s Price Action

Ethereum for the first time attempted to aim for a higher high above the $2,750 that and go above $2,780; however, the price could not break $2,850 region. This peak was recorded at $2,847 and then dropped tremendously. The price moved below the $2,700 and $2,650 levels and established a low at $2,605. At the time of writing, Ethereum is trading above $2,700 but in consolidation mode as the 100-hourly SMA shows an upward trajectory on the chart.

Overview of Current Market Conditions

Ethereum price still fluctuates and changes, with key technical parameters having a potential buy signal as well as a sell signal. On the bullish side Ethereum’s, there is a resistance around the $2,725 region and a stronger one at $2,750. If bulls break past the $2,750 level, ETH could target $2,850 up to and including its nearest target at $3,000 in the near term.

On the other hand, failure to overcome the $2,725 regain the price may lead to further decline as it indicated in the chart above. The first line of support is found at $2,660, below which the price falls to $2,600, or even below it in case of sustained bearish pressure.

Social Dominance and Market Sentiment Shift

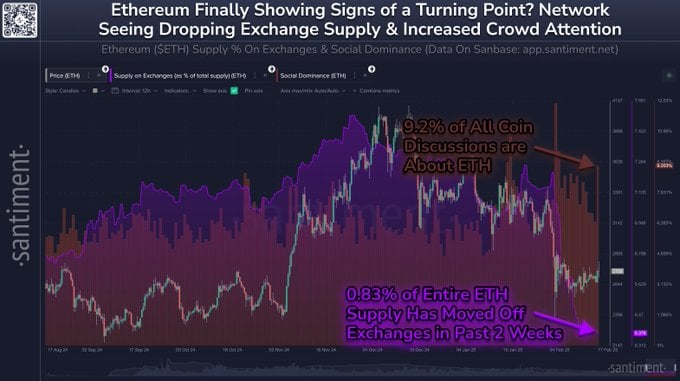

A peculiar pattern concerning Ethereum’s social activity has become apparent. Santiment data reveals that ETH has touched a high of 9.2% in Social Dominance. This metric tracks Ethereum’s share of discussions within the cryptocurrency sector on major social media platforms. Cryptocurrency discussions, and specifically ETH, occupy approximately tenths of all online discourse. This may mean that there is new social activity that can be attributed to the growth of interest in the asset by the community of retail investors at a time when the asset is struggling with price oscillations.

This spike in social sentiment corresponds with a similar shift in the ‘exchange balance’ of Ethereum. Based on this metric, 0.83% of the total ETH supply has pulled out in the last few weeks, with only 6.38% remaining on centralized exchanges. This points to the fact that investors are now holding their investments off-exchange for short-term speculative or long-term investments.

Resistance and Support Levels to Watch

ETH is in consolidation status now, some of the level to watch out are the resistance and support levels.

Resistance Levels: The first level is at $2,725 and the second level of resistance is at $2,750 level. If ETH goes above $2,750, the price could climb up to $2,850 and possibly more.

Support Levels: The first support region is at $2,660 followed by a support cone at $2,600. If it falls further below this level, the ETH price may go down to $2,550 or below that level.

Potential for a Bullish or Bearish Trend?

The price level is hovering around crucial supports and is, therefore, critically dependent on whether it can violate resistance levels or remain secure. Hence, there is a possibility of bullish sentiment emerging, bringing further social dominance and consequently leading to a higher exchange supply, unlocking higher price targets.

However, if upon retracement Ethereum is not capable of breaking the resistance level and continues to face bearish pressure, more downward movement could be expected.

Conclusion

The current state of Ethereum price can be described as an unstable market with the presence of both technical resistance and support points, as well as an increasing rate of appeal on social networks. In order for ETH to recover and continue its upward trajectory, it needs to overcome the resistance between $2,725 and $2,750. In this case, $2,850 and even $3,000 may be on the horizon in the near future. On the other hand, if the price goes lower than this range, further price drops to $2,600 or even lower may be observed.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1- What has caused Ethereum’s price to be volatile recently?

Ethereum’s price has been fluctuating around key resistance levels, struggling to break past $2,750 despite social media buzz and shifts in exchange balances.

2- What are the resistance and support levels for Ethereum right now?

Ethereum faces resistance at $2,725 and $2,750, with support levels at $2,660 and $2,600.

3- How does Ethereum’s social dominance impact its price?

Ethereum’s rising social dominance, now at 9.2%, suggests growing community interest, potentially driving future price increases.

4- Could Ethereum reach $3,000 in the near future?

If Ethereum breaks through the $2,750 resistance, it could target $2,850, and possibly even reach $3,000.

5- What could happen if Ethereum fails to break past its resistance levels?

Failure to break resistance could lead to further price declines, with key support levels around $2,660 and $2,600.

Appendix: Glossary of Key Terms

Resistance: A price level where selling pressure is strong enough to prevent further price increases.

Support: A price level where buying interest is strong enough to prevent further price declines.

Social Dominance: The percentage of cryptocurrency discussions involving Ethereum compared to other cryptocurrencies on social media platforms.

Supply on Exchanges: The portion of a cryptocurrency’s total supply held on centralized exchanges.

Consolidation: A phase where the price moves within a range, showing neither clear bullish nor bearish trends.

Fib Retracement: A technical analysis tool used to predict potential levels of support or resistance based on previous price movements.

Bullish Sentiment: Market optimism where investors expect prices to rise.

References

NewsBTC – newsbtc.com

Bitcoinist – bitcoinist.com

TradingView – tradingview.com

CoinMarketCap – coinmarketcap.com