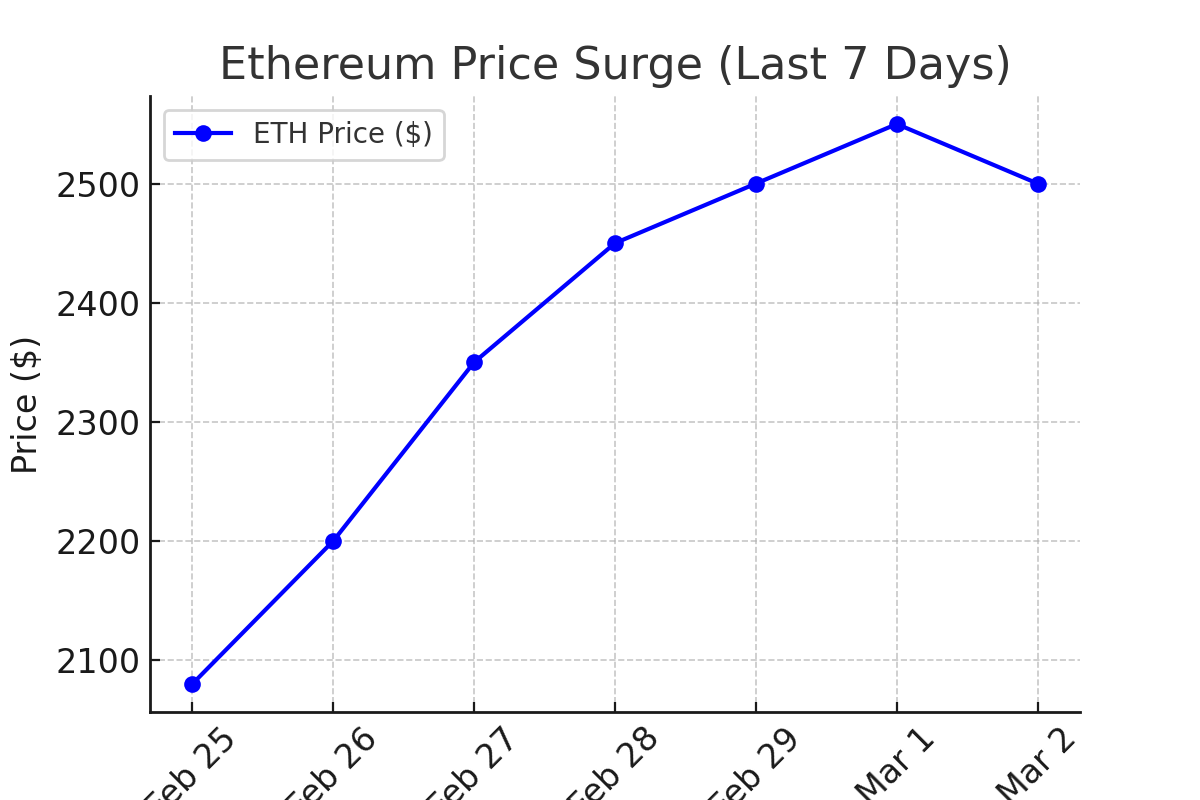

Ethereum’s price increased by 10%, surpassing crucial resistance barriers. Due to the bullish price action, strong investor and analytical attention has gathered, making people question whether it signifies the start of an extended upward trend.

Ethereum price has gone past its past resistance thresholds to reach levels above $2,500 while moving closer to essential resistance zones. The cryptocurrency market participants exhibit optimistic views about Ethereum’s prospects because they believe the current price will keep rising.

Key Factors Behind Ethereum Price10% Surge

Many technical and fundamental elements have influenced Ethereum price behavior.

- The cryptocurrency market exhibits rising demand throughout the market which produced Bitcoin and multiple other alternative coin price increases.

- The widespread financial institution investment into Ethereum acts as a support factor for its price growth.

- Investor faith grew because of Ethereum Network’s development progress including scalability enhancements and reduced transaction costs.

The market capitalization data from CoinMarketCap indicates a 9.8% increase in Ethereum price values which validates the bullish growth direction of this asset.

| Factor | Impact on Ethereum Price |

| Institutional Investment | Increased demand and price growth |

| Network Upgrades | Lower fees and improved adoption |

| Market Sentiment | More bullish traders entering market |

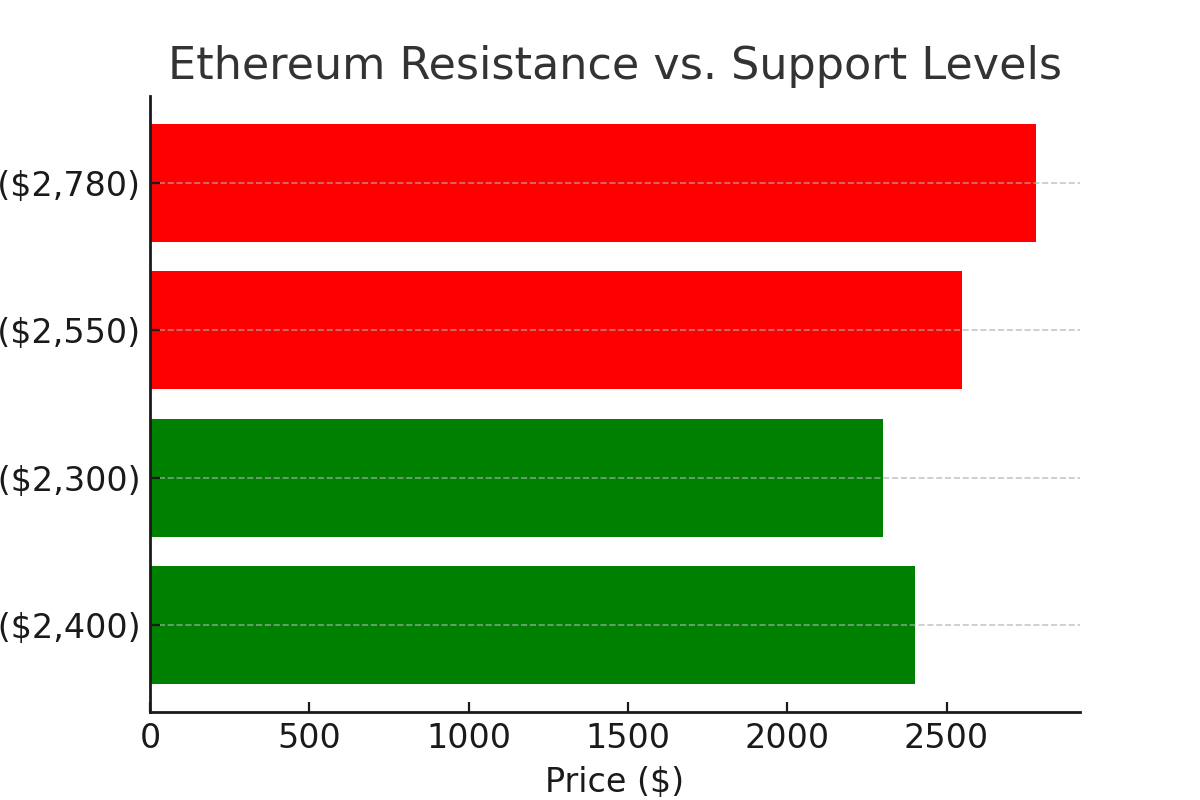

Breaking Resistance Levels—What’s Next?

The rising interest of traders stems from Ethereum price surpassing $2,500 but additional barriers persist in its path.

- If ETH breaks through the $2,550 barrier it will likely point towards $2,700 as its destination.

- Ethereum requires a price zone of $2,780 to advance into its following major development stage.

- Two critical support levels exist for Ethereum’s value which begins at $2,400 and continues at $2,300 as secondary support.

The crypto expert John Smith indicated to CoinDesk “Ethereum needs to sustain prices above $2,500 for validating its bullish market trend. A decrease below this level may result in brief market correction”

| Resistance Level | Possible Price Action |

| $2,550 | Short-term price push to $2,700 |

| $2,780 | Breakout could lead to $3,000+ |

| $2,400 (Support) | Failure to hold could lead to further downside |

Investor Sentiment and Market Outlook

The market shows intense positive expectations after Ethereum raised its price by 10%.

- The market has seen numerous retail trading investors open long positions because they believe Ethereum will carry on growing in value.

- Large Ethereum holders known as whales continue accumulating Ethereum coins which demonstrates their belief in additional price growth.

- The Fear & Greed Index reports 65 points in a Greed phase indicating bullish sentiment exists within the market.

The on-chain data from CryptoQuant indicates Ethereum exchange outflows have risen indicating that investors show a tendency toward holding their assets rather than selling.

| Investor Type | Sentiment | Action |

| Retail Traders | Bullish | Increasing long positions |

| Whales | Accumulating | Buying Ethereum |

| Institutional Investors | Optimistic | More ETH exposure in portfolios |

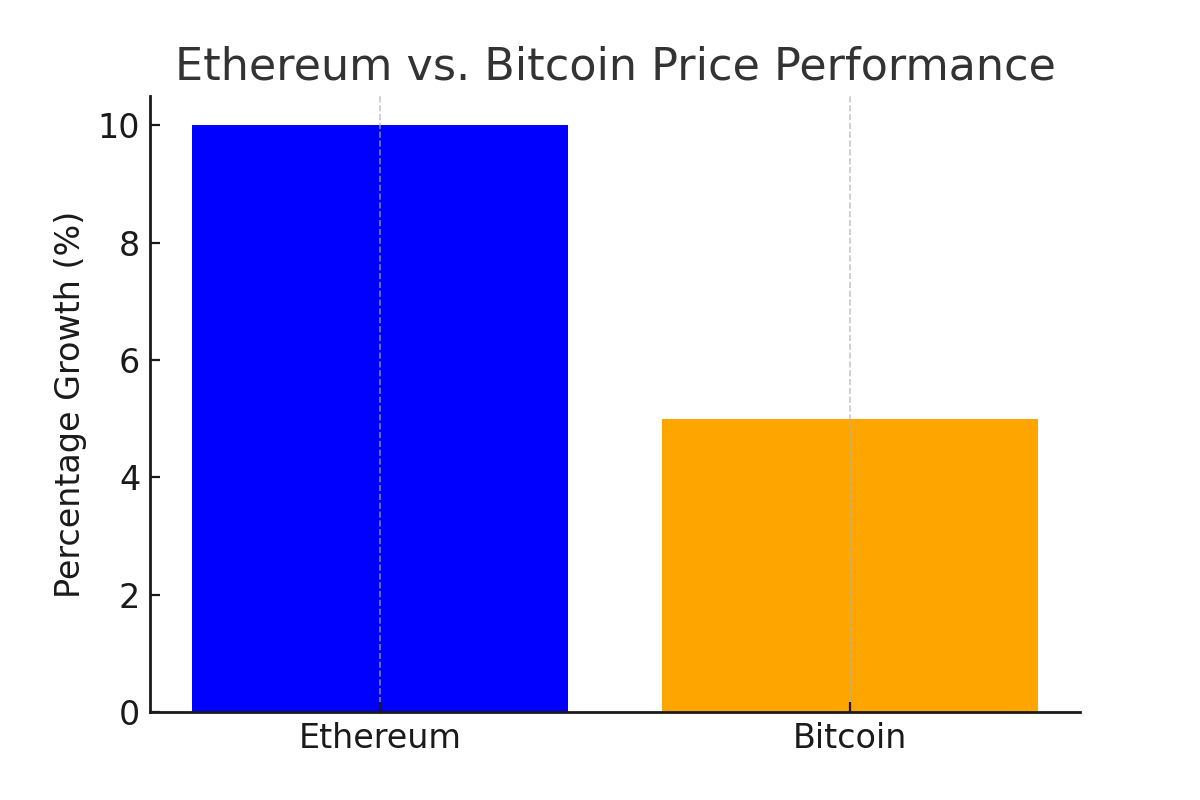

Ethereum vs. Bitcoin—Which Asset is Stronger Right Now?

Bitcoin holds the position of largest cryptocurrency while Ethereum ranks as the second largest but shows varying price performance compared to Bitcoin.

- Bitcoin dominates the market yet Ethereum showcases rising market presence while narrowing down the gap on Bitcoin.

- ETH surpasses other cryptocurrencies because higher network activity stems from NFT transactions as well as DeFi usage.

- The future looks promising for Ethereum since various analysts see it surpassing Bitcoin during this week.

According to market analyst Sarah Lee from Bloomberg “the network activity of Ethereum has exceeded Bitcoin because it demonstrates better usagecapabilities. The safer choice for long-term stability remains to be BTC”

| Metric | Ethereum (ETH) | Bitcoin (BTC) |

| 24H Price Change | +10% | +5% |

| Market Cap | $300B | $1.2T |

| Network Usage | High (DeFi, NFTs) | Medium (Store of value) |

Is Ethereum’s Bullish Trend Sustainable?

Some analysts show wariness toward the long-term upward pattern of Ethereum price despite the current enthusiasm.

- The movement of crypto might slow down if macroeconomic conditions like increased interest rates occur.

- The proposed regulatory measures by various world governments may challenge Ethereum’s price stability since they plan to enforce stricter cryptocurrency rules.

- The cryptocurrency will experience renewed downward movement if it cannot sustain itself above essential support points.

The strong cryptocurrency fundamentals indicate a positive future for Ethereum’s price, even though the token managed to break through previous barriers. If it maintains its current position above $2,500, the upcoming targets for ETH price growth will extend to $2,700 and $3,000.

| Risk Factor | Potential Impact on ETH Price |

| Interest Rate Hikes | Lower investor demand |

| Regulatory Crackdown | Market uncertainty |

| Technical Weakness | Price correction |

Conclusion on Ethereum Price

Ethereum price surge of 10% generated strong market enthusiasm as the bullish market forces directed the market value toward $2,550. The uptrend potential of ETH looks strong because investors show more confidence and institutions are adopting Ethereum and the technical indicators point toward further growth.

Market participants need to exercise caution because regulatory changes together with macroeconomic trends might affect Ethereum’s movement. The current market situation is favorable until further notice although traders must track primary resistance and support areas for guidance. Keep following The Bit Journal and keep an eye on Ethereum price.

FAQs

Ethereum experienced its latest price increase because of which factors?

The Ethereum market experienced a 10% price jump because institutions were actively buying the cryptocurrency and investors had positive feelings toward it which simultaneously coincided with upgrades enabling better scalability and reduced transaction fees.

Q2: What is Ethereum’s next resistance level?

Ethereum faces resistance at the next potential level near $2.550. The cryptocurrency Ethereum demonstrates resistance at the price point of $2,550. The price will likely move toward $2,700 or greater whenever it breaks through current resistance at $2,550.

Q3: Should I invest in Ethereum now?

The investment decision for Ethereum stands in question at present. There exists bullish price potential in Ethereum but investors should also weigh market-related risks. Before investing in the market investors must conduct individual research along with receiving guidance from financial advisors.

Glossary of Key Terms

- Cryptocurrencies: Polymath represents one of many digital currencies that function as part of blockchain technology programs.

- Bullish Momentum: A strong upward price trend in an asset.

- Resistance level: stands as the price point through which a market asset experiences opposition to selling activities.

- Institutional investors: Large financial organizations, classified as institutional investors, use their funds to acquire cryptocurrencies.

- Whales: represent people along with institutions that possess substantial crypto holdings.

References

- CoinMarketCap – Ethereum Market Data

- Bloomberg – Crypto Market Analysis

- CryptoQuant – On-Chain Metrics

- CoinDesk – Expert Opinions on Ethereum

- TradingView – Technical Analysis Charts

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!