Ethereum, the world’s second-largest cryptocurrency by market cap, has reached a significant new high. On November 10, it climbed to $3,200, marking its highest level since August. This bullish movement followed Bitcoin’s own rally to a record-breaking $79,000, a surge spurred by the election results of former U.S. President Donald Trump’s latest victory.

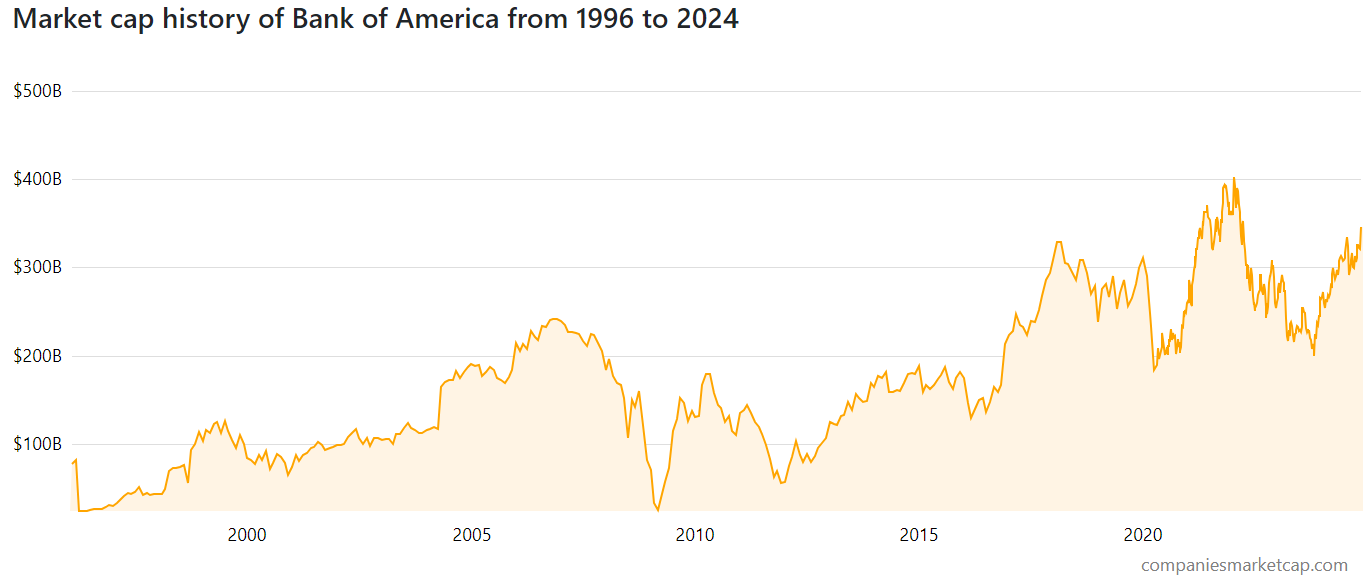

ETH Market Value Outpaces Bank of America

According to CoinMarketCap data, Ethereum’s (ETH) market value now stands around $383 billion, marking a 5% increase within 24 hours. This leap has enabled it to surpass Bank of America by approximately $40 billion, signaling a pivotal shift in the dynamics of financial markets. Blockchain’s rise is beginning to outpace traditional finance (TradFi), reflecting the growing adoption of decentralized finance (DeFi) and crypto assets. This shift aligns with the U.S. SEC’s current discussions about listing the first options tied to ETH spot exchange-traded funds (ETFs), further highlighting crypto’s increasing influence.

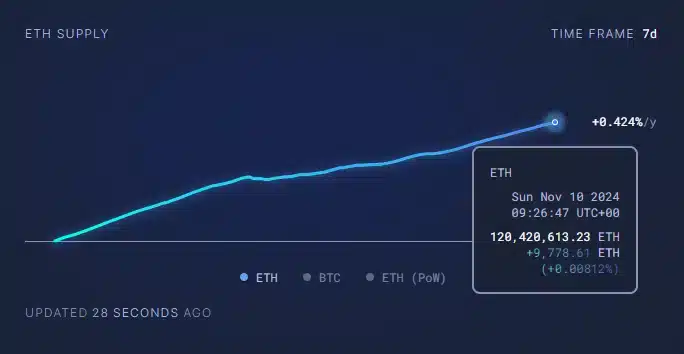

Ethereum’s price experienced its most significant weekly movement since May, supported by Bitcoin’s relentless push for new all-time highs (ATHs). However, ETH’s supply inflation rate increased to 0.424% over the past week, reflecting the current annual issuance rate, which, according to Ultrasound.money, sits at 957,000 ETH. In contrast, the annual burn rate is 452,000 ETH, leading to a slight annual supply expansion of 0.42%.

Analysis and Price Predictions

Analysis and Price Predictions

Crypto analysts on X remain optimistic about ETH’s upward trend, with many predicting another ATH on the horizon. One analyst anticipates that ETH will “easily break the $4,000 mark,” while Poseidon, another X commentator, expects a minor pullback before ETH crosses the $4,300 threshold.

On November 9, Ethereum’s co-founder Vitalik Buterin introduced a concept he calls “knowledge finance,” which he describes as a discipline that starts with a fact you want to learn and culminates in a market that best brings forth that insight from participants. Buterin advocates for prediction markets free from media influence, allowing public expectations to be shaped by collective insights into future events.

Key Takeaways

Ethereum’s recent performance demonstrates a clear shift in financial dynamics, as DeFi and blockchain technologies challenge established players. This trend, combined with rising mainstream acceptance and investor interest, sets the stage for continued momentum within the crypto space.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Analysis and Price Predictions

Analysis and Price Predictions