Ethereum is once again in the spotlight as institutional investors appear to be making bold moves ahead of a potential rally. According to fresh on-chain data, a crypto wallet linked to ConsenSys has quietly accumulated over 161,000 ETH—worth approximately $422 million—through Galaxy Digital’s OTC desk over the past three weeks.

$422 Million Accumulated, Staking Strategy Emerges

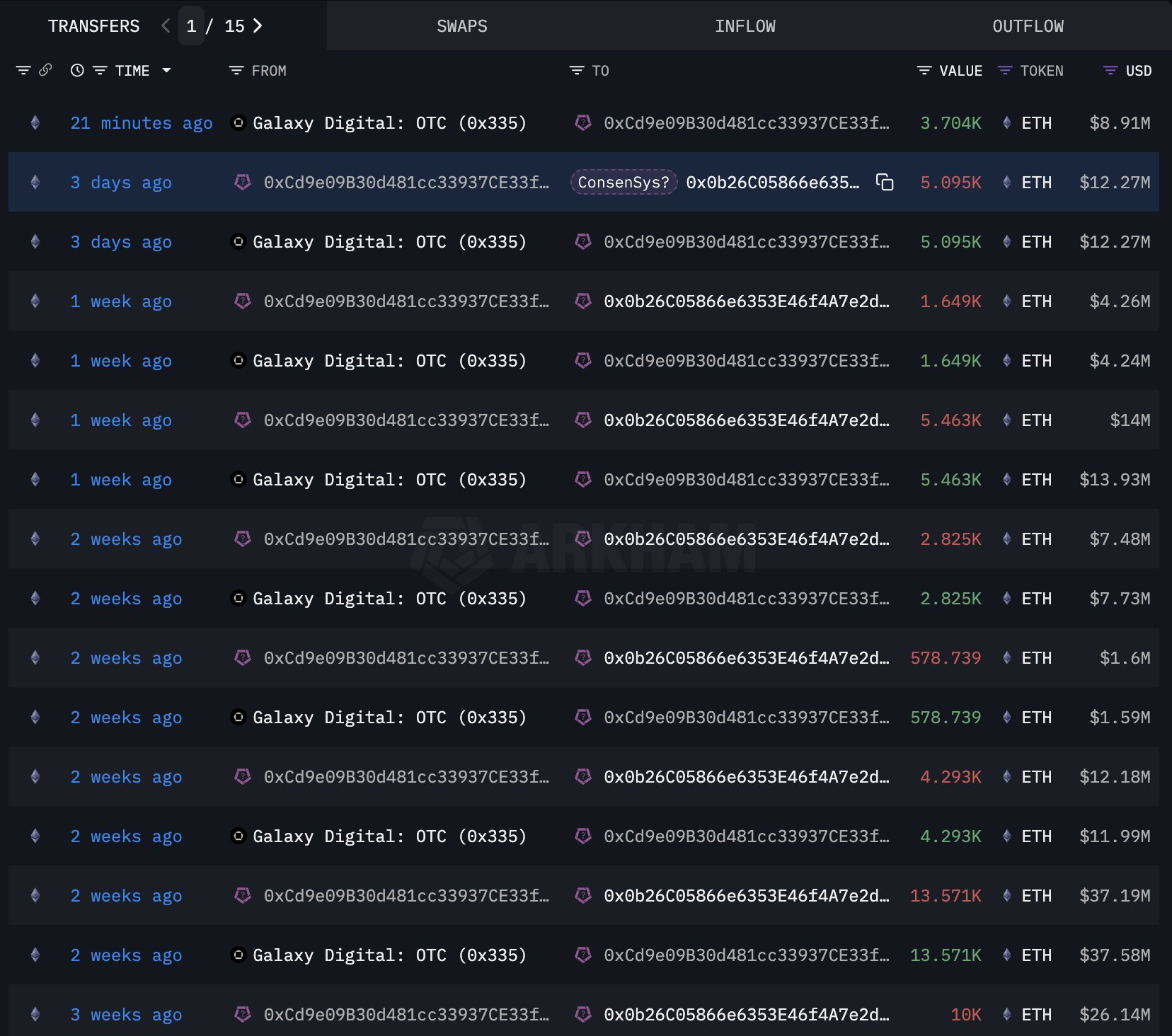

Blockchain analytics platform Lookonchain revealed that the most recent transaction, dated June 24, 2025, involved 3,704 ETH valued at $8.91 million. Interestingly, a significant portion of these holdings has been redirected to a wallet containing Liquid Staked ETH (LsETH). This shift suggests a deliberate strategy focused on long-term staking rewards, not just speculative gains.

The activity signals that major Ethereum holders—possibly corporate or fund-driven—are positioning for sustained exposure to ETH rather than short-term trading. The nature of LsETH usage further implies a sophisticated investment thesis that leverages both asset appreciation and yield generation.

Binance Transfer Sparks Speculation

In a separate but equally notable event, Whale Alert flagged a massive 28,000 ETH transfer—approximately $67 million—from Binance to an unidentified wallet. Such transactions are typically interpreted as cold storage moves, often a precursor to long-term holding strategies. Combined with a recent 7% price jump in Ethereum, the transfer strengthens the case for growing institutional interest.

Technical Indicators Support Bullish Outlook

Ethereum’s technical setup appears to be aligning with this on-chain momentum. The RSI (Relative Strength Index) has rebounded, suggesting renewed bullish sentiment. Analysts are eyeing the $2,500 resistance level; a confirmed breakout could trigger a broader price surge.

If Ethereum forms a golden cross—a bullish crossover of short and long-term moving averages—the $2,750 level could be tested as early as July. Meanwhile, crypto analyst Michael van de Poppe highlighted that reclaiming the 0.023 level on the ETH/BTC pair could set the stage for an even more aggressive upward move.

Conclusion: Quiet Accumulation, Loud Signal

The combination of stealth accumulation, staking-oriented strategies, and strong technical signals paints a clear picture: institutional confidence in Ethereum is returning. While market sentiment remains cautious, smart money appears to be making its move—silently but decisively.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

Lookonchain. On-chain analysis of Ethereum wallets. www.lookonchain.com

Whale Alert. Large transaction monitoring. www.whale-alert.io

CoinTelegraph. “Ethereum’s Technical Indicators Turn Bullish.” www.cointelegraph.com