Ethereum is once again at the center of market speculation, this time driven by the actions of a previously inactive Ethereum whale staking a sizable amount of ETH despite an unrealized loss. As this high-profile transaction stirred interest, a contrasting trend has emerged: retail traders are exiting the market en masse. The divergence in behavior has revived a familiar question: who’s usually right at turning points?

Dormant Ethereum Whale Resurfaces with $18M Stake

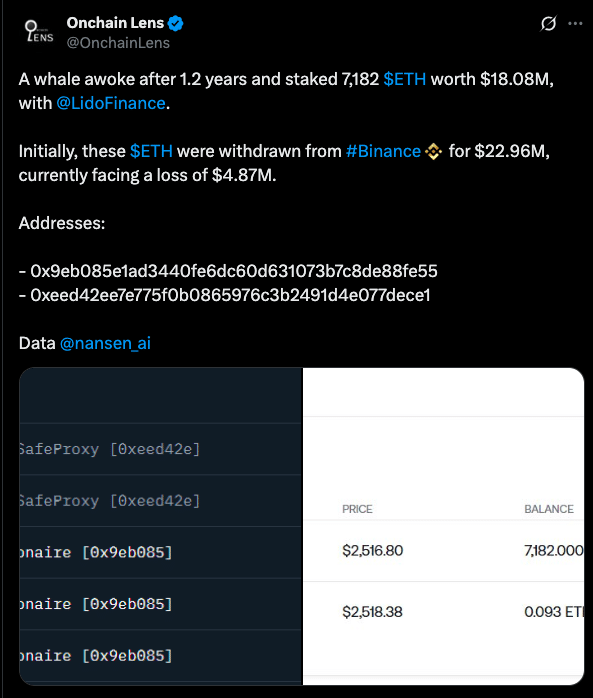

After more than a year of inactivity, a whale wallet holding 7,182 ETH resurfaced to stake its entire balance through Lido Finance, a popular Ethereum staking platform. The stake, valued at approximately $18.08 million, was originally acquired at $22.96 million, indicating a $4.87 million paper loss.

Rather than liquidating during a period of weak price action, the wallet’s owner opted to lock in the assets for yield, often interpreted in crypto circles as a signal of long-term confidence. The move is a tactical use of staking to mitigate holding risk and potentially accumulate more ETH via rewards, rather than sell into unfavorable conditions.

This isn’t an isolated action, according to data from IntoTheBlock, Ethereum whales collectively accumulated over 613,000 ETH within a 24-hour window. This kind of aggressive buying suggests that large investors still see opportunity in the current range, even as Ethereum struggles to regain bullish momentum.

Retail Sentiment Is Moving in the Opposite Direction

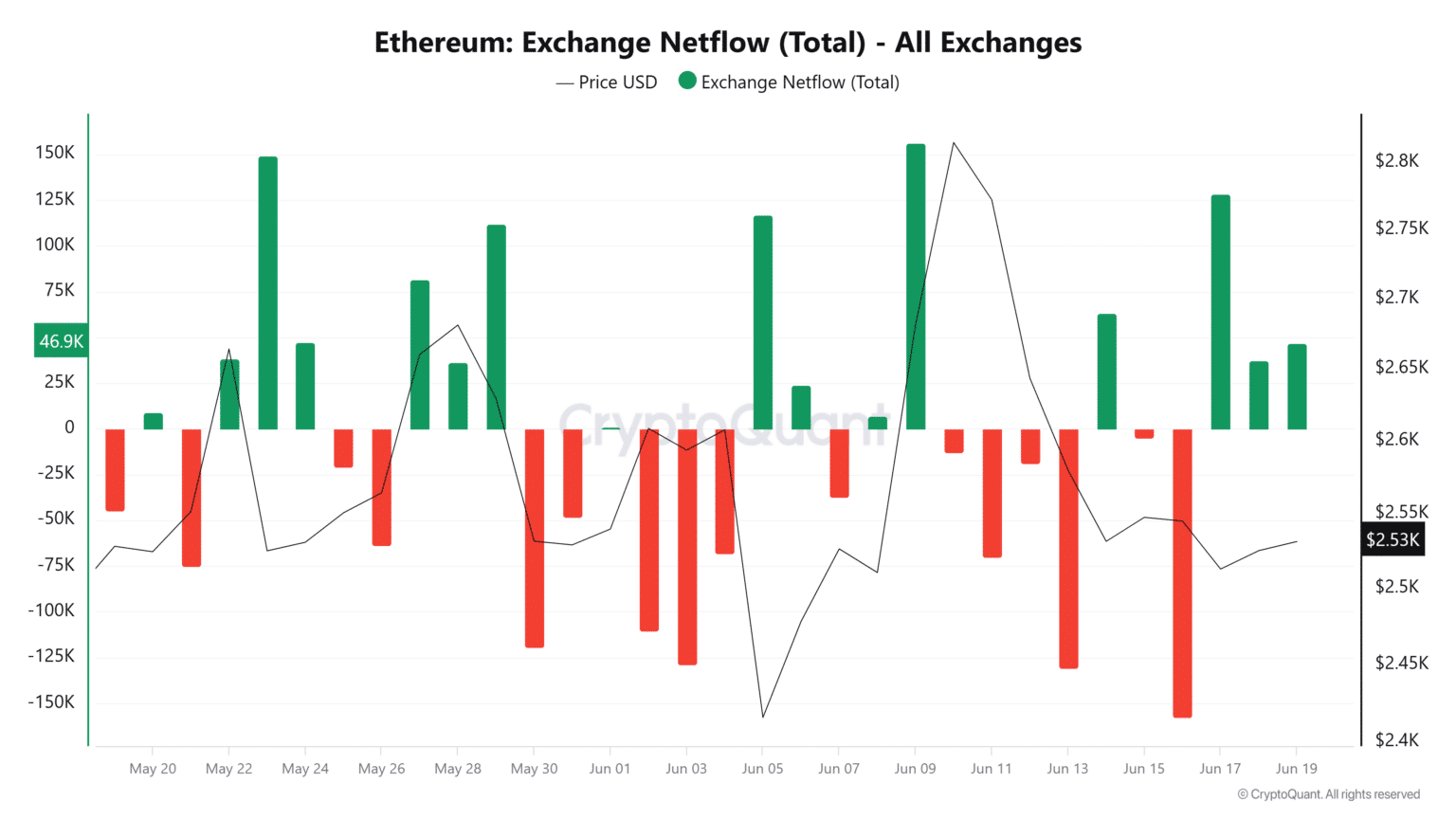

Retail traders, however, seem to be heading for the exits. On-chain data indicates an uptick in Ethereum sent to centralized exchanges, a classic sign of intent to sell. Over the last three days, more than 46,900 ETH flowed into exchange wallets, according to CryptoQuant metrics.

This influx into trading platforms suggests that smaller holders are either cutting losses or locking in profits, unsure of ETH’s near-term direction. The behavioral gap between large and small investors is widening, setting up an uncertain narrative heading into the latter half of June.

Indicators Hint at Caution

Technical signals lean bearish. The Stochastic RSI has fallen into oversold territory, slipping from a peak near 72 to as low as 8. Such a sharp drop suggests momentum has shifted decisively toward sellers. A similar outlook is supported by the Relative Vigor Index (RVGI), which recently posted a bearish crossover.

The $2,500 level, aligned with Ethereum’s 50-day Simple Moving Average, is emerging as a crucial threshold. If price action breaches this zone, the risk of a significant drop increases, with some analysts projecting a potential fall toward the $1,200 region, especially if the current selling pressure escalates.

Whale vs. Retail: Which Side Has the Edge?

Ethereum whale accumulation during downturns has often preceded price rebounds. These entities are typically more patient and better capitalized, able to ride out volatility while collecting yield. Retail, by contrast, tends to react more sensitively to price swings, sometimes exiting too early or during bottoms.

However, this time may be different. The Ethereum market is increasingly influenced by macroeconomic uncertainty, a lack of major DeFi catalysts, and fragmented narratives around scalability and competition from other L1 chains like Solana and Avalanche. That said, the recent ETF tailwinds and rising on-chain staking activity could provide a soft floor beneath current prices if whales continue to accumulate.

Conclusion: Compression or Capitulation?

The battle between conviction and caution is unfolding as Ethereum drifts between critical price zones. The market remains range-bound, with ETH struggling to stay above $2,500 while failing to convincingly hold above key moving averages.

If the $2,500 level holds, a return to higher support zones around $2,600–$2,750 could materialize. If it doesn’t, the bearish case strengthens, and ETH may revisit levels not seen since Q1.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What does Ethereum whale staking mean?

It refers to large holders staking their ETH tokens, locking them in smart contracts to earn rewards while removing them from immediate circulation.

Why did the whale stake ETH despite losses?

Rather than selling at a loss, the Ethereum whale likely aims to earn passive yield while waiting for long-term price recovery.

What are retail investors doing?

Retail traders are moving ETH into exchanges, a typical sign of increased selling activity or lack of confidence.

What price levels are critical now?

$2,438 is a key support level. A break below could lead to a deeper drop

Is this divergence between whales and retail common?

Yes, and it often occurs near major turning points. Whales accumulate as prices fall, while retail tends to panic sell, sometimes at market bottoms.

Glossary

Staking: Locking crypto tokens to earn rewards and support network operations.

Exchange Netflow: The net movement of tokens into or out of exchanges; positive netflow means more tokens being deposited (often to sell).

Stochastic RSI (Stoch RSI): A technical indicator used to identify overbought or oversold conditions.

RVGI (Relative Vigor Index): A momentum indicator used to confirm price trend direction.