According to news sources, big Ethereum whale has sold 10,000 ETH after holding for over 900 days, making a $2.75 million profit while missing out on a $27.6 million gain at ETH’s previous peak. The bad timing comes as the market is in a slump due to Donald Trump’s tariff campaign, which has sent global markets, including crypto, into a tailspin. Blockchain data also shows that the Trump-linked crypto initiative, World Liberty Financial, sold ETH at a loss during the same sell-off window.

ETH Holder Exits Position, Misses Out on $27.6M

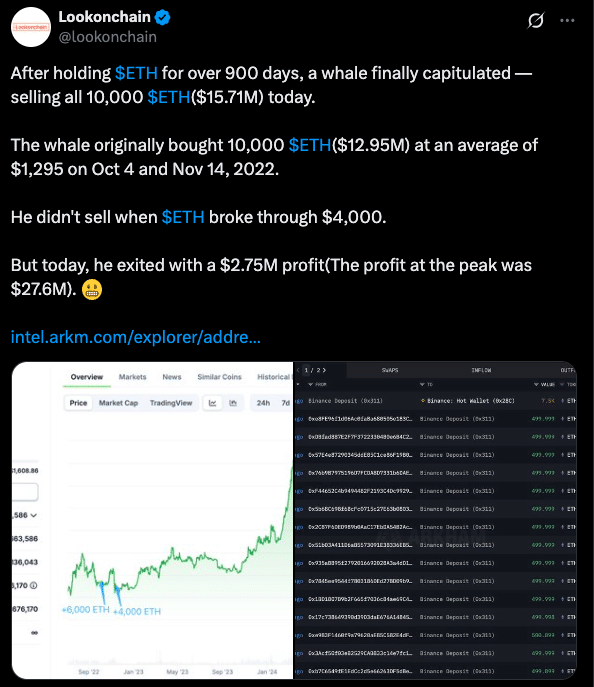

On April 8, on-chain analytics platform Lookonchain reported that a whale who had accumulated 10,000 Ether in late 2022 finally closed the position. The whale reportedly bought the ETH in two transactions in October and November 2022 at an average price of $1,295, investing a total of $13 million. Instead of selling during ETH’s surge to over $4,000, the whale held through the highs only to sell when the token had dropped to around $1,578.

“He didn’t sell when Ether broke $4,000. But today he sold with a $2.75 million profit. The profit at the peak was $27.6 million,” Lookonchain posted.

At the time of sale, ETH had lost almost 24% in the past week, dropping below $1,430. The timing of the sale reflects the broader market stress due to the global trade tensions triggered by Trump’s tariff plan.

Trump’s Tariffs Send Crypto and Equities into a Spin

The current market sell off isn’t happening in isolation. U.S. President Donald Trump had recently announced a global tariff sweep that slapped a 104% tax on Chinese imports. Other countries like India, Japan, South Korea and EU countries faced tariffs between 20% and 46%.

The move sent distress across equity markets, with the Dow Jones Industrial Average falling over 300 points and Asian indexes like Japan’s Nikkei and China’s Hang Seng dropping more than 3%. Bitcoin fell below $75,000 and dragged altcoins down with it. According to CoinMarketCap, the total crypto market cap dropped 5.8% to $2.38 trillion. Ethereum was already under pressure and dropped to a daily low of $1,386 before bouncing back.

Investor sentiment is extremely bearish with over $404 million in crypto liquidations in the past 24 hours, $304 million of which were from longs. The risk off mood was exacerbated by ETF outflows with Bitcoin spot ETFs seeing a net $327 million outflows, led by BlackRock’s IBIT.

World Liberty Financial, Trump’s Crypto Project, Sells ETH at a Loss

In an irony, Trump’s alleged crypto affiliated project World Liberty Financial (WLF) has reportedly sold ETH and not made profit. Lookonchain found a wallet possibly tied to WLF that sold 5,471 ETH for $8.01 million at an average price of $1,465. On-chain data shows WLF’s previous ETH holdings were acquired at an average of $3,259, so they took a big loss.

Before the sale, the WLF address had 67,498 ETH. The big drop suggests either panic selling or cutting losses before further downside.

WLF is especially interesting since it’s a financial vehicle that’s supposed to promote sovereignty and is now taking losses while the administration is causing market stress with tariffs.

Whales Getting Liquidated

Other whales are also getting liquidated. Reports say one big wallet injected 10,000 ETH ($14.5 million) to avoid liquidation on a 220,000 ETH position ($300 million) yesterday. Just a day before that another big player got 67,570 ETH liquidated on DeFi protocol Sky and lost over $106 million.

As whales reposition and market is getting more volatile, ETH’s long-short ratio has turned bearish. Technical analysts are saying Bitcoin could go down to $63,000-$67,000 which would take Ethereum and other alts down with it.

On-chain analytics from Santiment shows mid to long term investors might find value at these levels. Their MVRV metrics shows ETH and some alts are entering accumulation zones which are historically bottoms.

What This Means for Crypto

A long term whale exiting and a politically linked entity like World Liberty Financial selling Ethereum means even high conviction investors are getting nervous. The crypto market’s correlation with macro events (especially geopolitical ones like tariffs) is still the theme of 2025.

Some see this as a stress test for the crypto narrative as a hedge against centralized policy risk, but the data shows sentiment and liquidity are winning over ideology. Investors are waiting to see if Bitcoin and Ethereum can hold technical support or if the next drop, especially to $60K for BTC, will happen.

If Trump’s tariff war escalates without de-escalation, more volatility will follow. Until then the market is stuck in a storm of uncertainty where even whales are treading water and sometimes swimming for the exit.

FAQs

Why did the whale sell now?

Sources say the whale sold because of Trump’s tariffs and wanted to lock in profit rather than risk more losses.

What is World Liberty Financial, and why is it important?

Speculations are that World Liberty Financial is a Trump backed crypto project. Even entities endorsed by Trump are not immune to market volatility.

How have tariffs affected crypto?

Trump’s tariffs have caused risk off behavior and sharp sell offs in both equity and crypto markets including ETH.

Will Ethereum drop more?

Technical analysis suggests it could drop more depending on macro developments, key support zones are between $1,300 and $1,100.

Are whales buying or selling ETH now?

Some are exiting positions, others are putting in funds to maintain leverage or accumulate at value zones.

Glossary

ETH (Ethereum): A leading cryptocurrency and decentralized platform for smart contracts.

Whale: A crypto investor with large positions.

Liquidation: Forced sale of assets to cover loan positions, often seen in leveraged trading.

MVRV: A metric to compare market value to realized value to see if an asset is over or under-valued.

Spot ETF: An ETF that holds the actual asset (e.g. Bitcoin or Ethereum) rather than derivatives.

References

Disclaimer:

This is not financial advice. Cryptocurrency investments are risky. Do your own research or consult a financial advisor before making decisions.