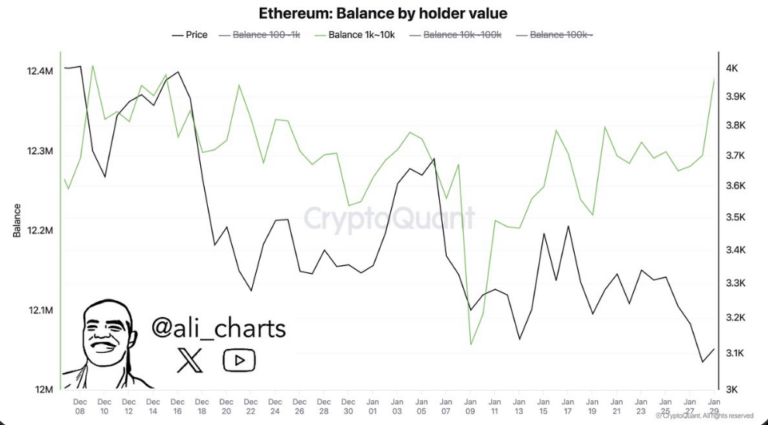

Ethereum whales are making bold moves, accumulating over 100,000 ETH amid the latest market dip. Despite macroeconomic uncertainties, Ethereum maintains a strong bullish outlook, with seasoned analysts pointing to key metrics that suggest further upside potential.

Whales Fuel Optimism with Massive ETH Purchases

According to renowned analyst Ali Martinez, large-scale investors have capitalized on the recent price drop by purchasing over 100,000 ETH. This significant accumulation highlights a strong buy-the-dip sentiment among whales. Increased buying pressure and rising interest in Ethereum signal that the long-term trajectory for ETH remains positive.

Adding to the bullish momentum, reports indicate that the Trump family project has recently acquired $250 million worth of ETH. Ethereum co-founder and ConsenSys CEO Joseph Lubin confirmed on X that this investment is linked to an upcoming DeFi initiative. While such major acquisitions hint at an upward trajectory, ETH’s price still faces volatility amid broader market trends.

Market Uncertainty Ahead of Key US Economic Data

The crypto market remains in limbo as investors await the latest PCE inflation data, set to be released later today. This anticipation has led to short-term price fluctuations across Bitcoin and major altcoins.

The Bit Journal reports that the recent FOMC decision to keep interest rates steady at 4.25%-4.50% has raised concerns over risk assets like crypto. Investors might opt to shift capital into USD-backed assets, increasing market uncertainty. However, large investors appear to be digesting the Fed’s latest decision, as reflected in Ethereum whales’ aggressive accumulation.

What’s Next for ETH?

At the time of writing, Ethereum is trading at $3,246, marking a 2% increase in the past 24 hours. The current price range fluctuates between $3,182 and $3,282. Key resistance remains at $4,000, a level that has historically posed challenges for ETH.

Despite short-term volatility, whale activity is reinforcing a bullish narrative. Crypto analyst Michaël van de Poppe shared on X that Ethereum and Bitcoin still have strong upside potential. He also noted that the DXY (U.S. Dollar Index) dynamic is shifting, suggesting a potential momentum shift favoring ETH over the dollar.

With increasing whale accumulation and a strong DeFi narrative, ETH’s future remains promising. However, investors should remain cautious as macroeconomic factors continue to influence the market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!