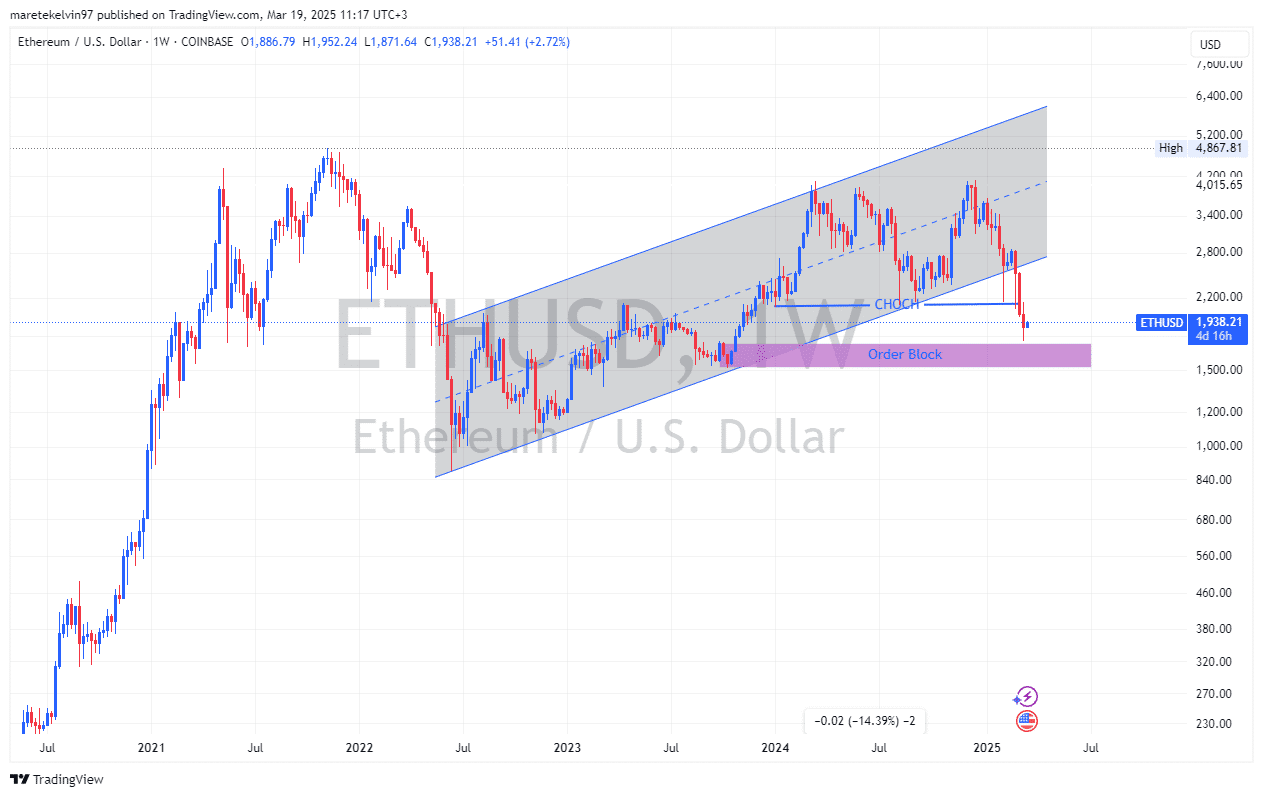

Ethereum’s market value to realized value (MVRV) ratio stood at 0.9, signaling a possible buying opportunity. Historically, an MVRV ratio below 1 has indicated undervaluation, often preceding strong bullish movements. ETH prices are testing a key demand zone at $1.6K, making this level critical for its next move.

ETH Price Signals a Bullish Reversal

Ethereum’s price has surged by over 3%, outperforming most top cryptocurrencies and showing signs of a bullish reversal. Market participants display growing optimism because the king altcoin has demonstrated power within shorter time span. The price movement indicates that whales along with dip buyers might step into the market to purchase expecting another price increase.

With the trend recently shifting to bearish, this price level remains a key factor in determining Ethereum’s trajectory. Market analysts predict a market rally because various technical indicators show their convergence at this time. The growing market involvement of institutional investors creates an optimistic environment for market movement to ensue.

The demand area established at $1.6K might maintain strong support to stop any downward movement. The resistance levels of recent times could possibly be broken through an upward trend that would start if this support level remains intact. This potential shift could attract more investors looking to capitalize on Ethereum’s discounted price.

Whale Activity Surges as Market Sentiment Strengthens

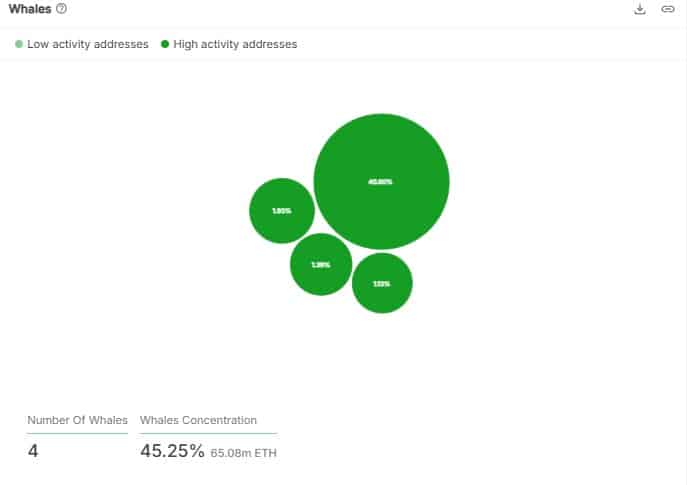

According to IntoTheBlock data, whale transactions account for 44% of total market movement. Whales are often seen as key market movers, and their growing participation signals confidence in Ethereum’s price potential. Such elevated activity from whales may trigger additional price growth during the short term.

The market dynamics function under significant whale transaction influence because these activities now and over extended periods impact market prices. The increased concentration of whale activity suggests institutional investors and high-net-worth individuals are accumulating ETH. The rise in buying pressure could create a significant price increase that may establish new high points.

Market observers note that ETH is showing signs of forming a flag pattern, which often precedes strong breakouts. With growing whale activity and technical indicators aligning, Ethereum’s short-term outlook appears increasingly bullish. If buying momentum continues, ETH could test key resistance levels in the coming weeks.

Ethereum Foundation to End Holesky Testnet, Introduces Hoodi

The Ethereum Foundation announced that the Holesky testnet would be discontinued due to extensive inactivity leaks. Developers introduced the Hoodi testnet as its replacement, ensuring continuity for testing Ethereum improvements. The transition was established to create a more secure platform for developers to develop network improvements before the main deployment.

Ethereum’s tesnets are crucial for validating updates before they go live on the main network. The Hoodi network has replaced Hoodi as the main validator and staking provider testing platform. This change underscores Ethereum’s commitment to maintaining robust infrastructure for developers and network participants.

A Pectra upgrade activation will happen on Hoodi starting on March 26 after developers complete their testing procedures. This upgrade will introduce increased staking limits and new account recovery options, enhancing Ethereum’s security and efficiency. The testing process succeeds when deployment of the mainnet is expected to occur around 30 days later.

FAQs

What does Ethereum’s MVRV ratio indicate?

The MVRV ratio measures market value relative to realized value, helping investors assess whether an asset is overvalued or undervalued.

Why is Ethereum’s demand zone at $1.6K important?

The $1.6K level serves as a key support zone, influencing Ethereum’s next price movement and potential bullish reversal.

How does whale activity impact Ethereum’s price?

Whale transactions can significantly affect price trends, indicating strong buying interest and potential future price increases.

What is the purpose of the Hoodi testnet?

Hoodi replaces the Holesky testnet, providing a reliable environment for developers to test Ethereum upgrades before mainnet deployment.

When will the Pectra upgrade be deployed?

If testing proceeds successfully, the Pectra upgrade will be deployed on Hoodi on March 26 and later on the mainnet.

Glossary

MVRV Ratio – A metric comparing an asset’s market value to its realized value, used to assess valuation levels.

Demand Zone – A price range where buying interest is strong, often preventing further declines.

Whale Activity – Large transactions made by high-net-worth individuals or institutions, often influencing market trends.

Testnet – A blockchain replica used for testing upgrades before deploying them on the main network.

Pectra Upgrade – A planned Ethereum update introducing increased staking limits and account recovery options.