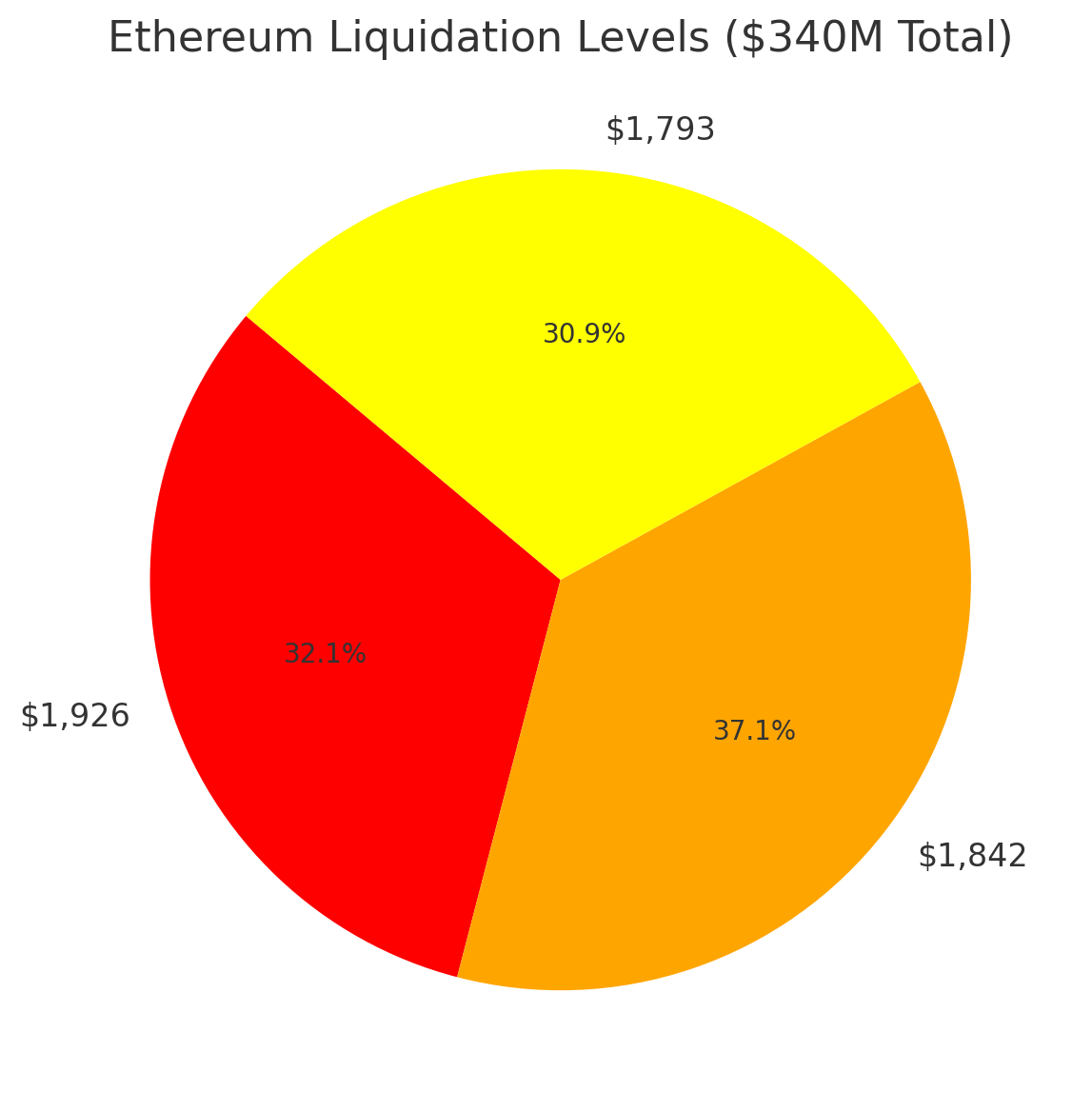

Ethereum is facing a critical moment as its price decline brings over $340 million in MakerDAO liquidations closer to reality. Over the past 24 hours, ETH has plunged 11.5%, dropping to $2,373, sparking widespread concern among traders and investors. If Ethereum falls another 19%, liquidation levels at $1,926, $1,842, and $1,793 will be triggered, potentially setting off a mass liquidation event across decentralized finance (DeFi).

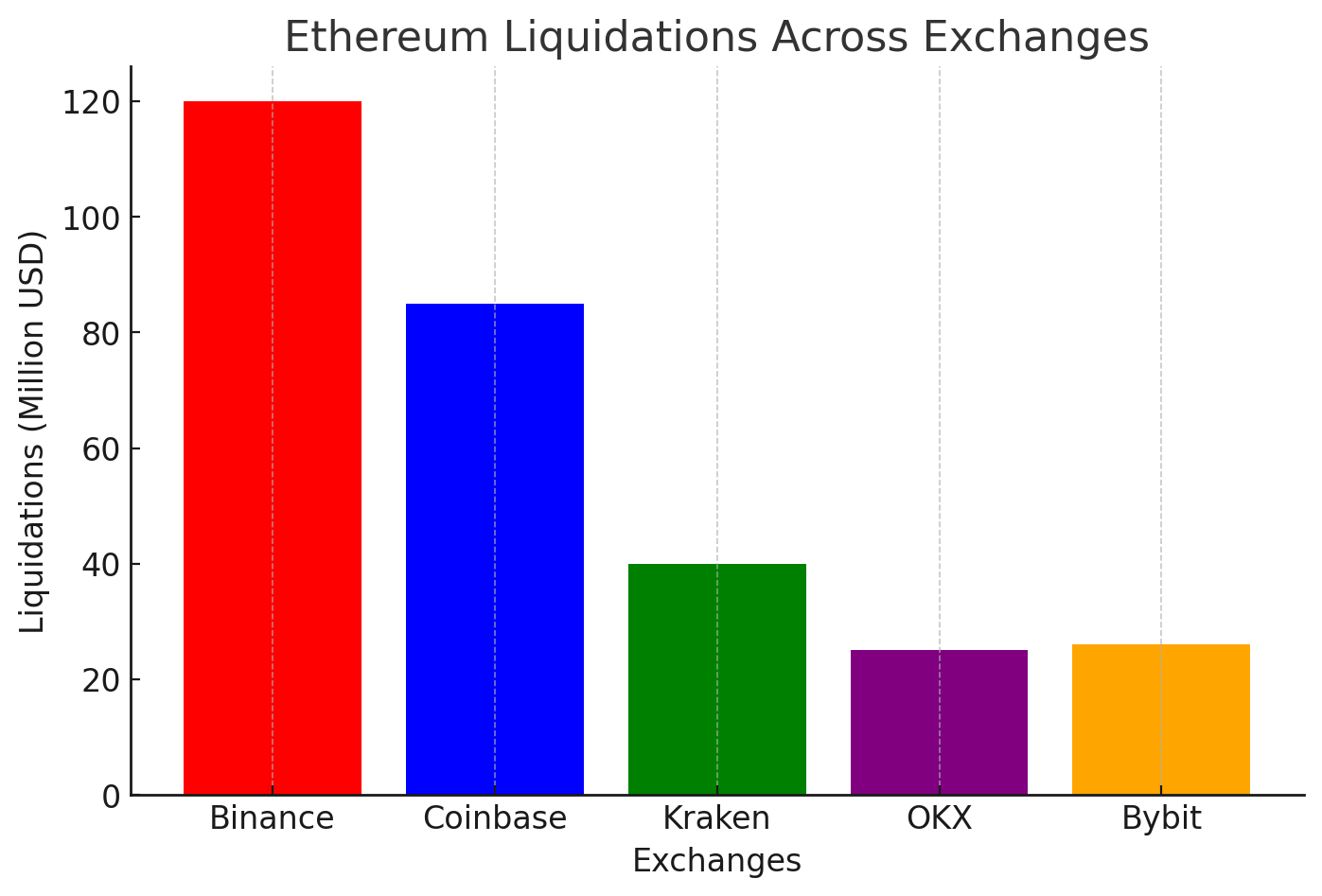

Market-wide sell-offs, waning sentiment, and global equity struggles have fueled ETH’s decline. The drop has already resulted in $296 million in liquidations on centralized exchanges, highlighting the increased volatility in the crypto space. Whether this downturn signals a larger bear market trend or a temporary correction remains uncertain, but the coming days will be crucial in determining Ethereum’s trajectory.

$340M in MakerDAO Liquidations Nearing as ETH Drops

Recent on-chain data reveals that three large MakerDAO positions, valued between $109 million and $126 million each, will face forced liquidations at specific price levels:

Liquidation Levels:

- $1,926

- $1,842

- $1,793

For these liquidations to occur, Ethereum must decline another 19% from its current price. If triggered, it could set off a cascading effect across decentralized finance (DeFi), liquidating more leveraged positions and accelerating sell pressure across the market.

“A drop below $1,900 could create a DeFi-wide deleveraging event, forcing mass liquidations beyond just MakerDAO,” noted blockchain analyst James Carter of CryptoQuant.

Mass Exchange Liquidations Already Underway

Ethereum’s rapid descent has already led to $296 million in liquidations across centralized exchanges, according to CoinGlass. This suggests that highly leveraged traders have been caught off guard, forcing them to close positions at a loss.

The sell-off comes as global equities struggle, weakening sentiment across risk assets. Market conditions now resemble past bull market corrections, where assets plunged up to 30% before rebounding to new highs.

“In previous cycles, sharp corrections of 25-30% have been healthy resets before price recoveries. Whether this is another shakeout or a deeper reversal remains to be seen,” said macro trader Alex Krüger.

Will Ethereum Trigger a DeFi Liquidation Cascade?

A further 19% drop in ETH could spark a chain reaction of liquidations across multiple DeFi lending protocols and derivatives platforms. As MakerDAO liquidations occur, other protocols with highly leveraged ETH collateral may also come under pressure.

The risk of a widespread DeFi unwinding depends on whether buyers step in before Ethereum hits these critical thresholds. If selling pressure intensifies, ETH could experience a liquidity crunch, forcing even more liquidations across lending platforms like Aave, Compound, and Frax Finance.

“Liquidation cascades amplify downside moves because forced selling pushes prices lower, triggering more margin calls,” explained DeFi strategist Rachel Lin of SynFutures.

Deleveraging Events—A Buying Opportunity for Smart Traders?

While liquidation-driven sell-offs can create panic, they also present opportunities for experienced traders. Prices often drop below their fundamental value during these events due to short-term liquidity crises rather than real declines in asset worth.

Historically, steep liquidations have marked local bottoms, where large buyers step in to accumulate undervalued assets before a rebound.

“Deleveraging events can be brutal but also set up excellent entry points for those who understand market structure,” said on-chain analyst Will Clemente.

Conclusion: Is Ethereum Headed for a Larger Correction or a Quick Recovery?

With $340 million in MakerDAO liquidations looming, Ethereum’s next moves could determine whether this is a temporary dip or the start of a deeper decline. If ETH falls below $1,900, a wave of forced selling could trigger further downside across DeFi platforms.

On the other hand, history shows that liquidation-driven crashes often reset over-leveraged markets, paving the way for stronger recoveries. Whether Ethereum rebounds from here or plunges further, this week will be crucial in shaping the crypto market’s trajectory.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What price levels could trigger major ETH liquidations?

If ETH falls below $1,926, $1,842, and $1,793, three large MakerDAO positions will be liquidated. These liquidations could lead to a broader sell-off across DeFi.

2. How much Ethereum has already been liquidated?

Over $296 million worth of ETH positions have been liquidated on centralized exchanges in the past 24 hours, according to CoinGlass.

3. Could this drop cause a market-wide crash?

A further 19% decline could trigger cascading liquidations, putting pressure on lending platforms and leading to more forced selling. However, sharp liquidations often mark buying opportunities before recovery.

4. Is this a good time to buy ETH?

Deleveraging events tend to create short-term undervaluation, presenting buying opportunities for traders who can withstand volatility. However, market risks remain, and further downside is possible.

Glossary

Liquidation: The automatic selling of an asset when it drops below a specified collateral level, forcing traders to close leveraged positions.

Deleveraging: A process where excessive leverage is removed from the market, often resulting in sharp sell-offs before a price recovery.

MakerDAO: A decentralized lending protocol that allows users to borrow stablecoins using crypto assets like ETH as collateral.

Exchange Liquidations: Forced closing of leveraged positions on centralized trading platforms due to price declines, often leading to price cascades.

DeFi Protocols: Decentralized finance applications like Aave and Compound that offer lending and borrowing services using smart contracts.

References

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly volatile, and readers should conduct their own due diligence before making investment decisions.