The recent drop in Ethereum (ETH) prices has raised concerns among investors. Whales and institutional players have been moving large amounts of ETH to exchanges, signaling potential sell-offs. According to a crypto expert on October 4, 2024, approximately $260 million worth of ETH was transferred to various exchanges, a move that could indicate further declines in the market.

Ethereum (ETH) Reserves Are Increasing

When whales and large investors move their assets to exchanges, it often signals an intent to sell. In this case, geopolitical tensions between Iran and Israel may be contributing to the negative market sentiment. Currently, ETH is trading at $2,375, showing a 1.3% gain in the last 24 hours. However, the trading volume has dropped by 25%, indicating that investors are becoming more cautious. This low volume could mean that the market remains volatile in the short term.

108,000 $ETH were sent to crypto exchanges in the past 24 hours, totaling roughly $259.2 million! pic.twitter.com/GBzwaMtjBp

— Ali (@ali_charts) October 4, 2024

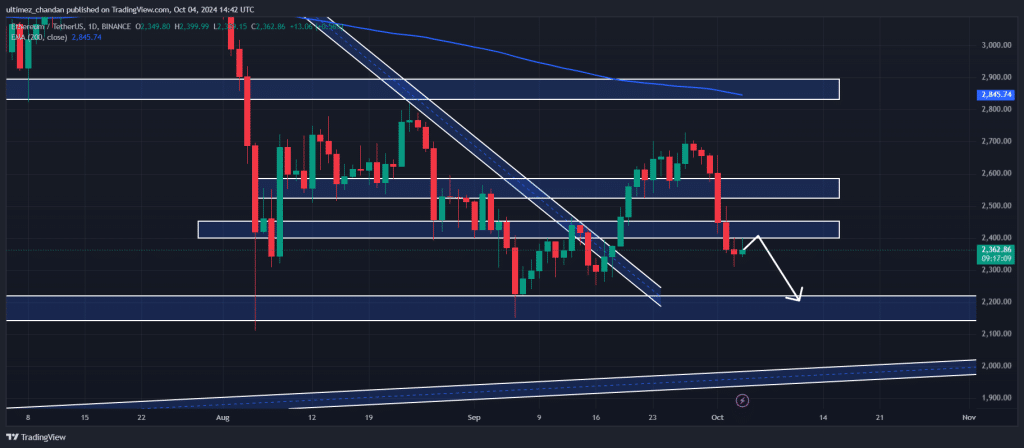

Technically, Ethereum is showing signs of weakness. The price recently broke below the critical support level of $2,400 and is trading under the 200-day Exponential Moving Average (EMA). The price is now retesting this broken support. If ETH closes below $2,330 by the end of the day, it could signal further declines, with prices potentially dropping to $2,200. Some analysts, however, anticipate a possible recovery at this level.

Bearish Chain Metrics

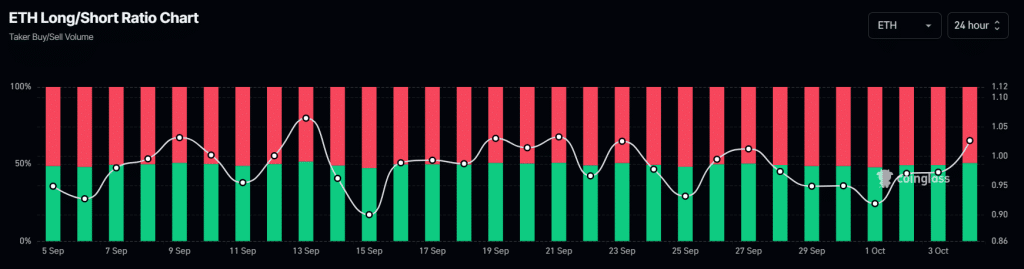

On-chain metrics for Ethereum (ETH) are giving mixed signals. According to Coinglass data, the long/short ratio for ETH stands at 1.0263, suggesting that traders are still cautiously optimistic. A ratio above 1 typically indicates a bullish outlook. However, open interest in ETH futures has dropped by 2.5% in the last 24 hours, as traders liquidate positions and refrain from opening new ones. This indicates a cautious market environment.

Overall, when we combine on-chain data, technical analysis, and the increasing ETH reserves on exchanges, it’s clear that Ethereum is currently in a vulnerable position. Bears are largely in control of the market, although short-term recovery signals may emerge. The large transfers of ETH by whales are exerting significant selling pressure, leaving investors uncertain. While chain data and technicals provide conflicting signals, the market’s uncertainty is keeping traders on edge.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!