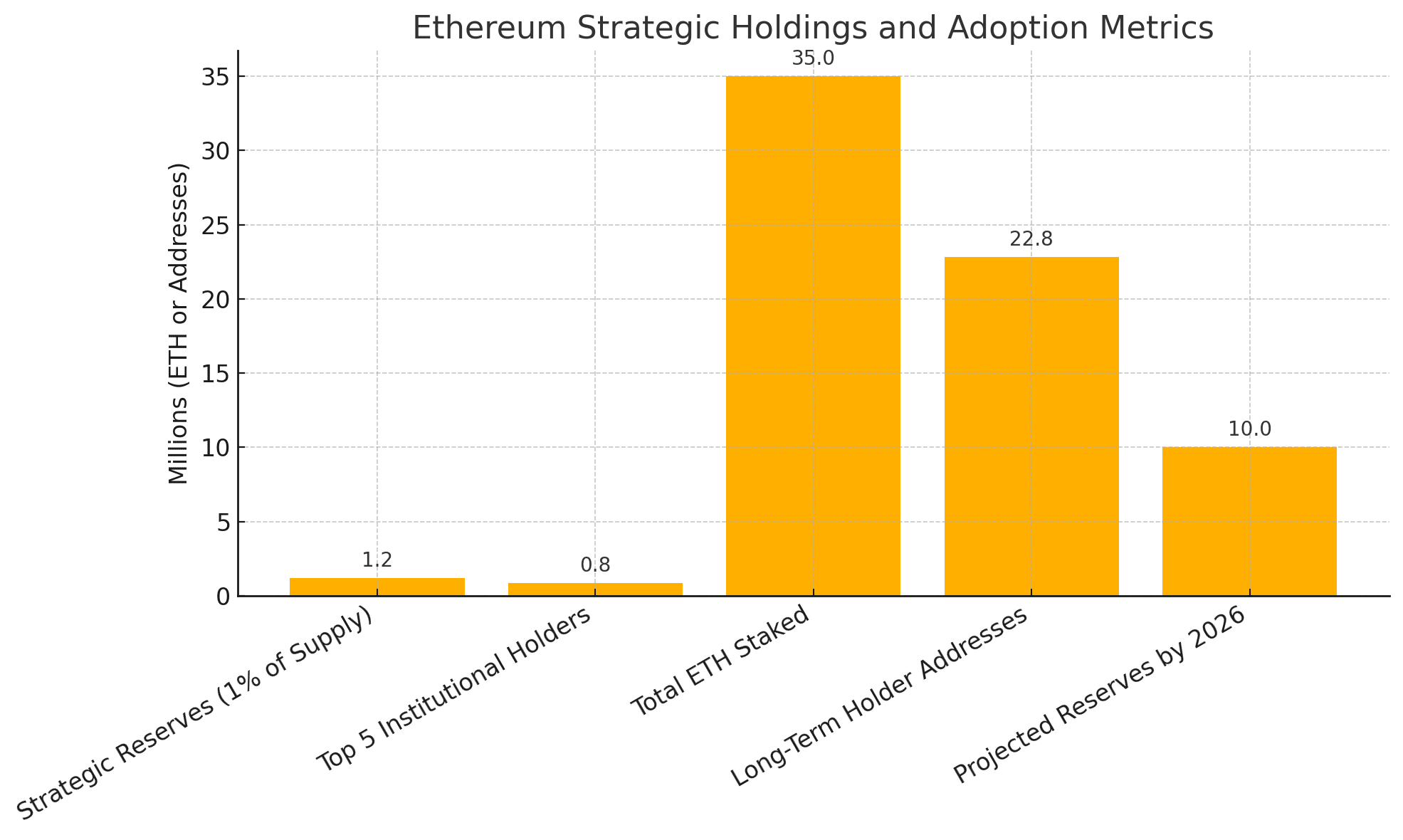

Ethereum is entering a new chapter of its evolution, not just as a smart contract platform, but as a strategic reserve asset. According to a recent report by Crypto.news, institutions now hold over 1.19 million ETH, representing more than 1% of Ethereum’s total circulating supply.

This milestone marks a pivotal shift in how ETH is perceived by major players in finance and technology. Once viewed primarily as a tool for decentralized applications and DeFi, ETH is now becoming a preferred asset for corporate treasuries, DAOs, and sovereign entities.

Who Is Holding the ETH?

Leading the pack is the Ethereum Foundation, holding between 259,000 and 269,000 ETH. They are followed by:

SharpLink Gaming: 176,000 ETH (majority staked)

PulseChain

Coinbase: approximately 137,000 ETH

Golem Foundation, 101,000 ETH

U.S. Government, nearly 60,000 ETH (mostly from seizures)

These five entities alone control over 70% of all ETH strategic reserves, as defined by long-term institutional holdings and staked assets.

Staking, Scarcity, and the Liquidity Squeeze

The strategic reserves surge coincides with rising staking levels. Over 35 million ETH, or 28% of total supply, is now staked, according to Cointelegraph. This significantly reduces the liquid supply of Ethereum available for trading or short-term speculation.

As a result, analysts from CryptoSlate and Gate.io argue that ETH is entering a supply squeeze scenario. With increasing amounts of ETH locked in smart contracts, staking validators, and treasuries, available liquidity continues to shrink, creating upward pressure on prices when demand resurges.

Why Institutions Are Turning to Ethereum

There’s more to this trend than simple yield farming. Ethereum is being reclassified by corporate analysts as a macro reserve asset, similar to how some institutions treat Bitcoin or even traditional commodities.

Several reasons explain this:

Stability and Infrastructure: Ethereum’s transition to proof-of-stake (PoS) and robust network security make it appealing for long-term holdings.

Yield and Utility: ETH not only stores value but also generates yield through staking, unlike most corporate treasury assets.

DeFi and Tokenization: As real-world assets (RWAs) and financial products become tokenized, ETH becomes the underlying gas for future finance.

A report by Yellow.com projects that strategic ETH reserves could exceed 10 million ETH by mid-2026, driven by DAOs, corporations, and cross-chain ecosystem funds.

Address Growth and Hodler Confidence

Supporting this trend is the on-chain rise of long-term holders. Data shows that 22.8 million addresses are holding ETH without moving it, indicative of strong conviction among both institutions and retail investors. These “hodlers” are reinforcing ETH’s resilience against short-term volatility.

Ethereum Strategic Reserve Snapshot

| Metric | Value |

|---|---|

| Strategic Reserves | 1.19M ETH (~1% of supply) |

| Top 5 Institutional Holders | Hold >70% of reserves |

| ETH Currently Staked | 35M ETH (~28% of supply) |

| Long-term Hodler Addresses | 22.8M |

| 2026 SER Projection | 10M+ ETH |

What This Means for Ethereum Price Outlook

While the crypto market has faced short-term turbulence, Ethereum’s long-term picture looks fundamentally strong. With rising strategic reserves, declining available supply, and growing institutional demand, ETH is well-positioned for a revaluation.

This supply-side constraint is particularly powerful. Unlike Bitcoin, where most institutional action focuses on ETFs and spot trading, ETH’s utility and staking mechanics lock coins in productive systems, creating scarcity with yield.

As more treasuries treat ETH as a programmable treasury asset, Ethereum could lead the next wave of institutional crypto integration.

Conclusion: Ethereum’s Next Identity, Global Financial Infrastructure

Ethereum’s ascent as a strategic reserve signals a deeper narrative shift. It is no longer just a DeFi engine or NFT playground. It is evolving into a global digital reserve asset, sought after by treasuries, sovereigns, and financial institutions.

With projections hinting at exponential growth in corporate holdings, ETH’s future may lie in becoming a backbone of digital finance infrastructure, not just for crypto natives, but for the entire global economy.

FAQs

What are Ethereum strategic reserves?

Strategic reserves refer to ETH holdings by institutions, governments, and corporations stored for long-term value rather than trading.

Why are companies adding ETH to their balance sheets?

ETH is seen as a secure, productive, and deflationary asset that offers staking yield and future relevance in tokenized finance.

Will this impact Ethereum’s price?

Yes. As more ETH is locked away from circulation, supply contracts, raising the potential for upward price momentum.

Glossary of Key Terms

Strategic Reserve: Long-term crypto holdings by institutions for balance sheet, treasury, or yield-generation purposes.

Staking: Locking up ETH to validate transactions and earn rewards under proof-of-stake.

Liquidity Squeeze: A scenario where supply decreases while demand holds or rises, often leading to price increases.

Macro Asset: An asset class viewed as part of large-scale, institutional portfolio strategies, like gold or bonds.

Hodler Addresses: Wallets that hold ETH for extended periods without activity, signaling confidence.