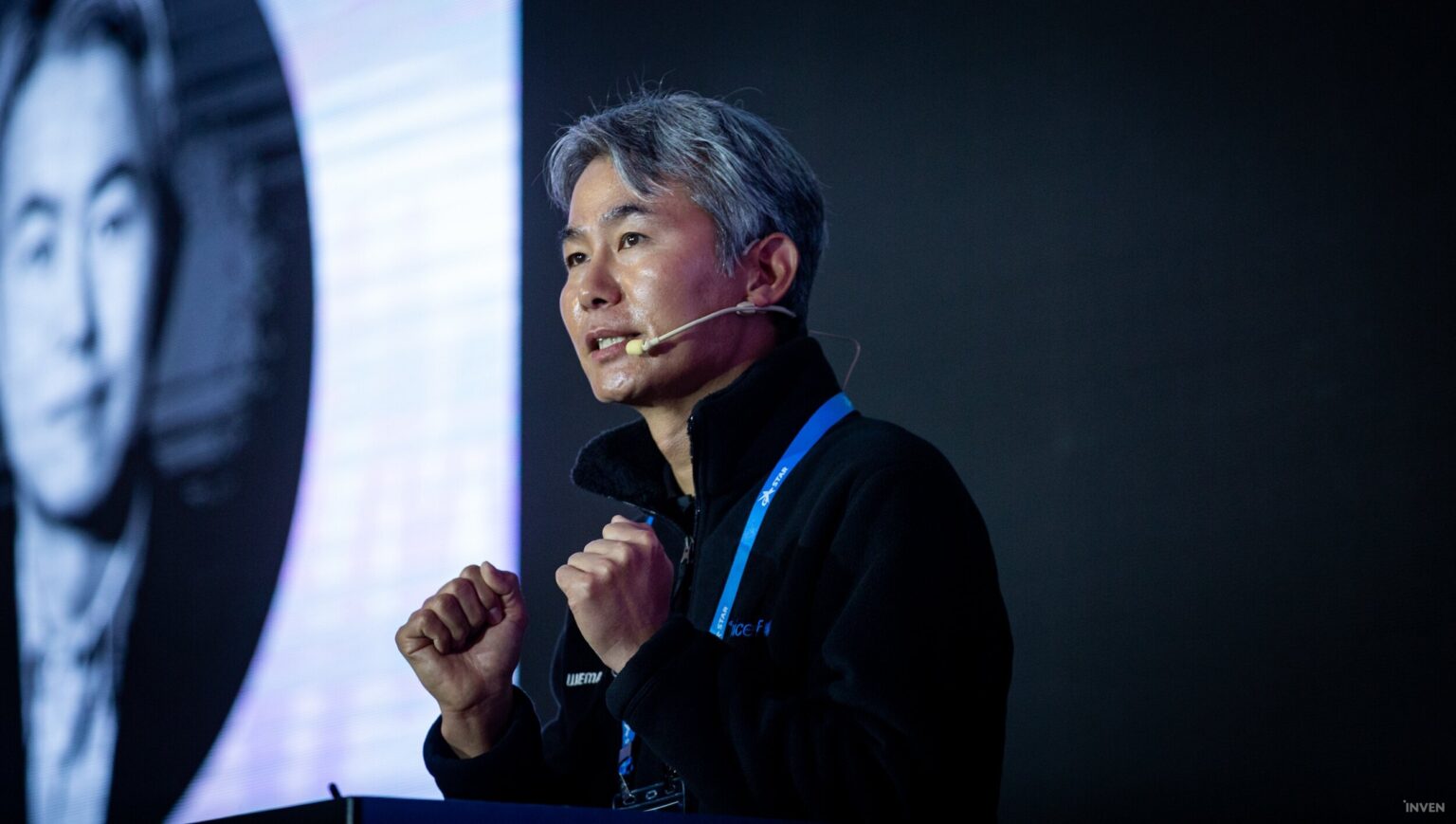

Chang Hyun-guk EX-Wemade CEO of the prominent gaming company Wemade, has been indicted by South Korean prosecutors for allegedly fabricating and withholding crucial information about the circulation of Wemix tokens. The indictment, announced on Monday, August 5, accuses Hyun-guk of deceiving investors by failing to disclose significant sales of Wemix tokens, despite promising transparency in February 2022.

Ex-Wemade CEO Charged with Deception

The charges against Chang Hyun-guk revolve around his alleged failure to fulfill promises made to investors regarding the sale and circulation data of Wemix tokens. According to Korea JoongAng Daily, the ex-Wemade CEO pledged in February 2022 to cease the sales of Wemix tokens and to provide transparent circulation data. However, prosecutors allege that between February and October 2022, Wemade continued to sell Wemix tokens worth ₩300 billion without meeting these disclosure requirements.

In addition to the undisclosed sales, the indictment also claims that Wemade used these tokens as collateral to invest in external funds and secure loans. These actions have raised significant regulatory concerns, leading to the delisting of Wemix by the Digital Asset eXchange Alliance, which comprises Korea’s top five cryptocurrency exchanges. Despite the delisting, Wemix was later re-listed after Wemade clarified it had stopped selling the token on the market.

The Story So Far

Wemade, a leading South Korean gaming company founded in 2000, began issuing Wemix tokens in 2020 to support its play-to-earn video games. The tokens quickly gained traction, and between November 2020 and November 2021, the company sold 108 million Wemix tokens, generating approximately ₩290 billion (over $210 million) in profits. This initial success was followed by a commitment from the company to halt further token sales and to disclose accurate circulation data.

However, the subsequent actions of Wemade, as alleged by prosecutors, paint a different picture. The continued sale of tokens and the use of Wemix as collateral have not only violated the company’s promises but have also undermined investor trust. The legal action against ex-Wemade CEO, Chang Hyun-guk comes nearly a year after Wemix investors first brought the issue to court in May 2023.

Market Response and Fallout

The indictment of Chang Hyun-guk has sent shockwaves through the cryptocurrency and gaming industries. It highlights the ongoing challenges of maintaining transparency and regulatory compliance in the rapidly evolving digital asset market. The allegations against Hyun-guk underscore the importance of trust and integrity in the management of cryptocurrency projects.

John Doe, a cryptocurrency analyst, commented on the situation, saying, “This case serves as a reminder that transparency and adherence to regulatory standards are paramount in the cryptocurrency industry. Investors need assurance that the information they receive is accurate and trustworthy.”

The actions of Wemade and the subsequent legal proceedings also emphasize the need for stricter oversight and clearer regulations in the cryptocurrency sector. The case has drawn attention to the practices of other companies in the industry, prompting calls for more robust regulatory frameworks to prevent similar incidents in the future.

Ex-Wemade CEO: A Test Case for Crypto’s Future

The indictment of Chang Hyun-guk, the ex-Wemade CEO, marks a significant moment in the ongoing efforts to regulate and ensure transparency in the cryptocurrency market. As the legal proceedings unfold, they will likely serve as a crucial test case for the enforcement of regulatory standards and the protection of investor interests. The outcome of this case will be closely watched by industry stakeholders and could have far-reaching implications for the future of digital asset management.

South Korean prosecutors have taken a strong stance against the alleged misconduct, signaling their commitment to upholding the integrity of the financial markets. The focus now shifts to the court’s verdict and its potential impact on the broader cryptocurrency and gaming industries.

By addressing the issues raised in this case, regulators and industry participants alike can work towards fostering a more transparent and trustworthy environment for digital asset investments. Keep following TheBITJournal to keep an eye on Ex-Wemade CEO case.