Last week, over $1 billion worth of Bitcoin was withdrawn from centralized exchanges, marking one of the largest movements of digital assets in recent months. This mass exodus has sparked debate about the motivations behind these withdrawals and their potential impact on the market. With more than 16,500 BTC now held in private wallets, many are questioning whether this signals growing confidence in Bitcoin’s long-term value or if it’s simply a reflection of evolving market conditions. The implications of this move could shape the next phase of Bitcoin’s journey.

Large-Scale Withdrawals Raise Questions

While this large withdrawal of Bitcoin from exchanges has garnered attention, its implications are open to interpretation. Some see it as a sign that investors are preparing to hold their assets for the long term, potentially signaling confidence in Bitcoin’s future value. Self-custody, which involves holding assets outside exchanges, is typically associated with a more cautious or long-term investment strategy, where assets are stored securely rather than traded actively.

Brian Dixon, CEO of Off the Chain Capital, offered his perspective on this trend. Speaking with TheStreet Crypto, he highlighted the importance of understanding the flow of Bitcoin to make better sense of the situation. “You really have to pay attention to where that Bitcoin is flowing to develop a better analysis of what’s happening,” Dixon explained. “If it’s going into self-custody, I would view that as a bullish indicator.”

This viewpoint suggests that some investors believe the reduction of available Bitcoin on exchanges could affect market dynamics, particularly the supply available for trading. When assets move off exchanges, they become less liquid, meaning fewer coins are available for immediate buying and selling. For some, this could indicate that holders expect the value of Bitcoin to rise in the future, though such outcomes are never guaranteed.

Potential for Supply Shrinkage

The concept of Bitcoin’s limited supply is central to many discussions about its future. Unlike traditional currencies, Bitcoin has a fixed maximum supply of 21 million coins. As more investors choose to remove their Bitcoin from exchanges and store it in self-custody, there may be fewer coins available for trading, contributing to a potential supply shortage.

Dixon also pointed out that this could lead to a narrative of scarcity. “It’s (self-custody) actually going to shrink supply. That could create a narrative around scarcity,” he stated. A reduction in the number of coins circulating on exchanges may, under certain conditions, influence price dynamics if demand remains strong or increases.

Recent Price Movements and Market Response

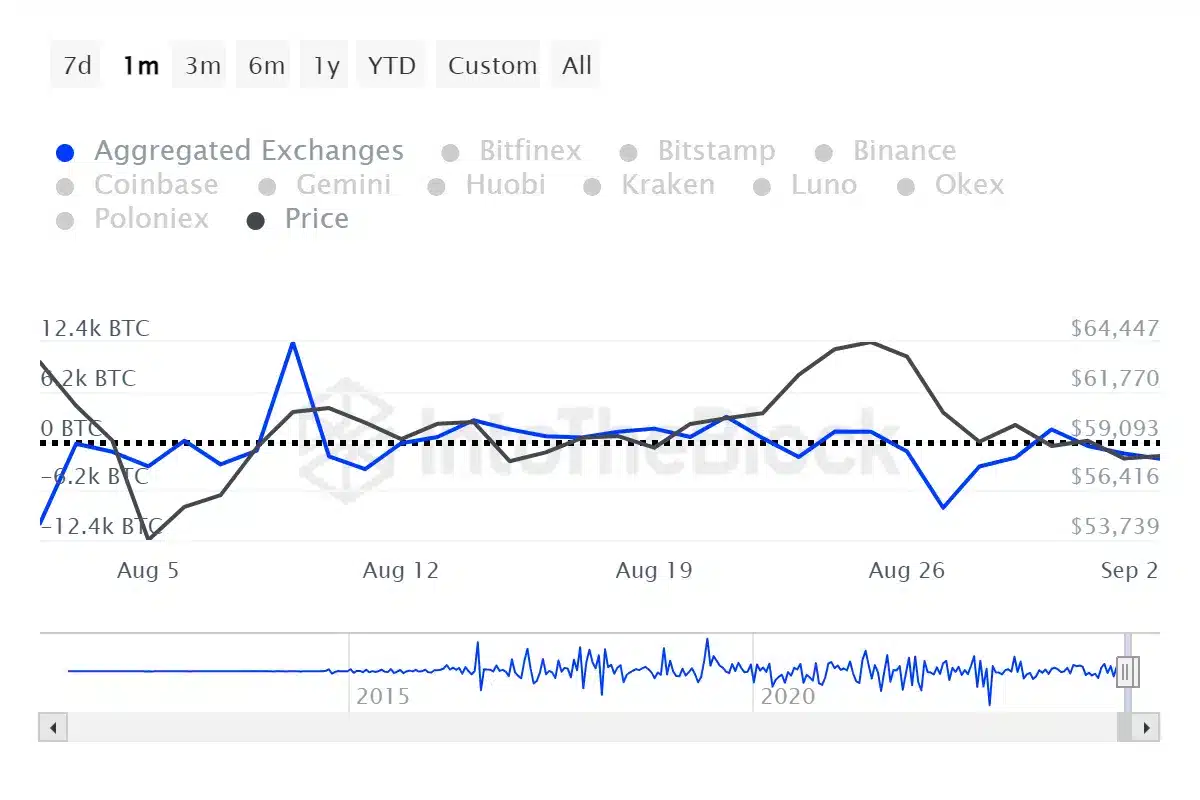

Despite the discussion around Bitcoin withdrawals and potential long-term trends, Bitcoin’s price has not shown a clear upward trajectory in the past week. Instead, it has experienced volatility, with its value dropping from around $64,100 to a low of $57,886. As of Tuesday, it had slightly recovered, trading between $58,000 and $59,000. This fluctuation in price demonstrates that short-term market movements do not always align with broader trends such as asset withdrawals or self-custody activity.

Some analysts have speculated that external factors, including Bitcoin’s upcoming halving event, may play a role in influencing the current market behaviour. Halving is a scheduled event that occurs roughly every four years, cutting the rate at which new Bitcoin is created. Historically, these events have been followed by significant price increases, although past performance is no guarantee of future results.

A Mixed Outlook for Bitcoin’s Future

Looking ahead, the future of Bitcoin remains subject to various interpretations. The recent wave of withdrawals from centralized exchanges has prompted discussions about self-custody, scarcity, and long-term holding strategies. Yet, Bitcoin’s price movements continue to demonstrate that the market is far from predictable.

The withdrawal of over $1 billion worth of Bitcoin from centralized exchanges has certainly sparked interest and debate within the crypto community. While some see this as a signal of confidence in Bitcoin’s future value, others remain cautious, given the recent volatility in its price. As with any investment, understanding the broader context is key to making informed decisions.