With the crypto bull market accelerating, the Solana network shows growth potential that could outpace Ethereum in the coming year. Solana has surpassed Ethereum in DEX trading volumes and other DeFi metrics, positioning it for further gains. According to crypto analyst Sohrab Khawas, this environment makes Solana-based meme coins especially attractive. Here are three meme coins that Khawas believes are worth watching.

Top Meme Coin: Bonk Inu (BONK)

BONK is challenging the resistance trendline of a long-standing triangle formation. With the current bull cycle, this meme coin stands on the edge of a breakout rally. BONK has surpassed the 50-day EMA and is now testing the dynamic resistance of the 200-day exponential moving average. BONK has surged around 28% over the past four days, marking a V-shaped recovery. It broke through the 23.6% Fibonacci level at $0.0000217 and surpassed the psychological barrier of $0.000020. With two large bullish candles, BONK is currently re-testing the breakout at the 23.6% level, signaling a potential push to the 50% level at $0.00002845.

As the extended rally prospects rise, a breakout above $0.000025 could lead to further gains, possibly reaching the 78.6% level at $0.00003568. The MACD indicator shows a bullish crossover, and the 50-day and 200-day SMAs are moving towards a golden crossover, indicating continued bullish momentum.

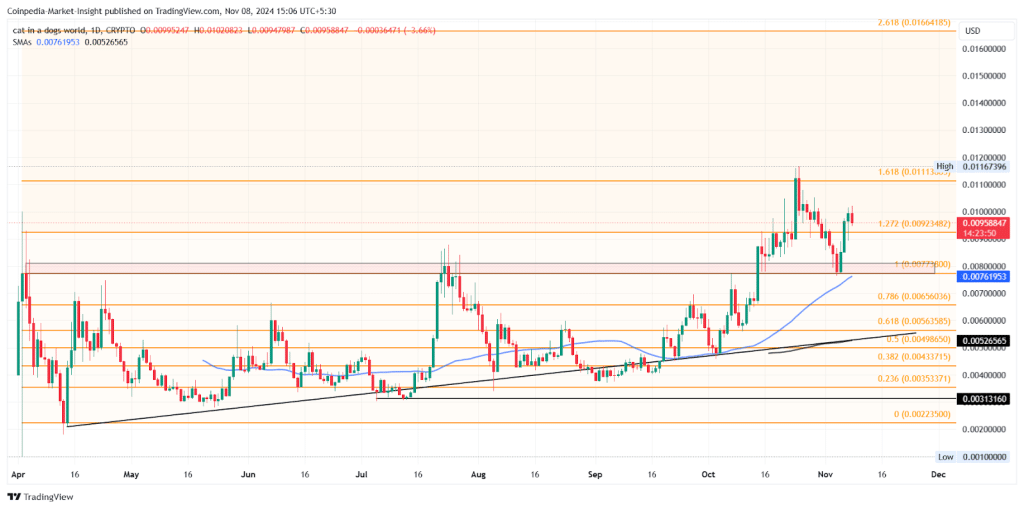

Second Meme Coin: Cat in a Dogs World (MEW)

On the daily chart, MEW shows a V-shaped recovery from the 100% Fibonacci level at $0.000738, accompanied by three consecutive bullish candles and an 8% price increase. Although the rally hit a temporary pause with a 3.58% intraday pullback, MEW continues to strive towards the $0.0010 psychological mark. Following a successful re-test, it may challenge the $0.0014 target and potentially surpass the ATH of $0.00167. Despite the pullback, the 50-day SMA provides dynamic support, keeping the bullish trend intact.

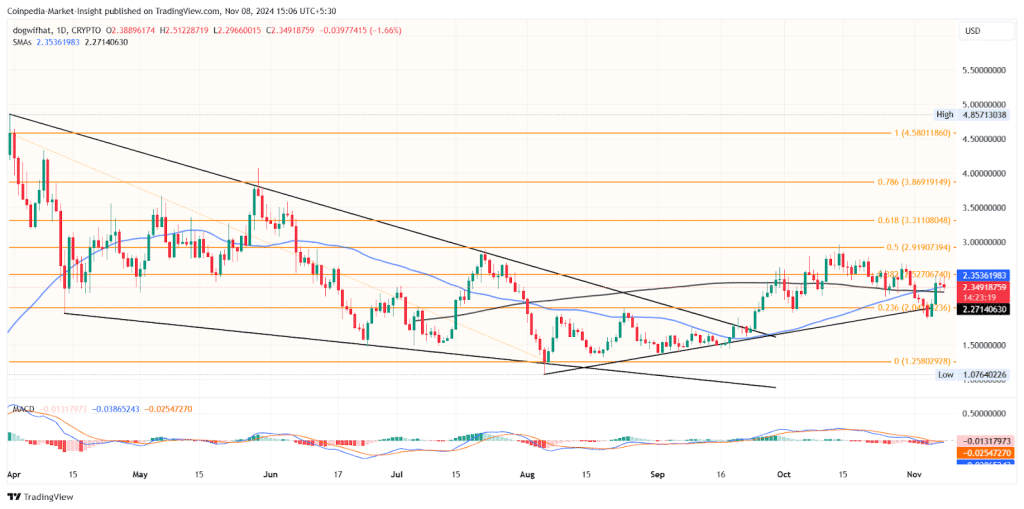

Final Meme Coin: Dogwifhat (WIF)

WIF is displaying a V-shaped reversal, with bullish momentum pushing past both the 50-day and 200-day EMAs to test the 38.2% level at $2.52. An intraday pullback of 1.58% has led to a morning star formation, encountering resistance at the psychological $2.50 level. Despite this, the rally remains intact, and the golden cross between the 50-day and 200-day SMAs hints at further gains. If WIF breaks above $2.52, it could trigger a rally to $3, with potential targets extending to $3.86 and $4.58.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!