Jasper De Maere, Head of Research at Outlier Ventures, has warned the market, stating that Bitcoin’s traditional four-year cycle may no longer be relevant and that investors should not act according to this principle. The statement comes as Bitcoin ratcheted its worst price performance after a full halving event. So, let’s get into decoupling in a bit more detail.

Is The So-Called Four-Year Bitcoin Cycle Over?

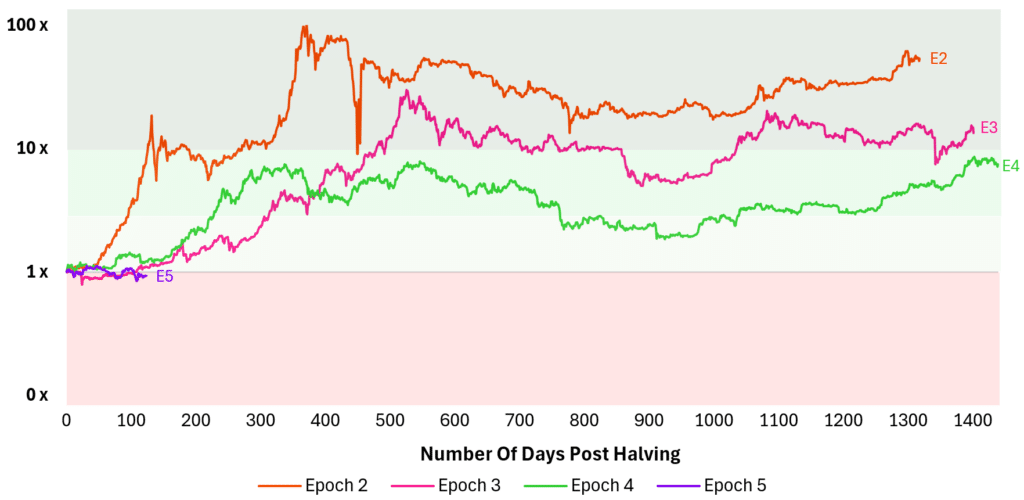

In the words of Outlier Ventures, the four-year cycle of Bitcoin is a myth. Coming from a report released on Tuesday by de Maere, he pointed out that “As we stand four months after the latest halving event, this would make it empirically the worst performing post-halving price. He added that halvings are less critical for the cost of Bitcoin, and we could see a significant one in 2016. However, de Maere says investors and project founders should no longer look at the four-year cycle when forecasting market behavior as the cryptocurrency space matures.

As reported by The Bit Journal. Image by Icons8 via Unsplash According to Bitcoin, halving on BuyUcoincom is part of the source: This happens every four years, and its mechanism would also enhance the cut in half of mining rewards per block. · The halving that occurred on April 20 reduced the block reward from 6.25 BTC to half, which makes it now set for miners at three 125BTC. Traditionally, these events have also lifted Bitcoin’s price – and in years prior, such a rise might have been cheered on by market participants. After 2018, though, questions are being asked about how valid that generalization could prove after another tepid year for cryptocurrency prices overall.

Changing the Market Dynamic

Bitcoin has seen substantial price gains after previous halvings, but it is very different this time. In the lead-up to this year’s process, data and recent history suggested as much—compared with a 10% spike in 2016, Bitcoin prices jumped by nearly eight times that percentage (739%) within about four months after the last halving back in July of 2012. But the Bitcoin price has fallen 8% since that, a divergence from history for previous halvings. De Maere said the halving has also not significantly influenced Bitcoin’s price since 2016, in the meantime, with the maturation of crypto ecosystems and miner rewards making up a far smaller portion of fiat liquidity in most cryptocurrencies than it once did.

De Maere mentions that although halving events still psychologically impact some investors, they are minor compared to how they affect the Bitcoin inflation rate and miner cashflows. Even with the worst scenario taken into account, where miners sell everything they mine, Influence over the market today is about 0.17%, compared to an order of magnitude more significant action on markets during end-of-rise manipulations in late 2017 (accordingly — from one to five percent).

De Maere also said the powerful price rally in response would have been primarily coincidental, driven by a global liquidity flood and burgeoning DeFi (Decentralized Finance emanating summer became known as “lag.”) For one, spot Bitcoin ETFs were the main driver of its price this year leading up to March 14 when you had a couple near as excellent ₿73 and $836 (asdf.).

Take a look at our other news

NVIDIA Investigation Shakes the Market: 5 AI Coins Plummet to New Lows!