Fartcoin (FARTCOIN) underwent notable trading activity, measuring both positive and negative changes across its price indicators. Current whale accumulation behavior indicates a possible price recovery despite the previous 3.67% market decline over 16 hours. The recent market fluctuations point to doubts regarding AI-driven tokens, specifically FARTCOIN, and their extended viability prospects.

FARTCOIN Price Drops but Recovery Hints Emerge

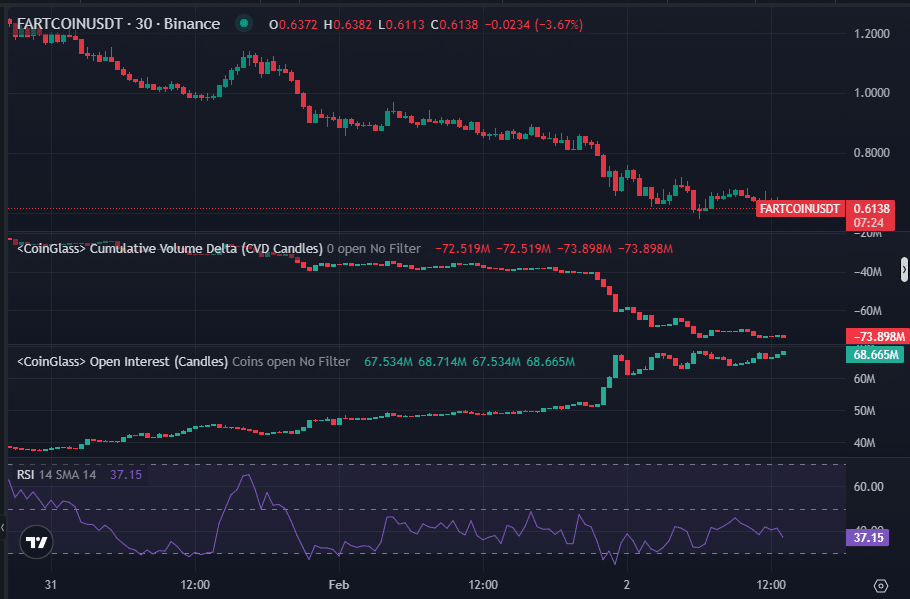

FARTCOIN’s price declined by 3.67% to settle at $0.6138 on Binance, demonstrating bearish market movement. An evaluation of the hourly data displayed declining high points and low points, which demonstrated continuous selling activities. According to technical indicators, if market conditions improve, there is potential for a market recovery.

The Relative Strength Index (RSI) moved to 37.15 while approaching the oversold area, suggesting decreasing bearish momentum. A price rise among investors has the potential to generate a market reversal against the recent negative market trend. Analyzing the RSI shows that it displays typical pattern shifts that occur before the price rebounds.

Source: TradingView

Major stakeholders within the market have increased their FARTCOIN holdings because they believe in the asset’s future despite facing temporary value declines. Whale 1 used 14,779 JITOSOL valued at $3.66 million to acquire 5.5 million FARTCOIN thus resulting in an overall coin ownership of 8.39 million. Due to this investment, Whale 1 saw its FARTCOIN portfolio value increase to $5.52 million.

The second whale investment strategy involved creating a new wallet for acquiring 2.84 million FARTCOIN at $2.43 million. Two characteristics of substantial investments enable market sentiment shifts that bring retail investors into markets and decrease price volatility. The growing interest in whales indicates upcoming price stability and potential upward price predictions.

Market observers actively track whale activities to detect changes in market sentiment because their significant activities speak for widespread feeling alterations. Acquisitions by investors with substantial assets develop positive sentiment, encouraging retail traders to participate in the market. According to recent whale data, market volatility will likely decrease, which signals positive sentiments despite the current bearish market conditions.

Rising Open Interest Supports FARTCOIN Market Stability

Market participation was strong because Open Interest in FARTCOIN derivatives rose to 68.665 million. An elevated Open Interest level shows investors remain active in the market because it upholds price equilibrium alongside potential price expansion. Market interest demonstrates its resilience through periods of short-term price changes.

Recent market sessions reveal a dominant selling trend because the Cumulative Volume Delta (CVD) showed a total of -73.898 million. A change in trading volume would yield opposite results on the negative CVD, thus demonstrating the development of bullish behavior. The market could recover when buying pressure intensifies.

Market stability evaluation requires investors to examine Open Interest variation and trading volume data. FARTCOIN’s position receives support from increasing Open Interest values and improving market sentiments. Market participants maintain a conservative yet positive attitude throughout the current period because they track new market trends.

Future Outlook for FARTCOIN

FARTCOIN is in a decisive stage with conflicting market data. The market shows bearish short-term conditions, but growing whale purchasing activity and increasing Open Interest positions indicate a possible price recovery. The upcoming price trend will likely stabilize because RSI indicators are approaching oversold limits.

Price movements for FARTCOIN depend heavily on how investors perceive the market. Market fundamentals and intensified buying activity continue to support FARTCOIN’s price recovery in the near future. How these selling pressures compare to accumulation activities will shape short-term market movements.

The recovery potential of FARTCOIN depends on market participants who track price movements and trading volume. AI volatility combined with investor trust will determine the future value of FARTCOIN in relation to market trends. The next few days will determine how the crypto coin will advance.

FAQs

What is happening with FARTCOIN’s price?

FARTCOIN’s price dropped by 3.67% in the last 16 hours, settling at $0.6138 on Binance.

Why is FARTCOIN’s price declining?

The price decline is due to continuous selling pressure and bearish market trends reflected in the hourly chart.

What does the RSI indicator say about FARTCOIN?

The RSI is at 37.15, which is near the oversold zone, suggesting that bearish momentum may be slowing.