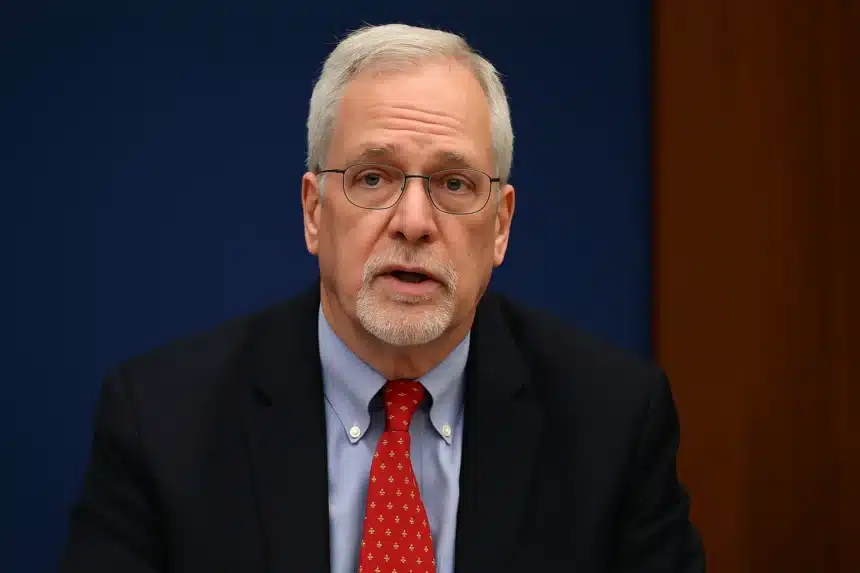

In a surprising yet impactful development, Federal Reserve Governor Christopher Waller signaled that a potential interest rate cut could be on the table as early as July. The statement, made during a CNBC interview on June 20, 2025, quickly resonated across the financial world—particularly within the crypto markets, where anticipation is building for how this policy shift could affect asset prices.

This speculation adds a fresh layer of volatility and excitement to a market already hungry for momentum. As always, The Bit Journal will be closely monitoring the evolving macroeconomic landscape and its implications for digital assets.

Fed’s Sudden Shift: A Turning Point?

The Federal Reserve has long been likened to a massive oil tanker—slow to change course and often predictable in its messaging. However, Waller’s comment marked a notable deviation from Chair Jerome Powell’s repeated caution regarding inflation. Waller stated, “We are in a good position to start lowering rates, potentially as soon as July,” suggesting that the long-standing inflation threat may finally be under control.

Although Waller qualified his remarks as his personal view, the tone signaled a potential pivot in Fed strategy—from combatting inflation to preventing broader economic stagnation.

Labor Market in Focus

Perhaps more telling than the headline itself was Waller’s concern over the labor market. He warned of a “sharp downturn” in employment metrics if rates remain elevated for too long. This acknowledgment hints at the Fed’s growing awareness of recessionary pressures, lending more credibility to the prospect of rate cuts in the near future.

Market Reaction: Sober Yet Hopeful

Despite the bullish sentiment from Waller’s remarks, market data tells a more cautious story. According to the CME FedWatch Tool, traders currently assign only a 12% probability to a July rate cut. The consensus remains skewed toward September or even December as more likely targets.

Nevertheless, the tone has undeniably shifted. The debate is no longer about “if” but “when.” Waller’s credibility and timing make his comments particularly significant—and they may serve as a leading indicator for the Fed’s upcoming policy decisions.

What It Means for Crypto Investors

For crypto investors, any signal of monetary easing is typically a bullish indicator. Lower interest rates often weaken the dollar and boost demand for alternative assets, including Bitcoin, Ethereum, and a wide range of altcoins. While immediate price action has remained muted, the potential for a broader crypto rally looms large if the Fed follows through in July or September.

More importantly, Waller’s remarks may serve as the psychological catalyst the market needs. A shift in investor sentiment—especially within crypto—is often driven more by expectation than reality. And right now, expectations are beginning to change.

Conclusion

Whether or not the Fed acts in July, Waller’s remarks have already begun to reshape the narrative. The Bit Journal will continue to provide timely updates and expert analysis as we approach a critical period for both traditional and digital markets.

Investors should remain cautious yet optimistic. A Fed pivot may not be guaranteed, but it’s no longer out of reach—and that could make all the difference for crypto in the months ahead.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

CNBC Interview with Christopher Waller (June 20, 2025)

CME FedWatch Tool