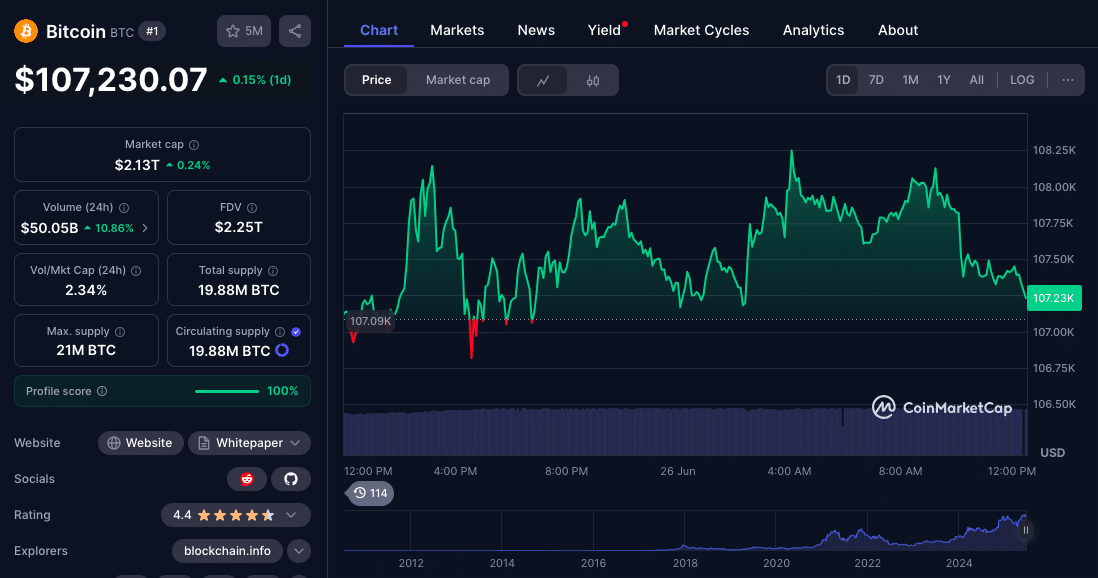

Bitcoin (BTC) has surged back above $107,000, reclaiming lost ground after dipping below six figures just a week ago due to heightened Middle East tensions. Traders and analysts now point to renewed optimism over potential U.S. Federal Reserve rate cuts, along with rising retail and institutional activity, as driving forces behind the crypto rebound. Altcoins like Ether (ETH), Solana (SOL), and Cardano (ADA) are also gaining traction as the market shifts back to a risk-on posture.

Dovish Fed Commentary Spurs Risk Appetite

Federal Reserve Chair Jerome Powell delivered remarks earlier this week that many interpreted as the first serious signal of a potential policy shift. He suggested that rate cuts remain “on the table” if trade negotiations continue to improve and inflation softens; an assessment traders took as dovish, especially in the context of rising market fragility and slowing economic data.

Market watchers like Nick Ruck, director at LVRG Research, believe this is a critical moment for crypto investors:

“Crypto will continue its bullish trend. Institutional purchases are picking up, and Jerome Powell’s comments hinting at rate cuts have flipped investor sentiment quickly.”

Bitcoin Regains Technical Ground Above Key Averages

Technical analysts have been watching closely for confirmation that Bitcoin’s uptrend is regaining momentum. According to Alex Kuptsikevich, senior market analyst at FxPro, BTC has now reclaimed both its 200-day and 50-day moving averages, a sign that support has solidified following last week’s dip. As of press time, Bitcoin is trading near $107,230, up 1.5% in 24 hours.

“Bitcoin briefly dropped below its long-term support, but the sharp rebound confirms strong buy-side interest. We’re now back above the 200-day MA, and the 50-day average has also been reclaimed,” said Kuptsikevich. “This validates the $100K zone as a key technical floor.”

He added that Bitcoin is still lagging behind the Nasdaq 100, which recently hit fresh all-time highs. However, he believes that if crypto-related equities and Bitcoin continue at this pace, “they may soon catch up with traditional finance.”

Retail and Institutional Flows Turn Positive

Beyond technicals, the resurgence in capital flows is reinforcing confidence in the rally. New data from eToro shows that 58% of U.S. retail investors are increasing their exposure to digital assets. A combination of a weakening dollar, stock market fatigue, and interest in decentralized finance is driving this pivot.

At the same time, CoinShares released its latest sentiment report, revealing that 89% of existing crypto holders plan to increase investments in 2025; 75% of respondents are actively seeking new market entry points; Institutional inflows into digital asset funds have also risen for three consecutive weeks.

Altcoins Hold Steady: Ether, Solana, and Cardano in Focus

While Bitcoin leads the charge, altcoins are quietly building strength. Ether (ETH) is up 1.8% and remains stable above $2,450. Solana (SOL) is holding near $144, and Cardano (ADA) has bounced to approximately $0.58.

Even meme-inspired tokens like Dogecoin (DOGE) and XRP have posted modest gains, though most lag behind BTC and ETH in terms of momentum.

Some traders are now speculating that altcoin rotation could follow if Bitcoin confirms a breakout above $110,000. That scenario has previously led to secondary rallies across DeFi, gaming, and Layer-1 assets.

Conclusion on Fed Rate Cut

Bitcoin’s next major resistance lies between $108,800 and $110,000, with short-term momentum contingent on macro signals and ETF-related inflows. If it breaks this level, analysts see room for a push toward $115,000.

Support remains at $104,000, followed by a more critical floor near $100,000, the psychological level that bulls defended successfully last week.

Altcoins are currently trading in sync with Bitcoin, but their breakouts may trail BTC’s move by days or weeks. Traders are advised to watch closely for rising volumes in ETH, ADA, and SOL as a sign of investor rotation.

Summary

Bitcoin has rebounded to $108K after dipping below six figures last week, driven by dovish remarks from Federal Reserve Chair Jerome Powell and strengthening investor sentiment. eToro data showing 58% of U.S. investors increasing their exposure. Bitcoin also reclaimed its 50- and 200-day moving averages, while altcoins like Ether, Solana, and Cardano posted moderate gains. Analysts expect Bitcoin to test $110K resistance, with support at $104K.

FAQs

Why is Bitcoin rising again after dipping below $100K?

Bitcoin’s rally is driven by growing expectations of a Fed rate cut, geopolitical relief, and strong institutional demand.

What did Jerome Powell say about interest rates?

He said rate adjustments remain possible if inflation softens and trade deals hold, comments seen as dovish by the market.

Are altcoins also rallying?

Yes. Ether, Solana, and Cardano are posting modest gains and could follow Bitcoin’s lead if the trend continues.

What price levels should investors watch next?

$110K is the next resistance for Bitcoin, while $104K is key short-term support. A breakout could trigger an altcoin rally.

Glossary

Risk-On Sentiment: A market phase where investors favor higher-risk assets like crypto, often due to improving macroeconomic outlooks.

Dovish: A term describing central bank behavior that favors lower interest rates and economic stimulus.

Institutional Flow: Investment activity by large entities such as hedge funds or asset managers, rather than individual investors.

200-Day Moving Average: A widely watched technical indicator that tracks the average price of an asset over the past 200 days.

Altcoin Rotation: A market trend where capital flows from Bitcoin into other cryptocurrencies after BTC rallies.

Retail Investor: Individual traders or non-professional investors, as opposed to institutional entities.