The United States Federal Reserve crypto crackdown on crypto-friendly institutions intensified after a cease and desist order was issued to United Texas Bank. This move highlights growing concerns within the Federal Reserve regarding the risks posed by banks servicing cryptocurrency clients. The Federal Reserve Crypto enforcement comes amid increasing scrutiny over the financial sector’s interactions with digital assets.

Federal Reserve Crypto Order Targets United Texas Bank

On September 4, the Federal Reserve issued a cease and desist order to United Texas Bank, a mid-sized bank with a reputation for being crypto-friendly. The Federal Reserve Crypto crackdown centers on what it describes as “significant deficiencies” in the bank’s risk management systems and its dealings with cryptocurrency clients.

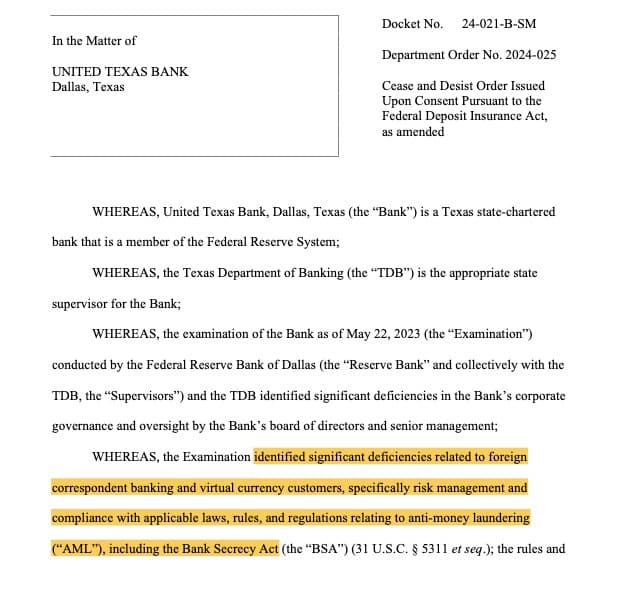

According to the Federal Reserve, an examination conducted in May revealed major issues with the bank’s corporate governance and the oversight of its board of directors and senior management. The order specifically pointed out flaws in risk management practices, especially those related to foreign correspondent banking and virtual currency customers. It emphasized the need for compliance with anti-money laundering (AML) regulations, including the Bank Secrecy Act (BSA).

Significant Deficiencies Identified in Risk Management

The cease and desist order highlights several key areas where the Federal Reserve believes United Texas Bank fell short. The examination identified “significant deficiencies” concerning the bank’s handling of transactions with crypto clients and its compliance with existing AML and BSA laws. This latest Federal Reserve Crypto action marks another step in the regulatory body’s efforts to tighten control over banks interacting with the crypto industry.

Notably, the Federal Reserve Crypto order did not provide specific details on how the bank had failed to comply with regulations. However, it did note that United Texas Bank has begun implementing additional measures to enhance its AML program and strengthen its compliance with the BSA.

“The examination identified significant deficiencies related to foreign correspondent banking and virtual currency customers, specifically risk management and compliance with applicable laws, rules, and regulations relating to anti-money laundering, including the Bank Secrecy Act,” the Federal Reserve wrote in its order.

Bank’s Response to the Federal Reserve Crypto Crackdown

In response to the Federal Reserve Crypto order, United Texas Bank’s board of directors has agreed to submit a formal plan to “strengthen board oversight” of its compliance with BSA/AML requirements. This move comes as the bank seeks to align itself more closely with regulatory expectations and avoid further sanctions.

United Texas Bank currently employs around 75 staff members and manages approximately $1 billion in assets, based on its latest quarterly report. The bank’s willingness to cooperate with the Federal Reserve’s demands suggests an awareness of the potential consequences of non-compliance, especially in a regulatory climate that is increasingly vigilant about cryptocurrency-related activities. The Fed said it had identified “significant deficiencies” in the bank’s dealings. Source: Federal Reserve

Broader Implications of the Federal Reserve Crypto Enforcement

This enforcement action is not an isolated incident. It comes just a month after the Federal Reserve issued a similar order against another crypto-friendly institution, Customers Bancorp, and its subsidiary, Customers Bank, based in Pennsylvania. The August 8 order against Customers Bank also cited “significant deficiencies” in risk management systems and poor performance in recent examinations by the Philadelphia Federal Reserve Bank.

These repeated actions by the Federal Reserve demonstrate a clear pattern: the regulatory body is determined to impose stricter oversight on banks engaged with cryptocurrency clients. The Federal Reserve Crypto strategy appears to be aimed at mitigating potential risks associated with the fast-evolving digital asset market, particularly concerning anti-money laundering practices.

What’s Next for Crypto-Friendly Banks?

With the Federal Reserve Crypto crackdown showing no signs of slowing down, other crypto-friendly banks may need to reassess their risk management procedures and compliance frameworks. The Federal Reserve’s actions indicate a desire to create a regulatory environment where banks dealing with cryptocurrencies are subject to the same rigorous standards as traditional financial institutions.

According to reports, industry analysts believe that the Federal Reserve Crypto strategy may compel more banks to distance themselves from crypto clients, fearing the possibility of similar enforcement actions. This could create significant barriers for the cryptocurrency industry, which relies on traditional banking services for liquidity and transaction processing.

Conclusion

The Federal Reserve’s recent actions underscore a heightened vigilance over the integration of cryptocurrencies into the traditional financial system. As the Federal Reserve Crypto crackdown continues, banks like United Texas Bank and Customers Bank may serve as cautionary tales for other financial institutions contemplating deepening their involvement in the digital asset space. For now, the future of crypto-banking relationships remains uncertain.

The latest developments in the Federal Reserve Crypto regulatory landscape will likely continue to unfold, and The BIT Journal will remain vigilant in bringing you the most up-to-date news and analysis.