Fetch.ai’s (FET) price is in an intriguing phase, with bullish momentum pushing it upwards while simultaneously being at high risk of a decline. As FET navigates this critical juncture, investors are keenly watching the market dynamics to determine their next move.

Recent Surge in FET Price

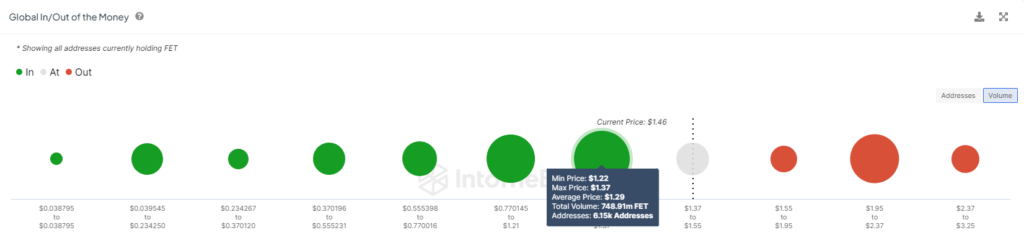

The FET price has experienced notable growth over the last few days, leading to a significant rise in profits for many investors. According to the Global In/Out of the Money (GIOM) indicator, about 748 million FET, worth more than $1.06 billion, turned profitable this week. This surge has brought the token into the spotlight, drawing attention from both seasoned traders and new investors.

The recent price increase has taken FET from its previous consolidation levels to new heights. However, this also sets the stage for potential profit-taking, which could pull the FET price back down. The increase in profitable supply has been substantial, with about 27% of the entire circulating supply of FET, bought between $1.22 and $1.37, becoming profitable this week.

Impact of Recent Merger

The merger between Fetch.ai, Ocean Protocol, and SingularityNET has also played a crucial role in the current state of the FET price. The supply of FET increased following the migration of OCEAN and AGIX, leading to a higher amount of FET-bearing profits. This merger will result in the creation of the Artificial Superintelligence Alliance and its token, ASI. The first phase of the migration has been completed, and the second phase, expected to take place before the end of July, will launch ASI.

The market’s reaction to this merger has been mixed. While it has contributed to the bullish momentum, it has also increased the risk of profit-taking. About 70% of the total FET supply is now profitable, up from 42%. Historically, the market tends to see selling around the 80% mark. However, considering this is the first time these investors have noted such high gains in a month, selling could start earlier, potentially impacting the FET price.

Profit-Taking and Potential Decline

At present, the FET price is trading at $1.44, with the market attempting to secure the $1.40 price into support. However, the potential for profit-taking looms large. If the selling pressure intensifies, the altcoin could lose this support level. The consequent drawdown might pull FET to $1.20 or even $1.04 again.

The consolidation range for Fetch.ai’s native token currently sits between $1.04 and $1.71. If the FET price fails to maintain the $1.40 support, it is likely to remain rangebound within this range. On the other hand, if the support holds, the FET price could bounce back towards the upper resistance level of $1.71. Breaching this resistance would invalidate the bearish thesis and could send the crypto asset on a significant run-up.

The Final Word

The future of the FET price hinges on several factors, including market sentiment and the actions of investors. The recent rise in profitable supply indicates a healthy market, but it also increases the risk of a sell-off. As investors decide whether to hold or sell, the FET price will likely experience fluctuations.

One of the critical elements to watch is the upcoming second phase of the merger, which will launch the ASI token. This event could further influence the FET price, depending on how the market perceives the new developments. If the launch is successful and well-received, it could bolster the FET price. Conversely, any hiccups could trigger more selling.

In conclusion, while the FET price is enjoying a bullish phase, it remains vulnerable to a decline due to potential profit-taking. The coming weeks will be crucial in determining the token’s trajectory. Investors should keep a close eye on market trends and be prepared for possible volatility.

By understanding the dynamics at play, including the recent merger and the increase in profitable supply, stakeholders can make informed decisions about their FET investments. Whether the FET price continues its upward momentum or faces a downturn will depend on how these factors unfold in the near future.