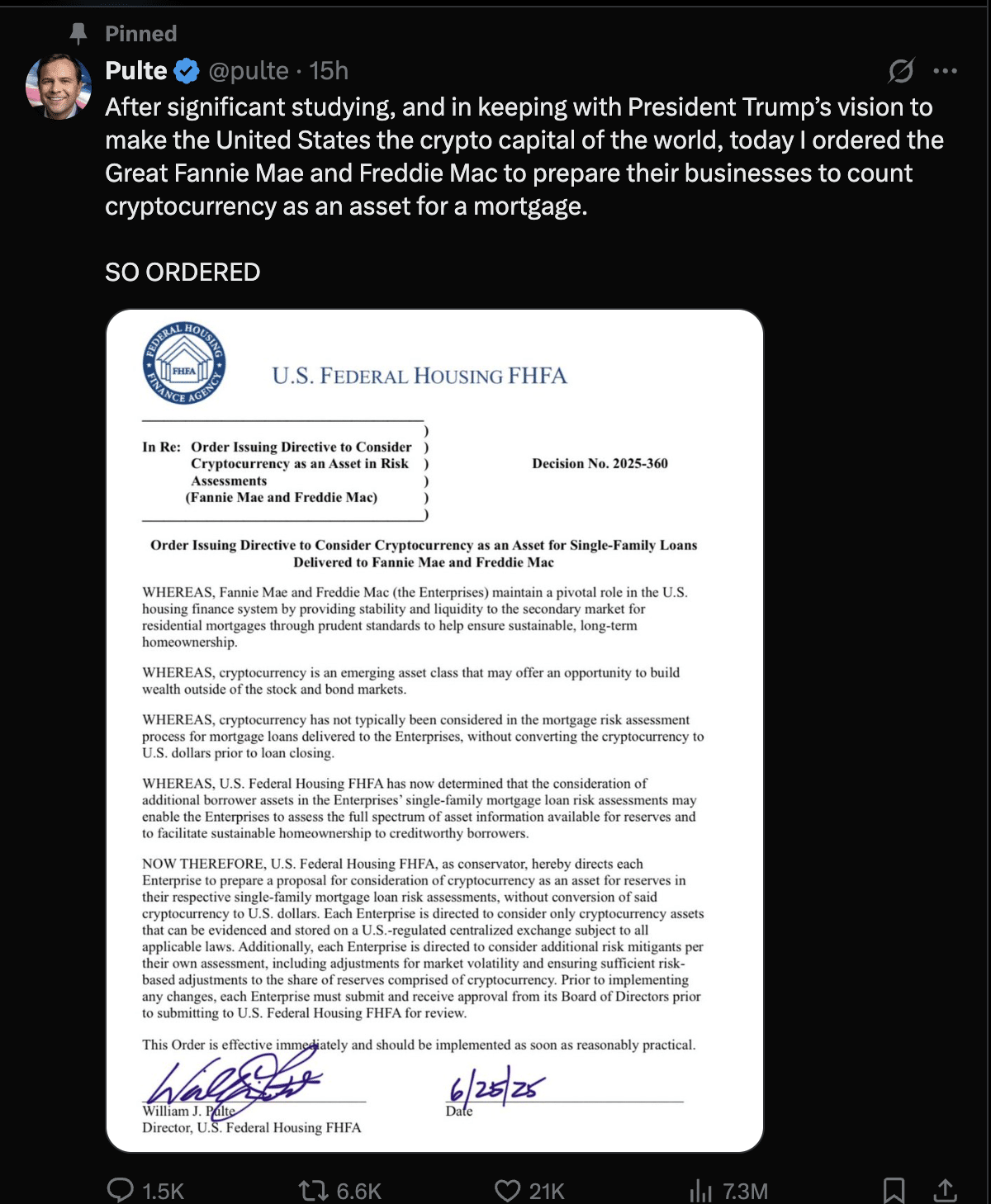

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive for Fannie Mae and Freddie Mac to expand how they evaluate mortgage applicants by incorporating crypto mortgages as part of their asset assessment.

In a letter sent this past Wednesday, FHFA Director William J. Pulte instructed the two government-sponsored enterprises to:

“prepare a proposal for consideration of cryptocurrency as an asset for reserves in their respective single-family mortgage loan risk assessments, without conversion of said cryptocurrency to U.S. dollars.”

Crypto Mortgages Will Expand Asset-Based Lending Models

Under this new guidance, borrowers who hold cryptocurrencies on U.S.-regulated exchanges could see their digital assets recognized as part of their financial portfolio in the loan approval process. Currently, Fannie Mae and Freddie Mac require applicants to convert crypto to fiat before factoring it into mortgage calculations, but this ruling would enable lenders to treat crypto as liquid reserves directly.

By including Tokenized mortgages in their underwriting model, they can refine the credit risk assessments and unlock funding for a growing segment of borrowers who hold crypto assets without selling them. Since the 2008 financial crisis, Fannie Mae and Freddie Mac have operated under FHFA oversight to stabilize the housing market by purchasing home loans and guaranteeing liquidity.

Now, after “significant studying,” the FHFA believes that including crypto mortgages will align with broader policy goals, including former President Trump’s ambitions to make the U.S. the “crypto capital of the world.”

Collateral Recognition Extends to More Than Just Real Estate

Beyond the housing sphere, the acceptance of digital assets as collateral is spreading. Major financial institutions, such as JPMorgan, are allowing wealth management clients to use Bitcoin ETFs as leverage in financing arrangements. Meanwhile, reports claim Circle’s USDC stablecoin will soon be approved as collateral in futures trading via Coinbase Derivatives and Nodal Clear.

Alongside other initiatives, these steps show how tokenized mortgages and asset-backed lending using digital assets are beginning to permeate traditional financial sectors; and how lenders are adapting mortgage risk frameworks to manage them appropriately.

Real Applications: Bitcoin and Ethereum in Property Finance

Though still niche, crypto-backed mortgages are already in use. Platforms like Ledn have helped clients secure loans using Bitcoin or Ethereum as collateral, allowing borrowers to purchase real estate without liquidating their digital assets.

Institutions like Fannie Mae and Freddie Mac must now update their underwriting systems to quantify mortgage risk from asset-backed loan exposure to digital asset volatility. Treating digital assets as part of mortgage underwriting introduces new layers of complexity. Lenders must assess custody solutions and fraud prevention to ensure that cryptocurrency collateral remains verifiable and secure.

Under the FHFA’s instructions, crypto holdings must be “evidenced and stored on a U.S.-regulated centralized exchange subject to applicable laws.”

This requirement helps mitigate the credit risk of hacks, insolvent platforms, or asset misrepresentation. Getting these protections right will be key for Fannie Mae and Freddie Mac to responsibly integrate crypto mortgages.

Conclusion

As crypto mortgages become part of mainstream lending, borrowers stand to benefit from new ways to unlock their financial power without liquidating digital assets. They may be able to treat crypto as part of a diverse asset portfolio when applying for a home loan. At the same time, lenders are tasked with balancing that flexibility against mortgage risk.

Properly assessing crypto assets; such as requiring verified custody arrangements and monitoring for price fluctuations, will be essential to integrate crypto mortgages safely.

Additionally, federal oversight bodies and congress may revisit existing frameworks to validate that incorporating digital assets aligns with broader housing finance goals while keeping credit risk within manageable parameters.

Summary

The U.S. Federal Housing Finance Agency (FHHA) has instructed Fannie Mae and Freddie Mac to begin considering cryptocurrencies as part of borrowers’ assets in mortgage risk assessments. This decision allows verifiable digital assets stored on U.S.-regulated exchanges to be used as reserves without converting to fiat.

FAQs

What Exactly are Crypto Mortgages?

Crypto mortgages allow borrowers to use their cryptocurrencies as collateral for home loans, treating digital assets like property, subject to careful evaluation of mortgage risk.

What Happens If Crypto Prices Drop After Loan Issuance?

Lenders may implement margin calls or adjustable LTV frameworks to manage mortgage risk arising from volatile digital assets in crypto mortgages.

Which Exchanges Qualify for Housing Collateral?

Only U.S.-regulated centralized exchanges, compliant with banking and anti-money-laundering laws, can be used to verify crypto held as collateral.

When Might Crypto Mortgages be Widely Available?

Following the FHFA directive, Fannie Mae and Freddie Mac will develop implementation plans. Full rollout depends on regulatory approval and system integration to manage mortgage risk.

Glossary

Crypto mortgages: A lending model that treats cryptocurrencies as eligible collateral for mortgage loans without requiring conversion to fiat currency.

Digital assets: Cryptographic financial instruments such as Bitcoin, Ethereum, stablecoins, and other tokens holding monetary value.

Mortgage risk: The potential financial exposure a lender faces, influenced by borrower assets, market volatility, and loan-to-value ratios.

Regulated centralized exchange: A crypto trading platform that operates under U.S. regulatory oversight (e.g., SEC, FinCEN) and complies with legal requirements.

Loan-to-value (LTV): A ratio indicating the loan amount relative to the asset’s current market value, used to assess mortgage risk.