Filecoin price has not had the smoothest ride this past quarter. A mix of market trends and internal challenges has contributed to a noticeable decline. The well-known market strategy, “sell in May and go away,” seems to have had a significant impact on Filecoin price, which struggled to gain momentum.

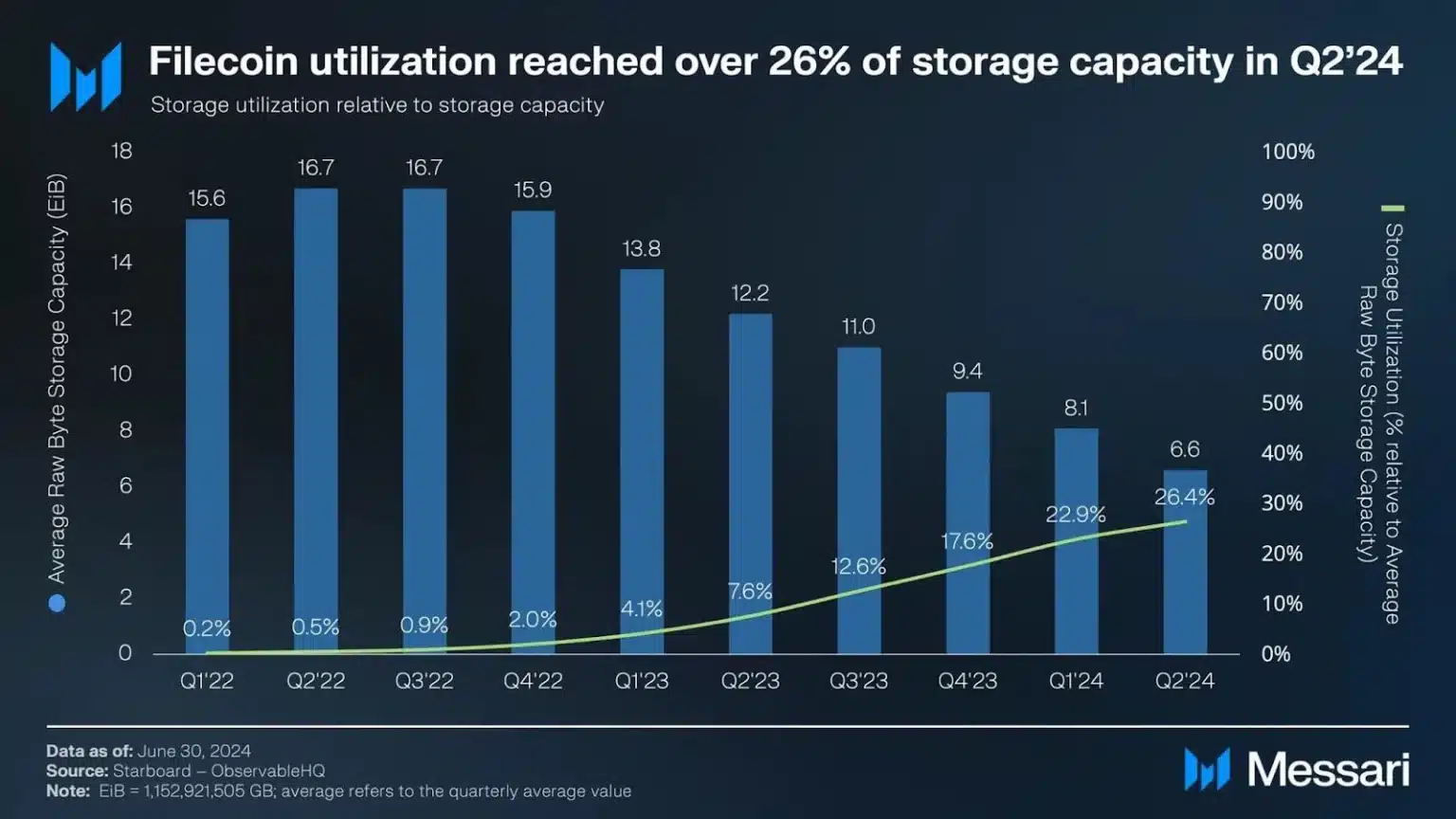

A detailed report by Messari indicates that Filecoin faced several hurdles in Q2. Active storage deals on the network fell by 6% compared to the previous quarter. This decline brought the storage utilization rate to 26%, with only a modest 3% increase from April to June. In contrast, Q1 exhibited a healthier 5% growth from the preceding quarter, highlighting a slowdown in adoption rates.

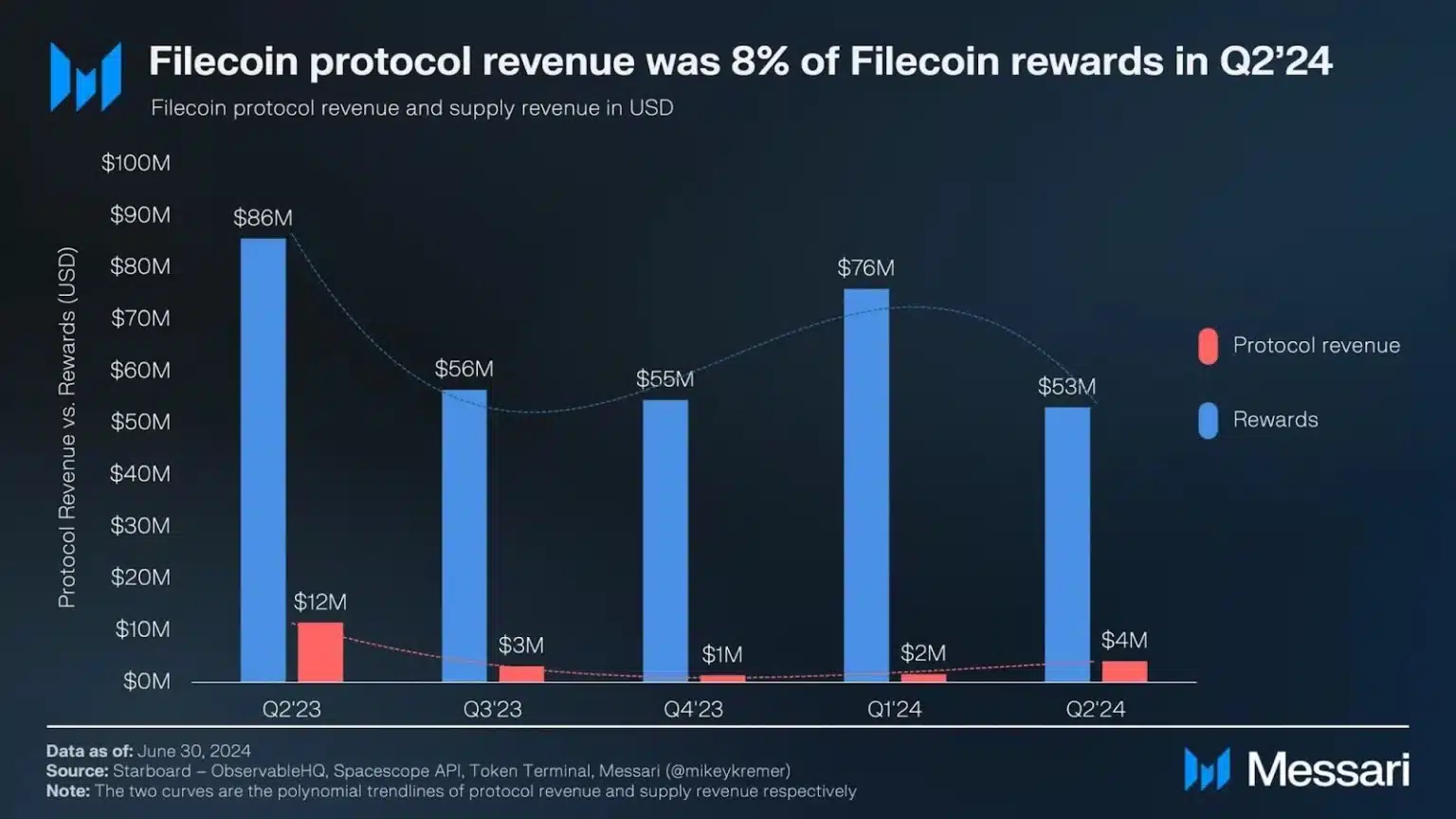

Despite these setbacks, Filecoin’s total revenue from fees experienced a boost, doubling to $4 million from $2 million in Q1, 2024. The network also saw over 3,700 unique contracts deployed, which fueled the total value locked (TVL) on the Filecoin Virtual Machine (FVM) to reach a peak of $213 million in Q2. However, these positive signs did not translate into a stable FIL.

The price of Filecoin dropped significantly, by 55%, between April 1 and June 30. This downturn began at the onset of Q2, with April seeing the most severe corrections. After mid-April, FIL entered a period of consolidation, remaining between $6.3 and $5.2 until mid-June. Unfortunately, the consolidation phase ended poorly, with Filecoin price plummeting to test the support level at $4.2, a struggle it continues to face.

Filecoin Price: Network Performance and Revenue

Hopes were high among investors for a rebound in Q3. However, with a third of the quarter already over, no substantial recovery signs have emerged. Filecoin price dropped another 12% over the past week, settling at $4.0, raising concerns about another bearish quarter.

The volatility in FIL has made it a focal point for market analysts and investors alike. While the network showed some promising signs, the overall negative trend in Filecoin price has dampened the outlook.

Filecoin Price: Struggle and Investor Concerns

The current performance of Filecoin has led to skepticism among investors and market observers. While the network’s advancements in contracts and total value locked show some growth, the persistent decline in Filecoin overshadows these achievements.

In Q2, Filecoin’s active storage deals saw a decline of 6% from the previous quarter. Storage utilization increased by just 3% from April to June, compared to a 5% growth from Q4, 2023, to Q1, 2024. This indicates a slowdown in the rate of adoption. Nonetheless, the total revenue from fees doubled, reaching $4 million in Q2, up from $2 million in Q1, 2024.

Moreover, the network observed the deployment of over 3,700 unique contracts, which contributed to the growth of the total value locked (TVL) on the Filecoin Virtual Machine (FVM). The TVL hit an all-time high of $213 million in Q2. Despite these positive indicators, the Filecoin price did not reflect these improvements, continuing its downward trend.

The decline in Filecoin was sharp, with a 55% drop from April 1 to June 30. The fall began at the start of Q2, with April being the hardest hit. Following mid-April, Filecoin price entered a phase of consolidation, trading between $6.3 and $5.2 until mid-June.

Unfortunately, the consolidation broke downwards, with Filecoin testing the support at $4.2 and struggling to recover since.

In conclusion, Investors had anticipated a recovery in Q3, but with a third of the quarter already gone, there are no clear signs of a rebound. Filecoin dropped another 12% over the past week, reaching $4.0, which has heightened concerns about continued bearish performance.

Filecoin price continues to be a vital subject in the cryptocurrency market. Keeping abreast of its movements can offer valuable insights for investors. Despite the current challenges facing Filecoin, the future remains uncertain and full of possibilities.

To stay updated with the latest news on Filecoin price and other essential market information, tune into The BIT Journal.