The cryptocurrency market is set to witness a major milestone as Volatility Shares LLC launches the first-ever Solana (SOL) futures exchange-traded funds (ETFs) on March 20, 2025. This marks a pivotal step in bridging digital assets with traditional finance, offering investors regulated exposure to Solana without direct ownership of the cryptocurrency.

With Bitcoin and Ethereum already having their own ETFs, Solana now joins the ranks, further solidifying its position as a top digital asset. Experts believe this move could significantly increase institutional adoption and pave the way for a spot in Solana ETF in the future.

Solana Futures ETFs: What Investors Need to Know

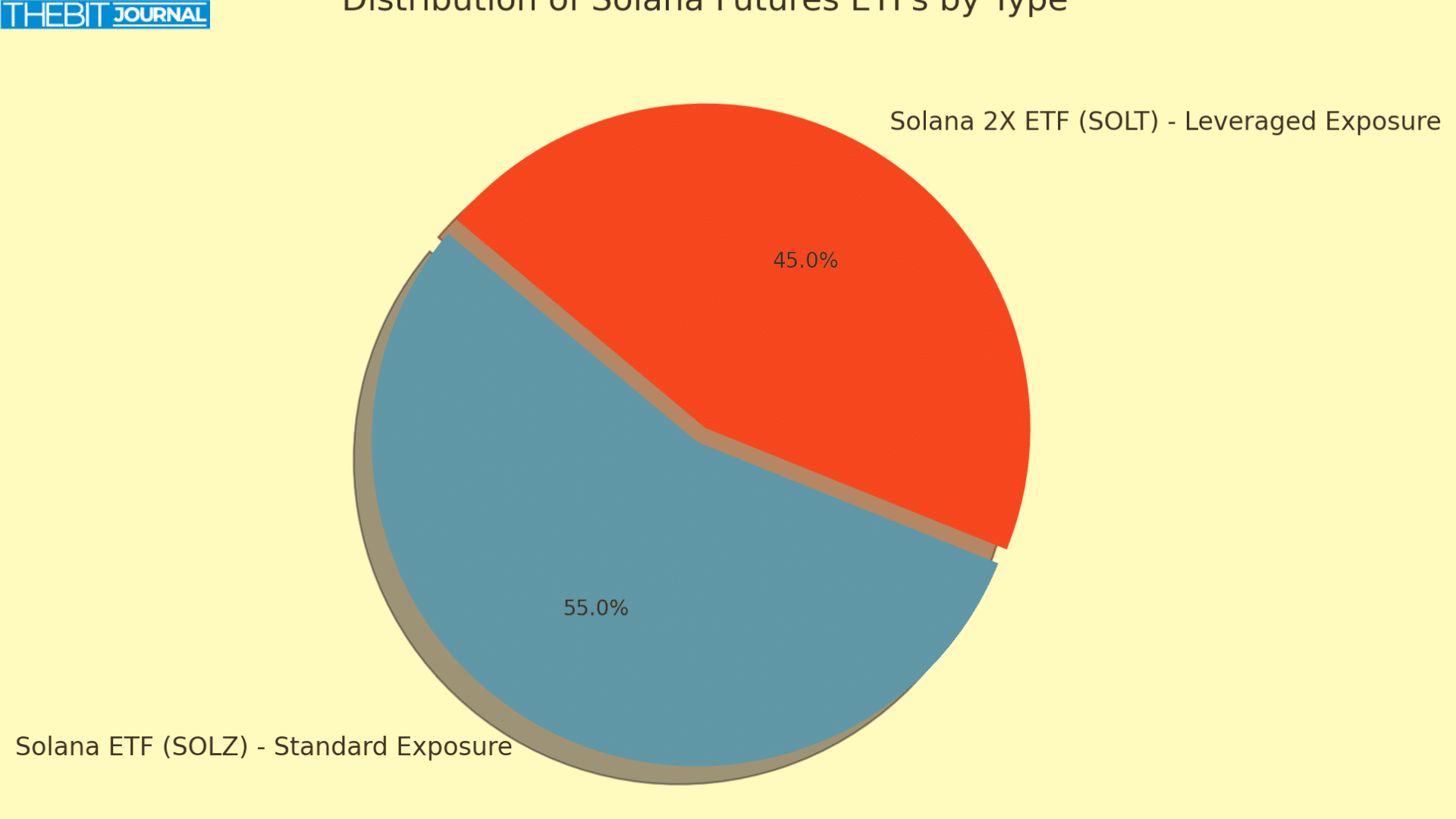

Volatility Shares will introduce two futures-based Solana ETFs, designed for different investment strategies:

Volatility Shares Solana ETF (SOLZ) provides standard exposure to Solana futures, allowing investors to track the token’s price movements without directly holding it. The management fee is 0.95%.

Volatility Shares 2X Solana ETF (SOLT): A leveraged product aiming to deliver twice the daily performance of Solana futures. This allows traders to amplify their gains or losses. Management fee: 1.85%.

Both ETFs track Solana futures contracts rather than the underlying asset itself, meaning their performance is based on market speculation rather than direct ownership of SOL tokens.

Market Impact: Will a Spot Solana ETF Follow?

Historically, the approval of futures ETFs has led to spot ETFs. Bitcoin (BTC) and Ethereum (ETH) both followed this pattern, making Solana’s case for a spot ETF highly likely.

According to CoinDesk, analysts estimate a 75% probability that a spot Solana ETF could be approved by the end of 2025.

Eric Balchunas, Bloomberg ETF analyst, stated: “It’s the first altcoin after Ethereum to be approved. But history has shown that ETF investors crave holding the physical asset as much as possible.”

The U.S. Securities and Exchange Commission (SEC) has historically prioritized futures-based ETFs before granting approval to spot ETFs. If Solana’s futures ETFs perform well, regulatory bodies may consider expanding their acceptance of Solana investment products.

Solana’s Market Performance After the Announcement

Following the ETF announcement, Solana’s price surged by 8% on March 19, 2025, reaching $134 with a market capitalization of $68 billion.

“The launch of a Solana ETF is a sign that traditional finance is starting to embrace blockchain beyond Bitcoin and Ethereum,” said crypto market analyst Michael Van de Poppe.

The increased institutional access to Solana through ETFs could lead to higher liquidity, stronger price action, and broader adoption.

Regulatory Considerations and the Future of Crypto ETFs

The SEC’s stance on crypto ETFs has evolved over the years, with Trump’s administration reportedly more open to approving alternative cryptocurrency investment products.

According to MarketWatch, the political climate could accelerate the approval of additional ETFs, including those for Solana and other altcoins. If this trend continues, 2025 could see more altcoin ETFs entering the market.

Conclusion: A Game-Changer for Solana’s Future?

The launch of Solana Futures ETFs represents a major milestone for both Solana and the broader crypto market. As institutional demand for regulated crypto investment vehicles grows, the success of these ETFs could accelerate the approval of a spot Solana ETF, making it easier for retail and institutional investors to gain direct exposure to SOL.

With growing adoption, bullish price action, and favorable regulatory developments, Solana could be positioned as the next major altcoin ETF success story after Ethereum. Investors should monitor how these ETFs perform in the coming months to gauge their impact on the market.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs: Understanding Solana ETFs and Their Impact

1. What is a Solana Futures ETF?

A Solana Futures ETF is an exchange-traded fund that tracks Solana futures contracts rather than the actual SOL token. Investors can speculate on Solana’s price movements without holding the cryptocurrency itself.

2. How is a Futures ETF different from a Spot ETF?

A futures ETF is based on contracts predicting an asset’s future price, whereas a spot ETF directly holds the asset. Futures ETFs are more susceptible to contango and roll costs, which can impact performance over time.

3. What are the risks of investing in Solana Futures ETFs?

- Contango: When futures contracts trade at a higher price than the spot market, leading to potential losses.

- Leverage Risk (for SOLT ETF): Amplifies both gains and losses, making it more volatile.

- Market Volatility: Crypto assets can experience rapid price swings, affecting ETF performance.

4. Could this lead to a Spot Solana ETF?

Yes, there’s a strong likelihood that a spot Solana ETF could be approved in 2025. The SEC has historically approved spot ETFs after futures ETFs prove successful in the market.

5. How can investors buy Solana Futures ETFs?

Solana Futures ETFs will be available through brokerage platforms offering ETF trading, such as:

- Fidelity

- Charles Schwab

- TD Ameritrade

- Interactive Brokers

Investors should consult with a financial advisor before investing in futures-based products, as they carry unique risks.

Glossary of Key Terms

Exchange-Traded Fund (ETF): A regulated investment fund that trades on stock exchanges, providing exposure to an asset or index.

Futures Contract: A legal agreement to buy or sell an asset at a predetermined price on a future date.

Leveraged ETF: An ETF designed to amplify the daily returns of an underlying index or asset, often using borrowed funds or derivatives.

Contango: A market condition where futures prices are higher than the current spot price, potentially leading to losses when contracts are rolled over.

Spot ETF: An ETF that directly holds the underlying asset (e.g., Bitcoin, Solana) rather than futures contracts.

SEC (Securities and Exchange Commission): The U.S. regulatory agency responsible for overseeing securities markets, including ETFs.

Market Liquidity: The ease with which an asset or security can be bought or sold without affecting its price.