Binance, the world’s largest cryptocurrency exchange, recently unveiled its new Launchpool project. Following the announcement, four major whales made significant moves, purchasing large amounts of BNB, causing the token to surge upward. According to analysts, BNB appears ready to maintain its bullish momentum in the coming days.

Binance Announces Scroll, Whales React

As reported by The Bit Journal, Binance’s recent announcement of Scroll as its new Launchpool project triggered swift reactions from four whales. These whales collectively bought $112.4 million worth of BNB to take advantage of the opportunity. Binance’s Launchpool projects offer users rewards in the form of airdrops, providing incentives for those who lock FDUSD and BNB tokens. Analytics platform Lookonchain shared the following details:

After Binance announced Scroll (SCR) on its Launchpool, four whales borrowed a total of 195,500 BNB (worth $112.4 million) from Venus and staked them on Binance to participate in farming.

- Whale 0x1e7f borrowed 65,000 BNB ($37.34 million).

- Whale 0x5c18 borrowed 52,000 BNB ($29.9 million).

- Whale 0xcd40 borrowed 39,500 BNB ($22.7 million).

- Whale 0x2d87 borrowed 39,000 BNB ($22.4 million).

After #Binance announced #Scroll($SCR) on Binance Launchpool, 4 whales borrowed 195,500 $BNB($112.4M) from #Venus and deposited it to #Binance to participate in farming.

0x1e7f borrowed 65K $BNB($37.34M).

0x5c18 borrowed 52K $BNB($29.9M).

0xcd40 borrowed 39.5K $BNB($22.7M).… pic.twitter.com/bdtLdqYV5C

— Lookonchain (@lookonchain) October 9, 2024

BNB Maintains Bullish Momentum

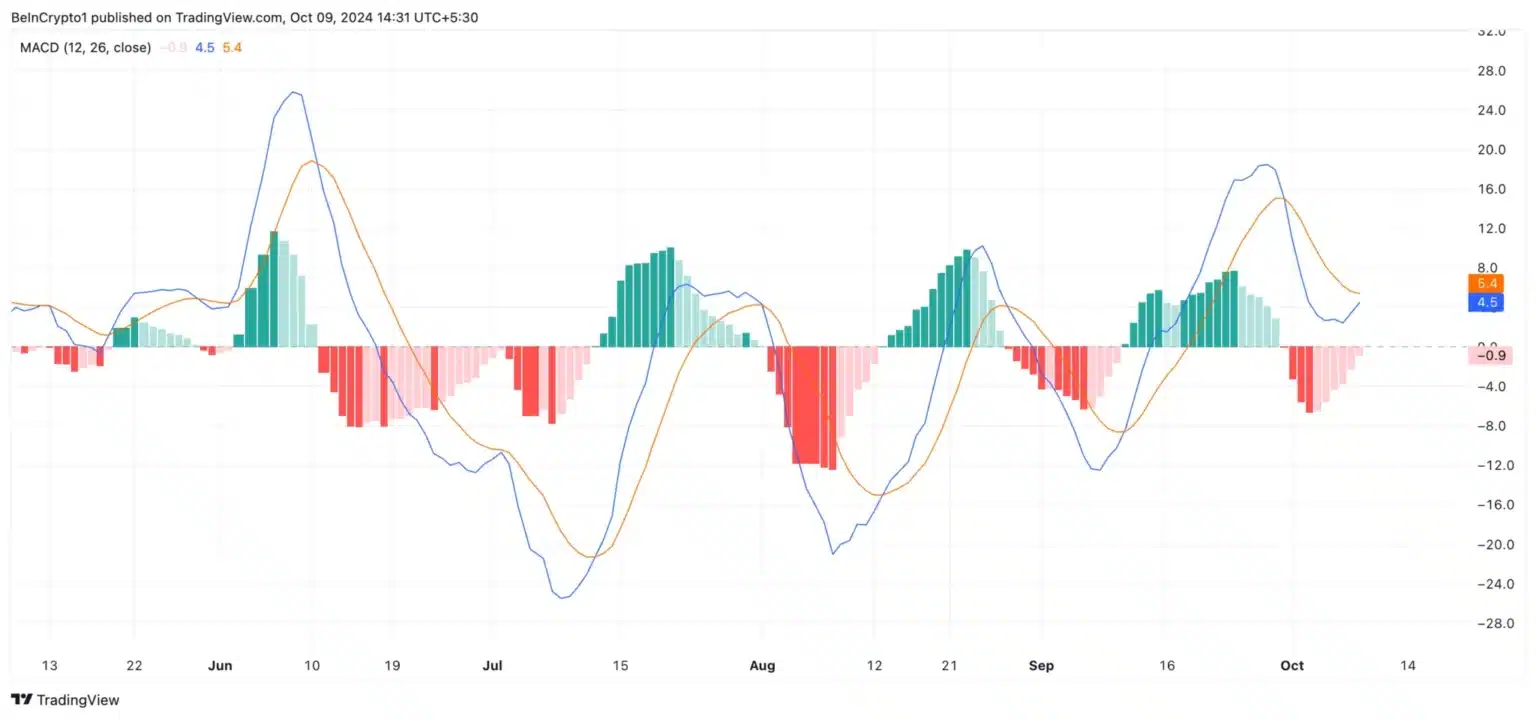

Crypto analyst Abiodun Oladokun examined the technical indicators and outlook for Binance Coin (BNB). At its current price, BNB is trading above both its 20-day exponential moving average (EMA) and its 50-day simple moving average (SMA). The 20-day EMA is a short-term indicator that reacts quickly to price fluctuations, while the 50-day SMA is a long-term indicator that tracks the average closing price over the past 50 days.

On October 4th, BNB surpassed its 50-day SMA, and during Tuesday’s trading session, it also broke past its 20-day EMA. This combination of surpassing both the 50-day SMA and the 20-day EMA signals a shift towards bullish momentum.

Additionally, the moving average convergence divergence (MACD) indicator shows that the MACD line (blue) is poised to cross above the signal line (orange), further confirming the bullish outlook. This suggests that BNB could enter a sustained upward phase.

BNB Price Forecast: Aiming for All-Time High

The ongoing demand for Binance Coin could push its price towards the resistance level of $598.90. This level has acted as long-term resistance, with BNB facing selling pressure each time it approaches this mark since June. If buying pressure continues to build, BNB may finally break through this barrier. However, if demand weakens, BNB may fall back to its support level of $522.90.

BNB is on a strong upward trajectory, with whale activity and Binance’s Launchpool announcement playing a key role. With continued demand and bullish technical indicators, the altcoin is heading towards testing its long-standing resistance levels. Investors should closely watch how these market developments unfold.