The FTX settlement, totaling $12.7 billion, has been approved, bringing a significant resolution to a lengthy legal battle. The approval, reported by The BIT Journal, was granted by a New York judge, allowing the collapsed crypto exchange FTX and its affiliate, Alameda Research, to repay their creditors. This settlement marks the end of a long-standing dispute with the United States Commodity Futures Trading Commission (CFTC).

This crucial settlement is a major relief for the global crypto community, particularly for FTX creditors who have been eagerly waiting for their money. The settlement not only concludes the legal issues but also sets in motion the process of reimbursing those affected by the collapse of FTX, offering them much-needed relief.

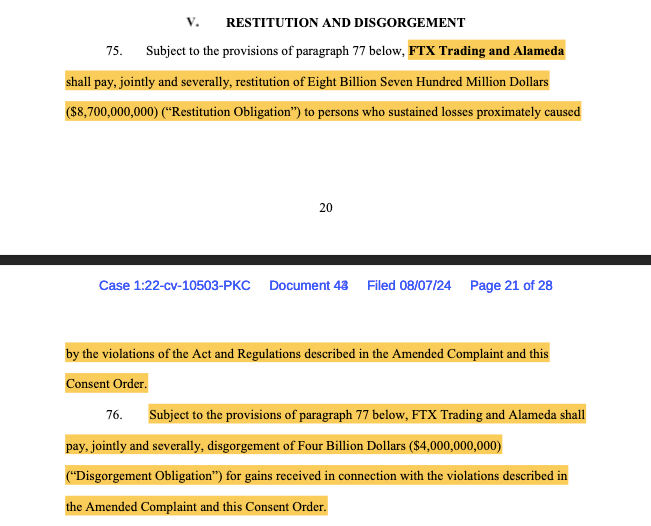

The FTX settlement was officially sanctioned by United States District Judge Peter Castel on August 7. The agreement includes a repayment of $8.7 billion to investors who were defrauded by FTX’s founder, Sam Bankman-Fried, and an additional $4 billion to be disgorged. The CFTC chose not to seek any civil monetary penalty, ensuring all funds go directly to the creditors.

Details of the FTX Settlement Approval

FTX and Alameda had initially agreed to the settlement on July 12, but it required the court’s final approval, which has now been secured. This decision guarantees that the entire $12.7 billion will be used to repay the creditors directly.

The FTX settlement will significantly benefit the creditors. Additionally, the order permanently bans FTX and Alameda from engaging in fraudulent activities or transactions involving digital asset commodities. They are prohibited from buying or selling digital asset commodities on behalf of third parties.

The commodities regulator, identified by FTX as the “most significant single creditor” in its bankruptcy case, filed a lawsuit against FTX, Sam Bankman-Fried, and Alameda Research in December 2022. The lawsuit accused the firm of fraud and misrepresentation as a “digital commodity asset platform.”

Expected Returns for Creditors

According to the current FTX reorganization plan, creditors are expected to see a 118% return for 98% of their claims under $50,000, based on the asset prices at the time of FTX’s bankruptcy filing in November 2022. Many creditors, however, prefer to receive their payouts in cryptocurrency, considering the crypto market’s 150% increase in total market cap since FTX filed for Chapter 11 protection.

FTX creditors are voting on their preferred payout methods and have until August 16 to submit their requests. US Bankruptcy Court Judge John Dorsey will make a final decision on October 7. This settlement ensures that the entire $12.7 billion will be repaid to the creditors, marking a significant step in resolving the bankruptcy case.

The FTX settlement is a crucial development in the efforts to repay those who lost money due to the fraudulent actions of FTX and Alameda Research. Judge Castel’s approval of this settlement is a significant milestone in the legal process.

The BIT Journal has closely followed this case and reports that the settlement was reached after a 20-month-long lawsuit.

The agreement ensures that creditors receive their due payments without any deductions for civil monetary penalties.

Conclusion: A Victory for FTX Creditors

In conclusion, the FTX settlement represents a significant victory for the creditors and the regulatory bodies involved. It ensures a substantial amount of money is returned to those who were defrauded. This decision underscores the importance of accountability and justice in the financial sector.

The FTX settlement has been approved, ensuring $12.7 billion will be repaid to FTX creditors. This decision by Judge Castel emphasizes the need for transparency and fairness in financial transactions.

The TBJ team believes this settlement is a critical step in restoring trust in the cryptocurrency market. The FTX settlement highlights the vital role that regulatory bodies and the judicial system play in protecting investors and ensuring justice is served.

The BIT Journal will continue to monitor the situation and provide updates on the final payout decisions and any further developments in this case.