Bitcoin was once seen as a risky digital experiment. But in 2024, that view changed when the United States Securities and Exchange Commission (SEC) finally approved 11 spot Bitcoin ETFs. This significant step provided the conventional investors with an easy and regulated process to invest in Bitcoin through normal brokerage accounts.

And, now in 2025, the crypto world is abuzz once again. Not only are Bitcoin ETF approvals gaining more attention, but there is also growing speculation around new altcoin ETFs like Solana, XRP, and Litecoin. The major question is: what do these approvals hold for the future of crypto markets? What will be their impact on investors, startups, and the economy of world?

Now, let us dive into what Bitcoin ETFs are all about, why they are important, and what the future holds.

What Are Bitcoin ETF Approvals and Why Was It So Hard to Approve?

An exchange-traded fund is a type of investment that tracks the price-tracking investment in an asset. A Bitcoin ETF does the same thing. The investors are not required to purchase or store the cryptocurrency. They instead purchase shares in the ETF, which holds real Bitcoin in safe storage.

Although futures-based Bitcoin ETFs were already permitted since 2021, spot Bitcoin ETFs took years longer. SEC was concerned about the manipulation of the market, security threats, and the security of the investors. It wasn’t until January 10, 2024, that the first 11 spot Bitcoin ETFs were approved in the U.S., including funds from BlackRock, Fidelity, and Grayscale.

This approval marked a new chapter for crypto. It allowed large investors to buy Bitcoin with fewer regulatory and technical concerns. And that changed everything.

How Do Spot Bitcoin ETFs Work?

Spot Bitcoin ETFs are relatively simple to understand. The provider of ETF purchases Bitcoin and stores it in licensed custodians. These Bitcoins are kept in safe digital vaults, which are usually offline so that they are not hacked. The ETF shares are then sold on the conventional exchanges.

These shares closely follow the market price of Bitcoin. That means if Bitcoin rises, the ETF share price also goes up. If Bitcoin falls, then so does the ETF. In the present time, investors can purchase and sell these shares like regular stocks, without the need for wallets, keys, or exchanges.

This setup, further, increases the market transparency. They are required to report their positions and tight rules. It is more open and the regulators can track the circulation of money, and this makes the market fair.

What Happened After the First Bitcoin ETFs Were Approved?

Following the approval of the spot Bitcoin ETF by the SEC, the price of Bitcoin soared. The newly listed funds came in billions of dollars. The institutional investors who had been reluctant began to enter the market.

BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) were among the most popular ETFs. Even options trading was introduced in some ETFs so that investors would have more risk and return management tools.

Bitcoin was also made more acceptable to traditional investors through the approval. It was an indication that the government of the United States was at last ready to accept crypto as a component of the financial system.

Why Are Investors So Excited About Crypto ETFs?

There are a lot of advantages to Crypto ETFs. To begin with, they are accessible. You do not have to create a crypto wallet or know anything about blockchain. All you need to do is log into your brokerage account and purchase the ETF.

Second, they are less dangerous. The ETFs employ professional custodians, with many of them being insured. This minimizes the possibility of theft or loss.

Third, they introduce liquidity. The fact that a large number of individuals are selling and purchasing the ETF shares aids in ensuring that the market is running smoothly. This minimizes the fluctuation in the price and enhances stability in the market.

Fourth, they bring in large amounts of money. The type of institutions that are likely to invest in a regulated product such as an ETF are those, such as pension funds and hedge funds. They can increase the price and trading volume of Bitcoin using their money.

What Are the Risks of Bitcoin ETFs?

Despite the hype, Bitcoin ETFs are not risk-free. The biggest concern is Bitcoin’s price volatility. An ETF cannot save investors even with professional management when it comes to a price collapse. The other risk is the risk of regulatory change. The fact that ETFs are permitted now does not mean that the regulations will remain consistent. New taxes, restrictions, or controls could be introduced by governments.

A tracking error is also a risk. The market price of Bitcoin is the same as the ETF price. This may be a result of slow price adjustment or management charges. The question of security is also involved. Investors may lose money in case the custodian is hacked or fails. Although this is a rare thing, it is not impossible.

What Is the Impact of ETF Approvals on the Broader Crypto Market?

Bitcoin ETF approvals do more than just help Bitcoin. They also support the entire crypto ecosystem. When ETFs bring in new investors, those investors often explore other cryptocurrencies too. ETFs increase trust. They show that regulators are willing to work with crypto, not just ban it. This encourages developers, startups, and traditional companies to build in the space.

ETFs also improve price discovery. When more people trade an asset, its price becomes more accurate. That helps all users of Bitcoin, including those outside the Bitcoin ETF approvals market. Some analysts think that maybe, just maybe, ETFs could even make Bitcoin less volatile. When huge entities purchase and hold lots, they help to regulate wild price fluctuation.

What Comes Next? Altcoin ETFs and New Possibilities

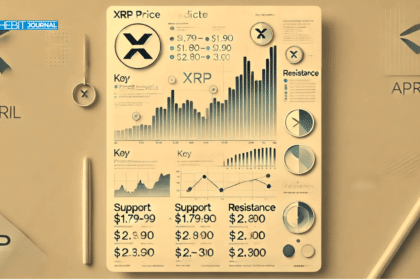

In 2025, it is no longer just about Bitcoin. According to Bloomberg analysts, now, the probability of XRP, Solana, and Litecoin ETFs approval is at 95 percent. This leads to the possibility of further crypto adoption.

Altcoin ETFs would enable investors to invest in other blockchain applications without having to worry about the individual management of coins. They would also assist in the distribution of investment in various use cases, including smart contracts, gaming, and payments.

Naturally, there is a risk of altcoins. They tend to be less liquid, more volatile, and subject to scams. Nevertheless, the approvals of Bitcoin ETFs may be used to sieve the weak projects and bring the best to the forefront.

How Will ETF Approvals Affect Startups and SMEs?

Startups, especially in Asia and Europe, are watching these changes closely. In countries like South Korea, new crypto laws are being introduced to support ETFs. Fintech firms will need to improve their compliance and reporting systems.

In Europe, the MiCA regulation is already pushing crypto firms to register and follow stricter rules. Small and medium businesses must now consider whether they want to operate under the new rules or look for friendlier jurisdictions.

At the same time, Bitcoin ETF approvals create new opportunities. Startups can build ETF-linked products, analytics tools, or custody services. They can also partner with larger firms to create financial services that include Bitcoin as an asset class.

Will ETFs Make Bitcoin Too Centralized?

The issue of the role of institutions in crypto is subject to increasing debate. There is a fear that letting big companies such as BlackRock and Fidelity own so much Bitcoin will cause centralization. Suppose that a handful of mega ETFs hold a significant percentage of the Bitcoin; they would be able to affect the prices as well as policies, and even protocols.

Others argue that Bitcoin ETF approvals are just another access point. The Bitcoin network remains open and decentralized. Anyone can still run a node, mine coins, or hold Bitcoin privately. The key will be balance. The market must allow both institutional and retail users to co-exist without one side overpowering the other.

Could Bitcoin ETFs Help Prevent Market Manipulation?

Ironically, one of the original reasons the SEC resisted ETF approvals was fear of manipulation. But now that ETFs are live, they might actually help. Since ETFs are traded on regulated exchanges, their activity is easier to monitor. This can make it harder for bad actors to pump or dump prices.

Also, Bitcoin ETF approvals add liquidity, which means fewer sharp price changes. When a market is deep and active, it is harder for a single player to control the price. Still, the crypto market is not perfect. Scams and fake volume still exist, especially on smaller exchanges. ETFs can help clean this up, but they are not a full solution.

What Will the Future Look Like?

The Bitcoin ETF approvals we have seen so far are just the beginning. More products are likely to follow, including multi-asset ETFs, DeFi-based ETFs, and even Bitcoin ETF approvals tied to stablecoins or Web3 tokens.

ETFs can also be observed as retirement portfolios, pension funds, or sovereign wealth funds. It would be a full circle moment when Bitcoin becomes a mainstream investment after being an underground currency.

Education will be significant at the same time. Some of the new investors are yet to comprehend the working of crypto fully. Guidelines, easy-to-use tools, and clear fees will be needed. The worldwide regulation will also be required to keep up. Nations will have to collaborate in order to eliminate loopholes, eliminate fraud, and maintain markets that are fair.

Conclusion

Bitcoin ETF approvals have changed the way people think about crypto. It has not only brought legitimacy and structure to a market that was viewed as wild and unpredictable, but it has also attracted new investors into an otherwise wild market. The more coins are added and the more ETFs are introduced, the bigger the effect will be. It can increase in price, volatility can decrease, and adoption can extend to every corner of the world.

There are still obstacles. The crypto world needs to keep evolving further, be it in matters of regulation or security, or education. Approvals of bitcoin ETFs are not the ultimate goal, but they are a good forward step. This is the time to be keen on the part of investors, startups, and institutions. It is possible to write the future of crypto funds by fund.

FAQs

- What is a Bitcoin ETF?

A Bitcoin ETF is an exchange-traded fund that allows investors to gain exposure to Bitcoin’s price movements without directly buying or managing the cryptocurrency.

- How is a spot Bitcoin ETF different from a futures Bitcoin ETF?

A spot Bitcoin ETF holds actual Bitcoin, tracking its real-time price. A futures Bitcoin ETF uses contracts that speculate on future prices, which can lead to tracking errors.

- Why did the SEC delay Bitcoin ETF approvals for so long?

The SEC was concerned about market manipulation, custodial risk, and the lack of investor protection in unregulated crypto markets.

- How do Bitcoin ETFs impact the market?

Bitcoin ETFs bring in institutional investors, increase liquidity, reduce price volatility, and add legitimacy to crypto as an asset class.

- Are Bitcoin ETFs safe for beginners?

While easier to use and regulated, Bitcoin ETFs still carry risk due to Bitcoin’s price volatility. They are safer than holding crypto directly but not risk-free.

Glossary of Terms

ETF (Exchange-Traded Fund):

A type of investment fund traded on stock exchanges, similar to stocks, which holds assets like stocks, bonds, or commodities.

Spot ETF:

An ETF that holds the actual asset (such as Bitcoin) rather than derivative contracts.

Bitcoin:

A decentralized digital currency without a central bank, using blockchain technology for secure peer-to-peer transactions.

Custodian:

A financial institution or service that securely holds assets on behalf of clients or funds.

Futures Contract:

A legal agreement to buy or sell an asset at a predetermined price at a specified time in the future.

Market Manipulation:

Actions taken to deceive or mislead investors by artificially affecting the supply, demand, or price of a security or asset.

Liquidity:

The ease with which an asset can be bought or sold in the market without affecting its price.

Tracking Error:

The difference between an ETF’s performance and the performance of the asset or index it is supposed to track.