In a dramatic turn of events, GameStop has officially confirmed the acquisition of 4,710 Bitcoins between May 3 and June 10, 2025. The announcement comes as a bold pivot in its financial strategy and signals a strong belief in cryptocurrency as a long-term asset. This development could reshape the way traditional retail companies think about digital assets, and it has certainly caught the attention of The Bit Journal and industry analysts alike.

From Slumping Sales to a Glimpse of Profitability

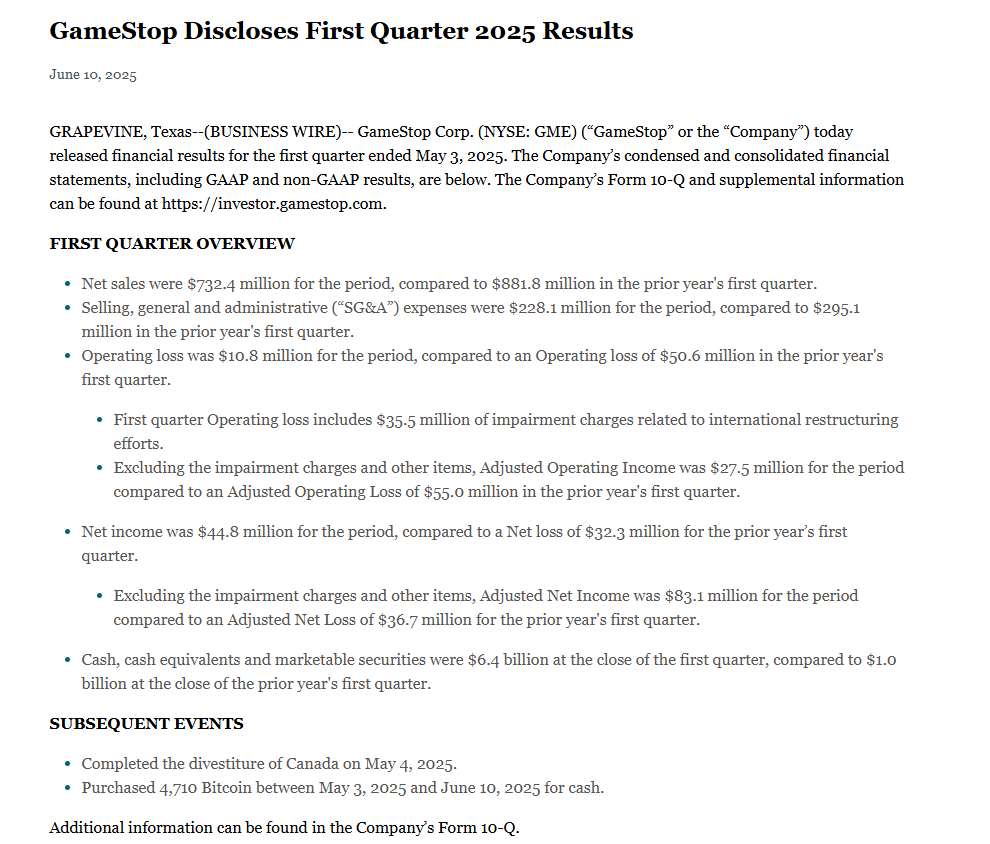

GameStop’s first-quarter report for 2025 revealed a 16.9% year-over-year decline in net sales—from $881.8 million to $732.4 million. At first glance, the numbers might seem discouraging. However, a deeper analysis unveils a more promising narrative. The company managed to significantly reduce its operating expenses, notably bringing selling, general, and administrative costs down from $295.1 million to $228.1 million.

One-time charges, such as a $35.5 million impairment, initially muddled the financial picture. But excluding such non-recurring items, GameStop actually reported an operating profit of $27.5 million. This turnaround suggests a stronger operational discipline and a clearer focus on profitability.

Exiting Canada, Doubling Down on Strategy

Another key part of GameStop’s restructuring was its decision to exit the Canadian market. While this move may seem drastic, it aligns with the company’s broader objective of streamlining global operations. By cutting underperforming regions, GameStop appears to be concentrating resources where they can have the most impact.

Bitcoin: A Strategic Treasury Play

The most headline-grabbing aspect of GameStop’s announcement is undoubtedly its $320 million (estimated at current market value) investment in Bitcoin. The company stated that the move was designed to diversify and strengthen its balance sheet, leveraging its substantial cash reserves. By the end of Q1 2025, GameStop’s cash and equivalents had soared to $6.4 billion—up significantly from just $1 billion a year ago.

This Bitcoin purchase is not merely a speculative bet. It reflects a growing trend among publicly traded companies to treat crypto as a treasury reserve asset. For GameStop, it could also signal readiness to explore blockchain-based strategies or fintech integrations in future initiatives.

Conclusion

GameStop’s transition from a meme-stock saga to a disciplined, strategic player is starting to take shape. Its foray into Bitcoin investment, cost optimization, and international restructuring suggests a roadmap toward long-term sustainability. Whether this gamble pays off remains to be seen, but the company’s bold moves are already sparking serious conversations in crypto and traditional finance circles alike—especially among followers of The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Sources:

GameStop Q1 2025 Financial Filing

Reuters – GameStop Invests in Bitcoin, Ends Canadian Operations

Bloomberg – GameStop Trims Costs, Boosts Crypto Holdings