According to a recent report, the GENIUS Act might be the missing piece that turns stablecoins from crypto tools into real-world payment options. BlackRock believes this new law could finally give stablecoin regulation the clarity it always needed.

A Quick Look at the GENIUS Act

The Guiding and Establishing National Innovation for U.S. Stablecoins Act was signed into law in July 2025. It’s the first federal law in the U.S. focused solely on stablecoins.

Here’s what it says:

- Stablecoins used for payments must be backed 1:1 with U.S. dollars or short-term Treasuries

- Issuers must publish monthly audits

- Only licensed institutions can issue them

- Algorithmic stablecoins are banned for two years

- No claims that mislead users (like saying the coin is “FDIC insured”)

In short, it’s a rulebook. And for a long time, that’s what stablecoins were missing.

Why BlackRock Thinks This Law Changes Everything

“Tokenized money market funds and the ability to use them in digital wallets…is the next generation for markets.”

said Larry Fink, CEO of BlackRock.

BlackRock doesn’t just talk. It manages the Circle Reserve Fund, which holds most of the dollars backing USDC. The company believes that the GENIUS Act turns stablecoins into something tangible: digital dollars you could use to buy coffee, pay a friend, or settle a bill just like cash or cards.

This makes stablecoin regulation more than legal talk. It becomes a step toward digital money that works in everyday life.

What Happened After the Law Passed?

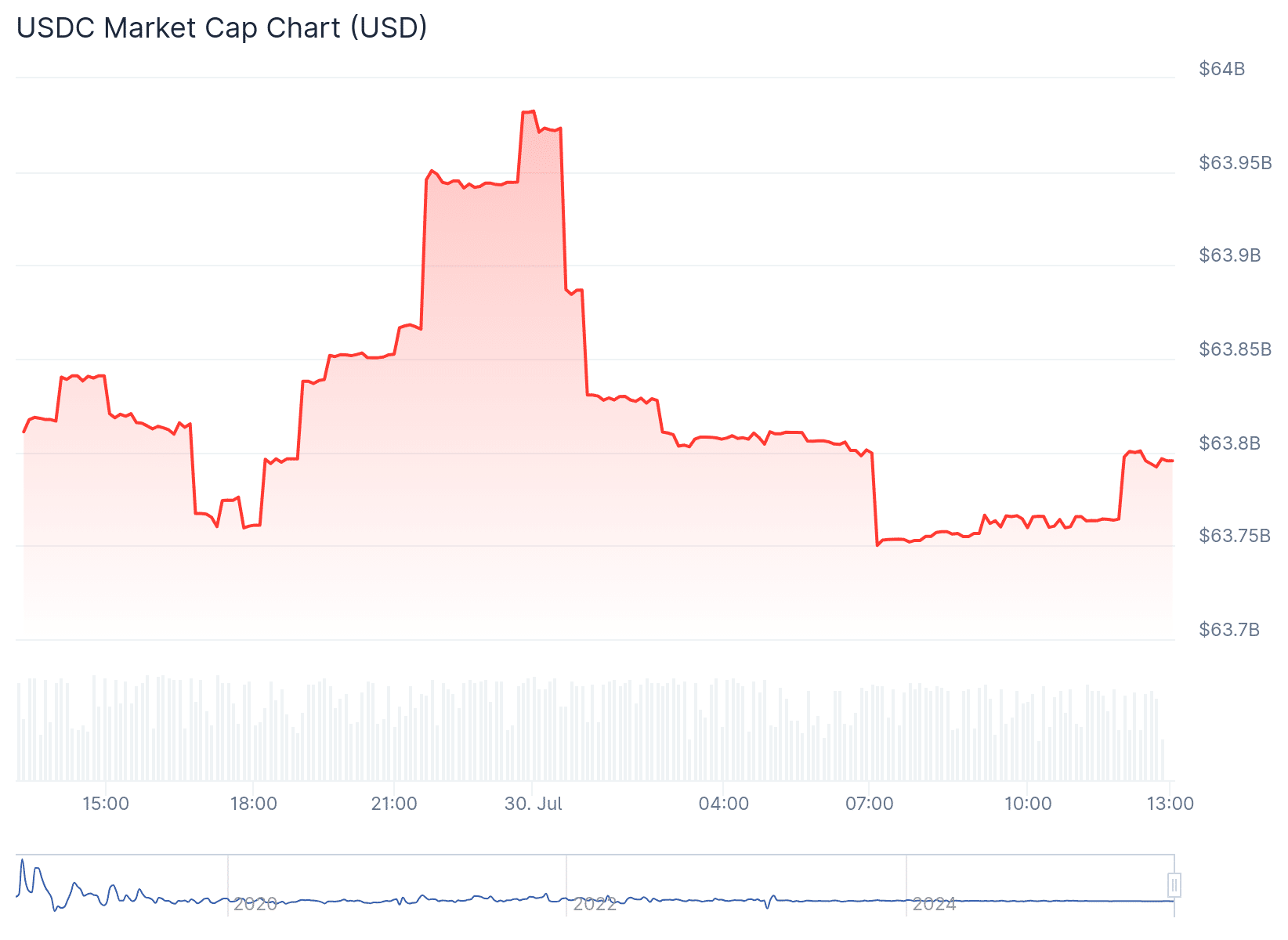

The numbers spoke immediately after the GENIUS Act passed.

CoinGecko data shows USDC’s market cap climbed from roughly $61 billion to over $64 billion within days of the law passing, adding more than $3 billion in value. This jump signals growing trust. A clear rulebook under the U.S. Stablecoin Law made people feel safer holding stablecoins, highlighting the value of transparent stablecoin regulation.

Well-known institutions like JPMorgan and PayPal have begun building their stablecoins under the new framework. This surge in institutional attention reinforces that trust and demand are building strong momentum.

What the Crypto Community Is Saying

“The GENIUS Act reverses this: It creates clarity for stablecoins and sets us on a path toward broader crypto market structure reforms.”

This quote underscores how the new law clears legal ambiguity and gives builders a clear framework to innovate responsibly.

And from industry analysts speaking to broader market impact:

“By establishing clear, actionable rules for stablecoins and digital assets, the Genius Act unlocks broader adoption by traditional institutions and brings much‑needed trust and transparency to the sector.”

The community sees it as a big deal. Not just another law but a chance to build better.

What the US Stablecoin Law Covers

| Feature | Requirement |

|---|---|

| Backing | 1:1 with cash or short-term bonds |

| Public audits | Monthly, verified |

| Who can issue | Licensed institutions only |

| Algorithmic coins | Banned for two years |

| Misleading labels | Not allowed |

Why It Matters

This isn’t just about new rules. The U.S. Stablecoin Law brings real structure to stablecoin regulation. It gives users safety. It provides builders with clear lanes. And it gives investors a sense that this part of crypto is finally growing up.

With firms like BlackRock stepping in, stablecoins are no longer just a “crypto thing.” They could become something as normal as PayPal except faster, cheaper, and easier to move around the world.

Conclusion

Based on the latest research, the GENIUS Act marks a clear shift in how the U.S. handles stablecoins. It gives structure to a space that once lacked rules and builds trust for users and institutions alike. With strong support from major players like BlackRock, this law lays the groundwork for making stablecoins part of daily life safe, regulated, and ready for real-world use.

Summary

The GENIUS Act is a new U.S. law that sets clear rules for stablecoins, including full backing, audits, and licensed issuers. Backed by major firms like BlackRock, it gives stablecoin regulation real structure for the first time. This move helps turn stablecoins into trusted digital dollars that people can use. With safer standards now in place, the act could reshape how money moves across the internet and everyday life.

For more expert reviews and crypto insights, visit our dedicated platform for the latest news and predictions.

FAQs

Q: What is the GENIUS Act?

A U.S. law that sets clear rules for issuing and using payment stablecoins.

Q: What does stablecoin regulation mean?

It means having laws that define how stablecoins work, how they’re backed, and who can offer them.

Q: Are algorithmic stablecoins allowed now?

No. They’re banned for two years under this law.

Q: Is BlackRock involved?

Yes. BlackRock manages the reserves for USDC and supports this new legal model.

Glossary

GENIUS Act: A 2025 U.S. law that governs stablecoins.

Stablecoin: A cryptocurrency tied to something stable like the dollar.

USDC: A popular dollar-backed stablecoin issued by Circle.

Algorithmic stablecoin: A stablecoin not backed by tangible assets, banned under the new law.

Sources / References