According to official sources, the GENIUS Act Stablecoin regulation is now official U.S. law. Signed on July 18, 2025, by President Donald Trump, it marks the first federal framework addressing how stablecoins should operate.

With growth in crypto adoption, this regulation promises structure, safety, and broader use of dollar-pegged digital assets from the outset.

What the GENIUS Act Stablecoin Regulation Brings to the Crypto Sector

The GENIUS Act Stablecoin regulation mandates that all approved issuers maintain actual 1:1 backing with U.S. dollars or Treasury bonds. Reserve reports are now issued monthly, and annual audits apply to the largest firms. Oversight is divided among the Federal Reserve, the OCC, and state regulators, depending on the size of the issuer.

“The GENIUS Act marked a watershed moment for stablecoin regulation,” noted Cointelegraph, emphasizing how entrenched crypto interests could not derail the legislation.

Token holders gain priority repayment rights if an issuer fails, providing overdue protection as an upgrade from prior unregulated schemes.

GENIUS Act Stablecoin Regulation Fuels Market Growth

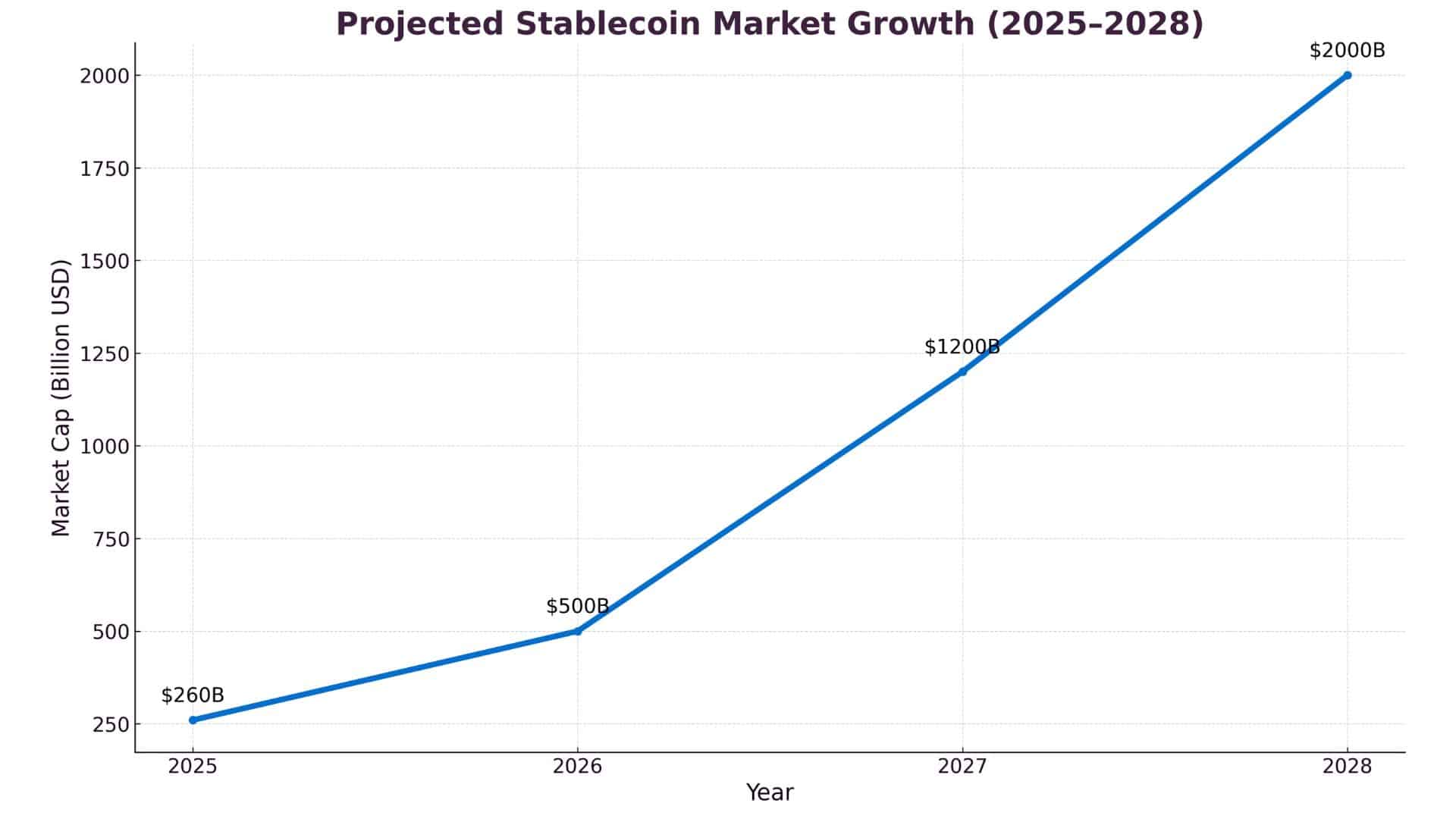

Experts project that stablecoin use could surge from around $260 billion today to $2 trillion by 2028, under the GENIUS Act Stablecoin regulation. A Reuters report confirmed that the market cap reached $251.7 billion soon after Senate approval.

Major issuers such as Circle and Paxos view the law as a milestone for transparency and stability. The U.S. Treasury also benefits, as issuers increase their holdings of government debt, reinforcing dollar liquidity and strengthening international demand.

“Stablecoins may become the bridge between traditional finance and blockchain. This regulation helps us build that bridge safely,” said Lina Hart, CTO at BlockTrust.

Key Concerns Surrounding Implementation

The GENIUS Act Stablecoin regulation introduces structure, but some challenges remain:

- Accounting gaps: CFOs await guidance on the treatment of stablecoins under U.S. financial rules.

- Timeline: Core rules are set to activate by late 2026, leaving a transition period.

- Corporate issuers: Large tech companies are not prohibited from launching stablecoins, raising concerns about potential monopolies.

- Systemic risk: Analysts caution that dependency on Treasury bonds could destabilize issuers in liquidity crunches.

The Bank for International Settlements (BIS) also warned that large stablecoin ecosystems might risk monetary control and financial privacy.

Regulatory Voices and Reactions

An article cited S&P Global Ratings saying, “Lack of regulation is one of the main barriers to stablecoin adoption in the U.S.” Meanwhile, privacy advocates at the Cato Institute have expressed concerns over surveillance possibilities.

“Lawmakers must ensure stablecoin rules don’t compromise financial privacy,” said Jennifer Schulp, Director at Cato’s Center for Financial Regulation.

Vincent Maliepaard of Sentora noted that more precise clarity could encourage U.S. banks to tokenize real-world assets, such as Treasuries.

Conclusion: The Road Ahead

Based on the latest research, the GENIUS Act Stablecoin regulation marks a clear and definable revolution regarding the way digital assets are perceived and treated in the United States. It lays down the first principles of user protection, market attraction for institutional players, and market stabilization.

This law has the potential to reshape interaction between trust, liquidity, and compliance along the lines of blockchain-based finance as it gets implemented in stages. Its architecture paves the way for issuers to achieve scale and compliance and secures insurance for holders.

As digital finance emerges, this law remains a reference point for responsible innovation. One of the charms of the GENIUS Act is that it aims to provide guidance and restrictions, stating in more precise terms that the U.S. is drawing a line from speculation to stability and leading the way into the crypto sector.

Summary

The first federal framework for stablecoins was the GENIUS Act, which established regulations to ensure transparency and user protection for stablecoin customers, as well as a regulatory framework for supervising these assets. By signing and enforcing it into law in July 2025, this step would pave the way toward safer digital finance and market expansion potential.

Although it still needs to address accounting and systemic risks, it marks a historic shift in the name of responsible crypto adoption, as well as builds a bridge of trust between blockchain innovation and traditional financial systems.

Explore more: GENIUS Act – understand its long-term impact on stablecoins and digital finance.

FAQs

Q: What is the GENIUS Act?

A: It’s the first U.S. federal stablecoin law, enacted in July 2025.

Q: Who will oversee the stablecoin market?

A: The Federal Reserve, OCC, or state regulators, based on issuer size and scope.

Q: When does the law come into effect?

A: Most provisions are expected to activate by November 2026.

Q: How does this help stablecoin users?

A: It enforces reserve backing, financial audits, and repayment protections.

Glossary of Key Terms

Stablecoin: A cryptocurrency pegged to a stable asset, usually the U.S. dollar.

OCC: Office of the Comptroller of the Currency, a U.S. regulator for national banks.

Treasuries: Debt securities issued by the U.S. government, considered low-risk.

Token Holder: An individual or institution owning a stablecoin.

AML/BSA: Anti-Money Laundering rules under the Bank Secrecy Act.

Sources & References