The German government’s recent actions in the cryptocurrency space have sent shockwaves through the market. It has transferred a substantial amount of Bitcoin, totalling over $172 million, to various destinations. This significant move involving 3,000 BTC has caught the attention of blockchain analysts and sparked discussions about its potential impact on Bitcoin’s market dynamics.

On July 4th, blockchain investigator PeckShieldAlert flagged a noteworthy transfer originating from a cryptocurrency wallet labelled “German Government (BKA).” The transaction involved 1,300 Bitcoin, valued at approximately $75 million, being distributed across three prominent crypto exchanges: Coinbase, Kraken, and Bitstamp. This move underscores German authorities’ deliberate strategy of interacting with the broader cryptocurrency ecosystem.

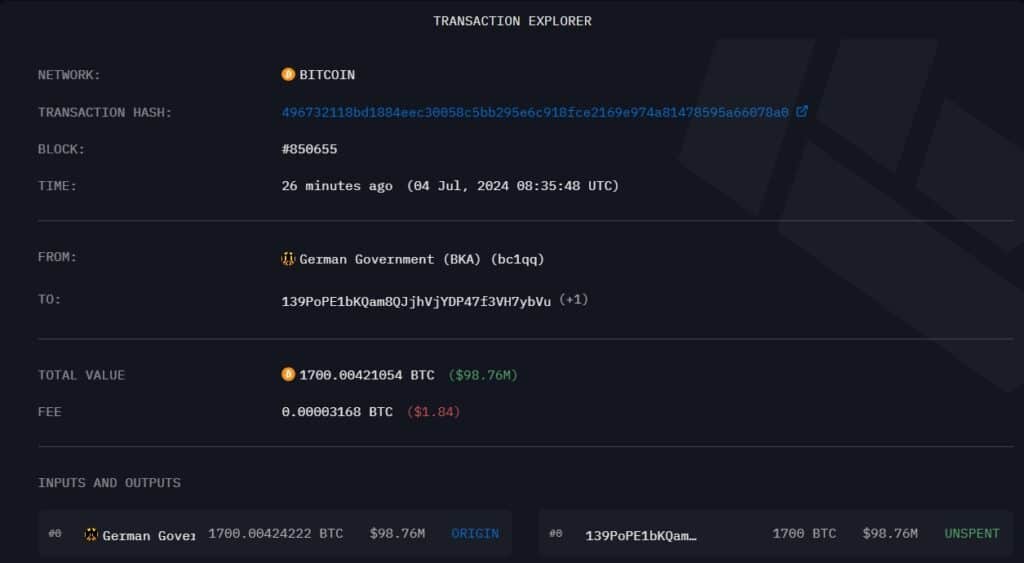

According to sources familiar with the matter, the same government-linked wallet concurrently transferred an additional 1,700 BTC to another undisclosed wallet address. This brings the total Bitcoin transferred from the government wallet to 3,000 BTC, as confirmed by the PeckShield team.

The implications of such a significant transfer are profound, particularly in the context of Bitcoin’s price stability and market sentiment. As reported by Cointelegraph, the movement of these funds suggests a strategic decision by German authorities to either liquidate a portion of their Bitcoin holdings or redistribute them for operational purposes.

Moreover, data from on-chain analytics platform Arkham Intelligence reveals that while 1,300 BTC found their way to centralized exchanges, the remaining 1,700 BTC were directed towards an unlabeled crypto wallet. This diversification of destination addresses indicates a nuanced approach by the German government, potentially involving both market transactions and storage considerations.

German Government Bitcoin Transfer: Impact on Bitcoin Selling Pressure

The recent series of Bitcoin transfers by the German government mirrors global trends in state management of cryptocurrencies. Similar to the U.S. auctioning seized Bitcoin from cases like Silk Road, these actions, combined with pending Mt. Gox repayments, may increase selling pressure on crypto markets. Analysts expect price fluctuations as substantial amounts of BTC enter circulation or move between wallets.

Since February 2024, Germany has held 50,000 BTC, making it a significant player in the crypto space. Recent transfers reflect strategic shifts in managing seized or legally obtained digital assets.

Global Context and Market Response

The international cryptocurrency community is observing these developments with keen interest, as governmental interactions with Bitcoin continue to evolve. Instances of asset seizure and subsequent management, as seen in Germany’s case, highlight the growing institutional engagement with digital currencies and their implications for broader market stability.

Market analysts warn that governmental transfers can introduce short-term volatility but signify a maturing regulatory landscape where digital assets are increasingly integrated into mainstream financial operations. Although conducted through pseudonymous wallets, the transparency of such transactions underscores the need for regulatory frameworks that balance security concerns with market efficiency.

Historical Context and Precedents

Germany is not alone in this practice. Governments around the world have a history of confiscating Bitcoin and other digital assets linked to criminal activities. These assets are often sold off in auctions, adding to the liquidity in the market and raising questions about the timing and market impact of such large transactions.

For example, the United States government has previously sold significant amounts of Bitcoin seized from the Silk Road, a notorious dark web marketplace. In 2014, Tim Draper, an American businessman and Bitcoin advocate, purchased 29,656 BTC from one such auction. These actions, while beneficial in terms of recovering value from illegal activities, also contribute to fluctuations in the cryptocurrency market.

Speculative Implications

Speculation abounds regarding the reasons behind the German government’s recent Bitcoin transfers. Some analysts suggest that these moves could be preparatory steps for further regulatory measures or potential market interventions. Others believe it could be a strategy to test the market’s reaction to large-scale transactions.

According to reports, the German government may be looking to capitalize on the current high valuation of Bitcoin, converting some of its holdings into fiat currency to fund various initiatives or reduce national debt. Alternatively, the transfers to an unknown wallet could signify preparations for future transactions or security measures to safeguard the assets.

Market Reactions and Predictions

The cryptocurrency market is inherently sensitive to large transactions, especially government-held assets. These transactions can influence market sentiment and trading behaviour as they become public knowledge. Short-term traders may react with increased buying or selling activity, while long-term investors will closely watch for any signs of government policy shifts or strategic moves.

Analysts believe that governments’ continued involvement in cryptocurrency is a testament to the growing recognition of digital assets as legitimate financial instruments. However, it also underscores the need for robust regulatory frameworks to manage the risks associated with large-scale transactions and market manipulation.

Conclusion

In conclusion, the German government’s strategic Bitcoin transfers underscore its proactive stance in the digital economy, setting a precedent for future governmental engagements with cryptocurrencies globally. As the market evolves, these actions will be critical in shaping the trajectory of digital assets and their role in the global financial ecosystem. For more of the latest crypto news, Stay informed with BIT Journal.