Ghana is taking significant strides in the world of digital finance. The Bank of Ghana (BoG) has put forward new regulatory measures aimed at governing digital assets, including popular cryptocurrencies such as Bitcoin and tether. This initiative follows a thorough internal review by the central bank, reflecting the nation’s growing interest in the cryptocurrency market.

Growing Interest in Cryptocurrencies

Over the last three years, the BoG has observed a marked increase in the number of Ghanaians engaging in cryptocurrency activities. Whether for investment purposes or everyday transactions, digital currencies have become increasingly popular in the country.

However, this surge in interest has highlighted the need for a regulatory framework to manage potential risks such as money laundering, terrorism financing, and fraud, while also ensuring consumer protection. In response, the Bank of Ghana has drafted guidelines to address these concerns. The proposed regulations aim to bring order to the rapidly expanding digital asset space and safeguard the interests of the public.

Strengthening Oversight of Crypto Exchanges

A key component of the BoG’s proposal is an eight-pillar framework that enhances the registration and reporting requirements for cryptocurrency exchanges and other virtual asset service providers (VASPs). This framework suggests that exchanges should be more closely monitored, particularly in relation to suspicious transactions.

One notable aspect of the proposed regulations is the requirement for crypto exchanges to adhere to the Financial Action Task Force’s (FATF) Travel Rule, which mandates that certain information accompany digital asset transfers to combat illicit activities. The Bank of Ghana also plans to work in collaboration with other stakeholders, including commercial banks and offshore regulators, to ensure a comprehensive approach to regulation.

“The Bank would collaborate with the Securities and Exchange Commission (SEC) to develop distinct complementary regulatory frameworks that encompass various applications or use cases of digital assets,” a BoG representative mentioned. This statement reflects the central bank’s commitment to creating a cohesive regulatory environment.

Engaging with the Public and Industry Experts

To ensure the proposed regulations are well-rounded and effective, the BoG is inviting feedback from various stakeholders, including industry experts and the general public. This consultation period, which is open until the end of August, provides an opportunity for those involved in the cryptocurrency space to share their views and contribute to the final guidelines.

The Bank of Ghana has emphasized that all feedback will be carefully considered before finalising the regulations. “The bank will consider these inputs in determining the next steps forward,” the draft proposal stated. This inclusive approach highlights the BoG’s dedication to transparency in the regulatory process.

In addition to seeking public input, the BoG is considering the introduction of a sandbox environment for crypto exchanges. This would allow these platforms to test their operations in a controlled setting before receiving full licenses to operate in Ghana, ensuring the reliability and safety of the services provided.

A Cultural Nod to Digital Assets

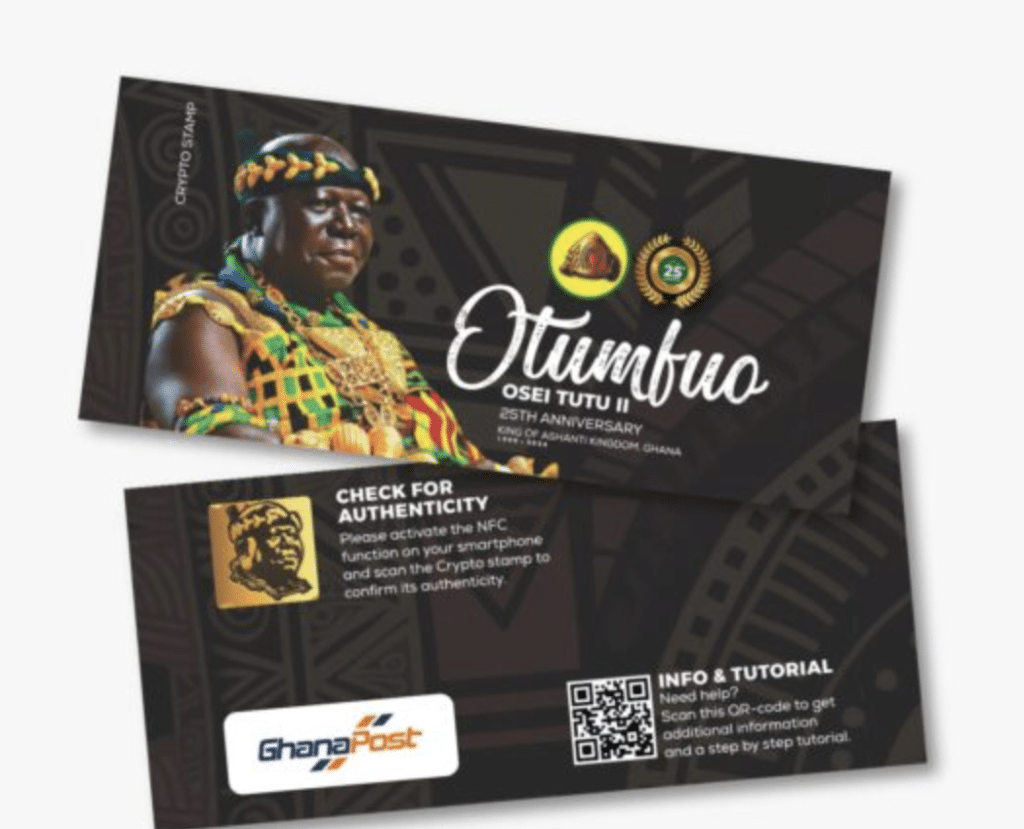

This regulatory initiative comes at a time when Ghana is also making cultural connections with the digital asset world. In May, Ghana Post, the national postal service, introduced a special collection of crypto stamps. These stamps, known as the “Crypto Stamp,” were created to commemorate the 25th coronation anniversary of His Majesty Otumfuo Osei Tutu II.

Limited to just 7,200 pieces, the stamps are priced at 250 Ghanaian cedi (approximately $18) each. This collection is a unique blend of Ghana’s rich cultural heritage and its embrace of modern technology, symbolising the country’s forward-looking approach.

Looking Ahead: Ghana’s Crypto Future

As the deadline for public feedback approaches, it is evident that Ghana is poised to enter a new era in its financial landscape. The Bank of Ghana’s proposed regulations represent a thoughtful approach to the growing world of digital assets, balancing the need for innovation with the importance of security and consumer protection.

By actively involving a diverse range of voices in the regulatory process, the BoG is working to ensure that its guidelines are comprehensive and effective, while also being aligned with the needs of those most affected. As Ghana navigates this digital frontier, its progress will undoubtedly be watched closely by the global community, eager to see how this West African nation shapes its future in the world of cryptocurrencies.