GMX, a prominent on-chain perpetual and spot exchange, is taking significant steps to alter its revenue distribution model, now reaching the crucial on-chain voting stage. This pivotal moment, reported by The BIT Journal, is set to potentially transform the platform’s operational dynamics. The new GMX revenue model aims to increase the GMX token’s value while providing substantial benefits to its users.

Announced on July 31, the proposal named “Buyback GMX and Distribute GMX” targets enhancing the GMX token’s long-term value. The proposed GMX revenue model shifts from the current system of buying back and distributing Ethereum (ETH) to a new approach focusing on the GMX token itself. This change is anticipated to elevate the native token’s value, ensuring real-yield advantages remain for users.

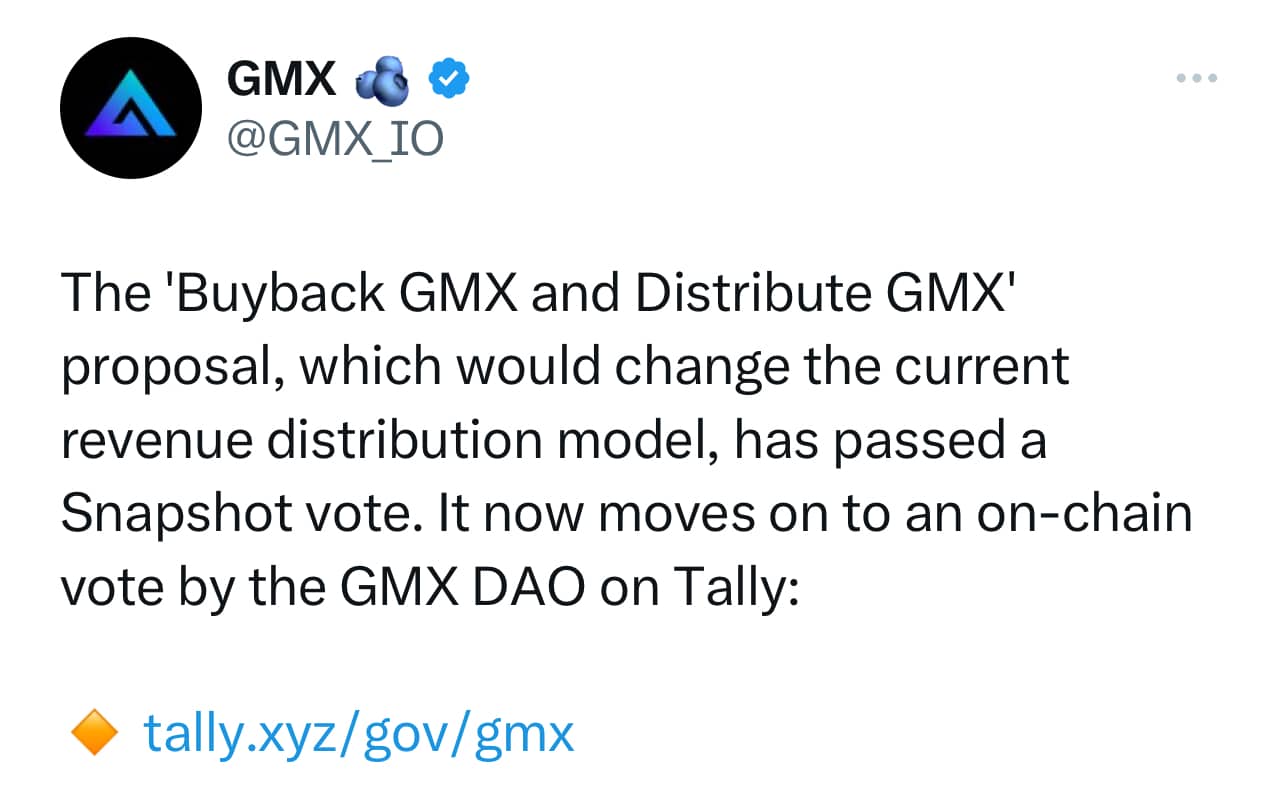

Having passed the snapshot vote, the proposal now moves to the decisive on-chain voting phase. The GMX DAO community has until August 4 to vote on this proposal. If approved, the existing GMX revenue model of “buyback ETH and distribute ETH” will be replaced with the new “buyback GMX and distribute GMX” model.

GMX Revenue Model Conversion Flexibility

A notable feature of the “Buyback GMX and Distribute GMX” proposal is the option for users to convert the distributed GMX tokens back to ETH if they wish. This flexibility ensures network fees will be accumulated in GMX and distributed accordingly, with the added benefit for users to convert to ETH if needed.

As The BIT Journal reports, the buyback contract will allocate one-seventh of the fees daily over a week to purchase GMX tokens. The GMX revenue model stipulates that the buyback price will be based on GMX’s Chainlink oracle price on the Arbitrum and Avalanche networks. The contract will also introduce a premium on the buyback, gradually increasing from 0% to 5% throughout the week.

Enhancing GMX’s Competitive Edge

GMX’s unique trading model enables liquidity providers to earn from spreads, funding fees, and liquidations. According to DefiLlama , GMX stands as the 45th largest chain by revenue and fees, with close competitors like dYdX and Jupiter Perpetual Exchange. This shift in the GMX revenue model is expected to enhance its competitive position significantly.

The GMX revenue model proposal includes several innovative features aimed at improving the platform’s value and user experience. By adopting a GMX-based revenue distribution, the platform seeks to establish a more sustainable and robust ecosystem. The BIT Journal highlights that this strategic move could attract more users and liquidity providers, reinforcing GMX’s stance in the decentralized finance sector.

Key Features of the Proposal

One key aspect of the GMX revenue model is the premium on the buyback contract, which will gradually increase from 0% to 5% over a week. This premium aims to enhance the model’s effectiveness and ensure a consistent increase in the GMX token’s value. This feature is expected to incentivize greater user participation in the GMX ecosystem, contributing to its growth.

The GMX revenue model proposal represents a broader strategy to enhance the platform’s sustainability and value over the long term. By aligning its revenue distribution with GMX tokens, the platform intends to align its interests with those of its users, fostering a more resilient ecosystem. This approach is likely to receive positive feedback from the community and boost the adoption of the GMX platform.

Anticipating the GMX Revenue Model Transformation

As the GMX community eagerly awaits the outcome of the on-chain vote, the potential impacts of this proposal are significant. If the “Buyback GMX and Distribute GMX” model is approved, it will mark a substantial shift in the platform’s revenue distribution. The new GMX revenue model aims to boost the GMX token’s value while offering users greater flexibility and real-yield benefits. The on-chain vote, concluding on August 4, will ultimately determine GMX’s future revenue distribution strategy.

The BIT Journal’s insights remain essential for those tracking this transformative change on the GMX platform. In summary, the GMX revenue model proposal stands as a pivotal moment for the platform and its users. With the on-chain vote underway, the decentralized finance community watches closely to see if the “Buyback GMX and Distribute GMX” model will usher in a new era of value and innovation for GMX.