According to an official source, the Grayscale IPO project made significant progress with the recent confidential filing with the U.S. SEC. Although all particulars are still under review, this move speaks volumes about the intention to enter public markets and represents greater confidence in crypto investment products that are being regulated.

Grayscale’s Position in the Crypto Investment Sector

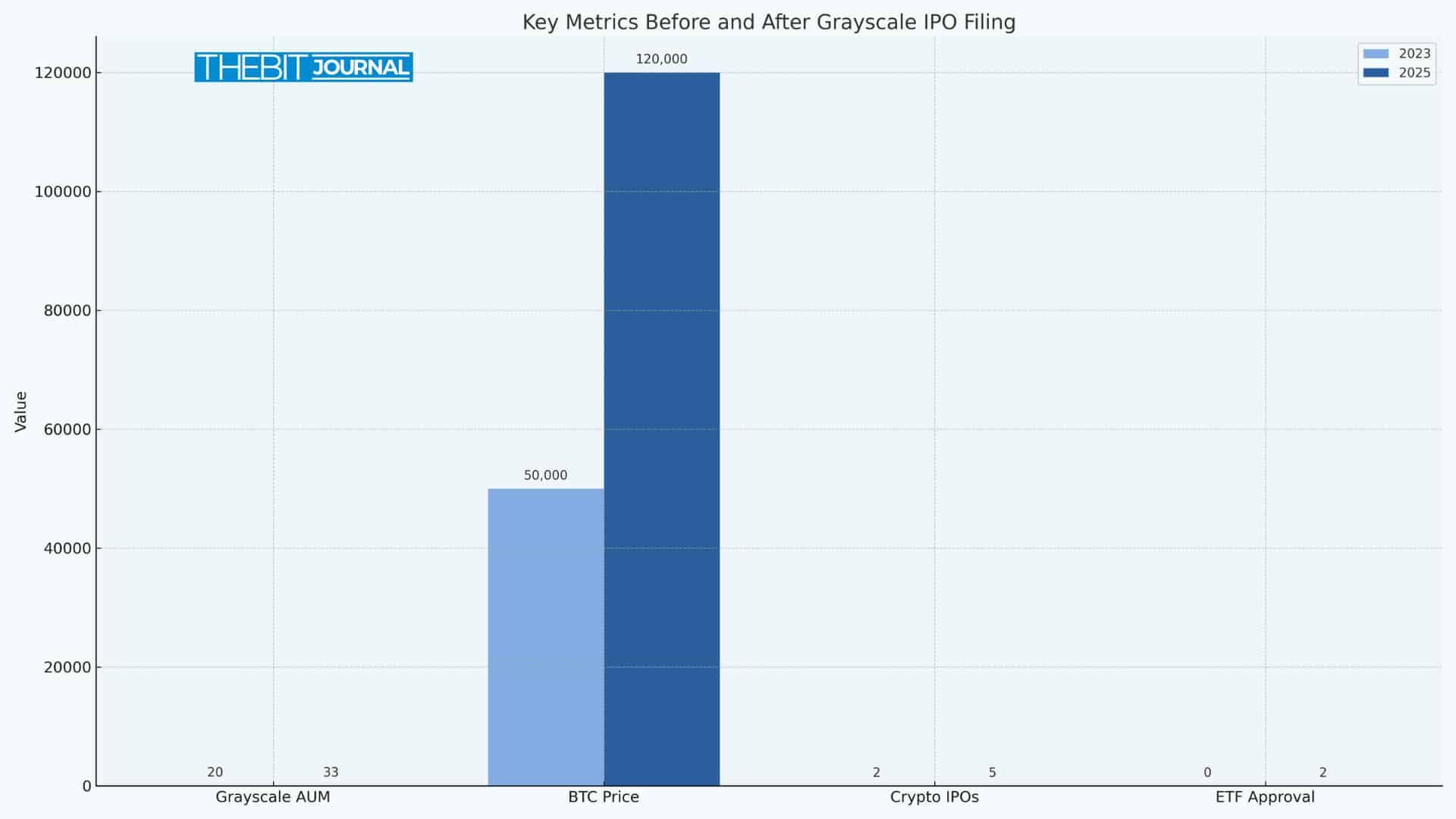

Grayscale Investments is one of the most trusted cryptocurrency asset managers in the world. It was founded in 2013. The company currently manages more than $33 billion in assets through more than 35 digital currency investment products. Some of these are Ethereum ETFs and spot Bitcoin, which attract both institutional and retail investors.

After suing the SEC, Grayscale got permission from the government to run its spot Bitcoin ETF in January 2024. That win was crucial in determining U.S. policy regarding financial instruments backed by cryptocurrency.

The upcoming Grayscale IPO increases that momentum. If it succeeds, the business will have direct access to equity markets and improve its financial standing as the crypto asset management industry becomes more competitive.

What a Confidential IPO Filing Means

A company can start the SEC review process without immediate public scrutiny by filing a Form S-1 confidentially. This strategy has gained popularity among financial and tech companies. Once Grayscale has addressed the comments made by the SEC and set the launch date, the company will disclose further details, including share quantity and target price.

In addition, the confidential nature of the filing allows time for adjustment to changes in the environment or regulatory signals. It seems that Grayscale could be holding for the golden moment to optimize valuation, particularly given recent spikes in cryptocurrency prices and a surge in institutional interest.

Market Timing: Strategic and Opportunistic

Grayscale’s IPO application was filed at a time when Bitcoin surged past $ 120,000, a key psychological and technical level. Market mood favors a successful listing. In addition, the timing coincides with “Crypto Week” in Washington, where lawmakers are debating new regulations concerning digital assets.

Politically, the winds are also favoring the company. Bipartisan support for regulation has risen significantly as the Trump administration has shown a willingness to embrace innovation in the cryptocurrency sector. All things considered, these events portray a favorable picture for Grayscale IPO aspirations.

According to a senior analyst at Galaxy Digital, “Grayscale is positioning itself to be the public face of institutional crypto investing.”

What Investors Should Watch

| Key Factor | Why It Matters |

|---|---|

| Bitcoin’s price trend | Strong prices drive optimism and increase demand |

| SEC review process | Could delay or accelerate IPO timeline |

| Competitor IPO performance | Gemini, Circle, and others set valuation benchmarks |

| Regulatory decisions | Bills under review in Congress could shape market impact |

The performance of other crypto IPOs will likely affect Grayscale’s decision-making. Circle, for example, saw its valuation soar nearly 500% in its first month after listing.

Why the Grayscale IPO Is Important for Crypto Markets

For investors, the Grayscale IPO offers more than just a new stock. It signifies a change in the way traditional financial markets perceive digital assets. For years, cryptocurrency investing was conceived as something speculative or fringe. Grayscale has entered the public markets, thereby gaining more legitimacy and introducing an investment avenue for regular investors.

It also signals to the regulators that established cryptocurrency companies are ready to comply with rules and seek transparency. This may have ramifications for how the SEC or other bodies up ahead might see future regulation of cryptos.

The IPO also acts as a signal for cryptocurrency watchers and holders. Others might follow if Grayscale determines there is sufficient value and stability to go public.

Conclusion

The Grayscale IPO is a critical milestone in the process of bringing cryptocurrencies into line with conventional finance. Grayscale, with its substantial assets and growing regulatory clarity, is on an excellent roll to start going public by late 2025, bringing much more access to investment in cryptocurrency through the U.S. equity markets.

Summary

According to a report from Grayscale, the company intends to raise between $33 billion in assets and a growing selection of cryptocurrency products through an end-of-2025 SEC filing for confidential initial public offering (IPO). This conduct is a clear indicator of confidence among people in regulated digital investing. Grayscale may open the doors to greater public access to cryptocurrency through traditional markets as investor interest increases and directions sharpen.

FAQs

Q: What is Grayscale mainly involved in?

Grayscale invests in Bitcoin and Ethereum, among other cryptocurrencies, by providing investment products such as specialized ETFs and trusts.

Q: What do confidential IPO meanings imply?

This means that the company is filing its IPO records privately with the SEC. Eventually, closer to launch, such details will all be revealed.

Q: When is the actual date that the Grayscale IPO will take place?

Grayscale has not officially announced a date yet, but from the look of things in the market, such a date may be during the last quarter of 2025.

Q: Why is this IPO important to the crypto market?

It raises digital asset investing to mainstream strategy, which can lead to institutional investors’ attraction to digital asset investments.

Glossary of Key Terms

IPO (Initial Public Offering): A company’s first sale of stock to the public.

Form S‑1: A document companies file with the SEC to register for an IPO.

ETF (Exchange-Traded Fund): A fund that trades like a stock and often tracks a specific asset or index.

SEC (Securities and Exchange Commission): U.S. government agency that regulates financial markets.

Confidential filing: A private IPO submission to the SEC under the JOBS Act.