In a significant development for the cryptocurrency market, the U.S. Securities and Exchange Commission (SEC) has officially commenced its review of Grayscale Investments’ application to convert its XRP Trust into a spot exchange-traded fund (ETF). This move, initiated on February 14, 2025, marks a pivotal moment for XRP, the digital asset associated with Ripple Labs, as it could potentially enhance its accessibility to institutional investors and reshape its market dynamics.

SEC Review Process and Timeline

The SEC’s acknowledgment of Grayscale’s application has triggered a 240-day review period, culminating in a final decision by October 18, 2025. This period includes a 21-day public comment phase, allowing stakeholders to provide feedback on the proposal. The SEC will meticulously evaluate the application, focusing on compliance with securities laws, market integrity, potential manipulation risks, and investor protection measures. It’s important to note that while the acknowledgment initiates the review, it does not guarantee approval.

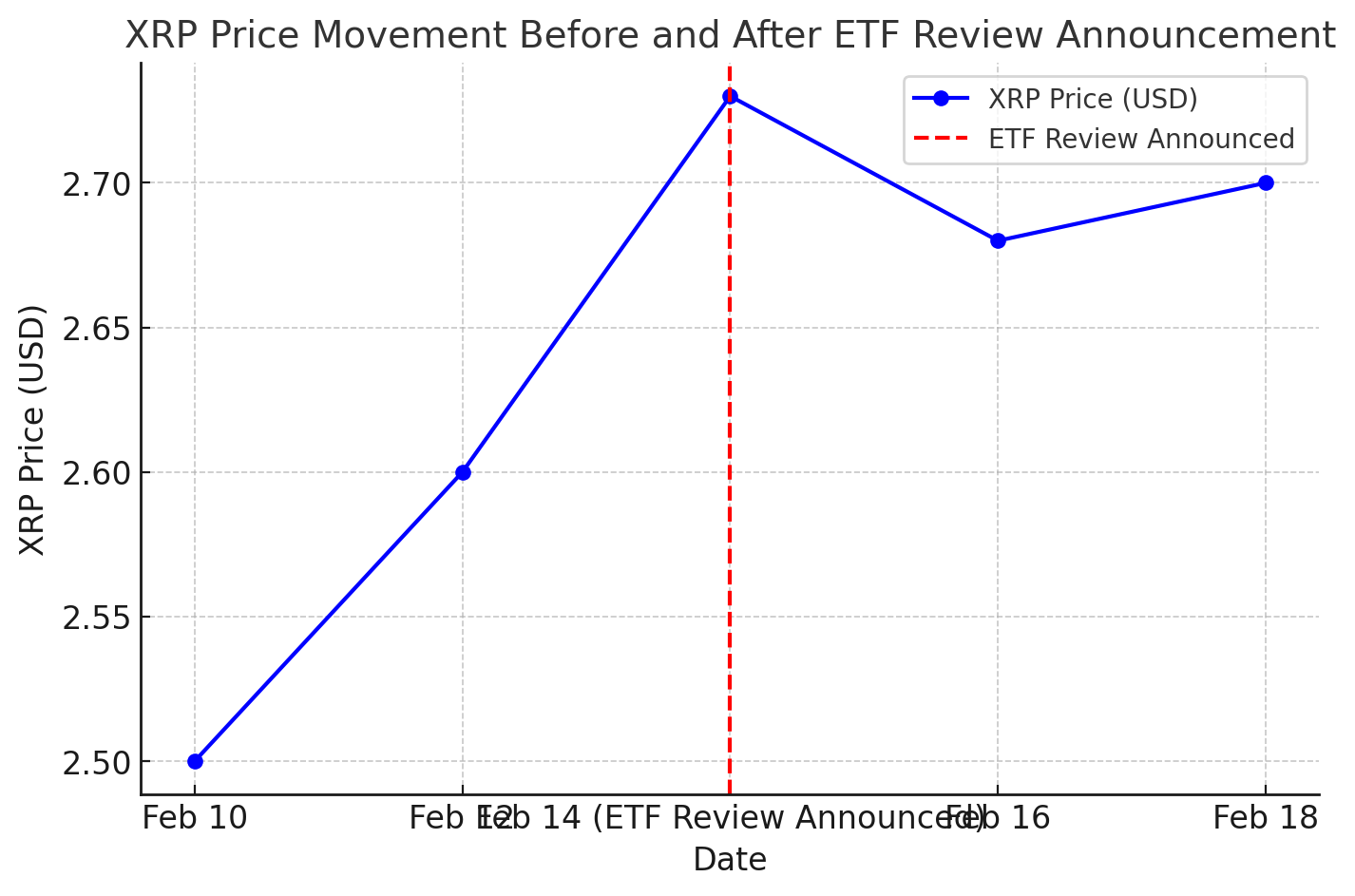

Market Implications and Investor Sentiment

The initiation of the SEC’s review has already influenced XRP’s market performance. Following the announcement, XRP experienced a notable price increase, climbing approximately 9.1% to just under $2.73 on February 14, 2025. This surge reflects growing optimism among investors about the potential approval of the ETF and the broader acceptance of XRP in mainstream financial markets.

Analysts suggest that the approval of a spot XRP ETF could increase liquidity and attract substantial institutional investments, potentially driving the asset’s value higher. However, the market remains cautious, as the SEC’s decision is pending, and the regulatory environment continues to evolve.

Regulatory Landscape and Legal Considerations

The SEC’s review of the XRP ETF comes amidst ongoing legal proceedings involving Ripple Labs. The SEC has previously filed a lawsuit against Ripple, alleging that XRP was sold as an unregistered security. This legal backdrop adds complexity to the ETF approval process, as the regulatory status of XRP remains a contentious issue.

Despite these challenges, the current U.S. administration under President Donald Trump has exhibited a more crypto-friendly stance, leading to speculation that regulatory hurdles may be less stringent. Industry observers closely monitor how these legal and political factors will influence the SEC’s decision-making process.

Global Perspectives and International Developments

While the U.S. regulatory process unfolds, other countries are making strides in integrating XRP into their financial systems. Notably, Brazil’s securities regulator has approved the launch of the world’s first spot XRP ETF, managed by Hashdex. This development signifies a growing acceptance of XRP in international markets and may set a precedent that influences regulatory perspectives globally.

The Brazilian ETF aims to provide investors with regulated exposure to XRP, potentially boosting its adoption and liquidity. Such international advancements could impact the SEC’s considerations as the U.S. seeks to maintain its competitive edge in the rapidly evolving digital asset landscape.

Potential Outcomes

The approval of Grayscale’s XRP ETF could have far-reaching implications for the cryptocurrency market. A green light from the SEC would likely pave the way for increased institutional participation, enhanced market liquidity, and greater mainstream acceptance of XRP. Conversely, a denial could perpetuate existing uncertainties and hinder the asset’s growth prospects.

As the October 18 deadline approaches, stakeholders are advised to stay informed about regulatory updates and market responses. The interplay between legal proceedings, regulatory decisions, and market dynamics will be crucial in shaping XRP’s future trajectory and its role within the broader cryptocurrency ecosystem.

Summing Up on Ripple XRP ETF

In conclusion, the SEC’s review of Grayscale’s application to convert its XRP Trust into a spot ETF represents a critical juncture for XRP and the digital asset market at large. The outcome of this process will not only influence XRP’s market position but also signal the regulatory direction for similar digital assets. Investors and industry participants should closely monitor developments, as the decisions made in the coming months will have lasting impacts on the cryptocurrency landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is Grayscale’s XRP ETF, and why is the SEC reviewing it?

Grayscale’s XRP ETF aims to provide investors with regulated exposure to XRP. The SEC reviews it to assess compliance, market risks, and investor protection.

2. When will the SEC decide on the XRP ETF?

The SEC has a 240-day review period, with a final decision expected by October 18, 2025.

3. How could the approval of an XRP ETF impact the market?

Approval could boost institutional adoption, liquidity, and XRP’s price, similar to Bitcoin ETFs. However, rejection may create market uncertainty.

4. What are the main concerns the SEC might have about the XRP ETF?

The SEC is likely examining market manipulation risks, liquidity concerns, and XRP’s legal status following its lawsuit against Ripple.

5. Has any country approved an XRP ETF yet?

Yes, Brazil recently approved a spot XRP ETF, setting a precedent that could influence the SEC’s decision.

Glossary of Key Terms

XRP ETF – A financial product allowing investors to gain exposure to XRP without directly holding the asset.

Grayscale Investments – A digital asset management firm applying to convert its XRP Trust into an ETF.

SEC (Securities and Exchange Commission) – The U.S. regulatory body overseeing securities, including crypto ETFs.

Spot ETF – An ETF that holds actual cryptocurrency rather than futures contracts.

Institutional Investors – Large entities like hedge funds and banks that invest in financial assets.

Market Liquidity – The ease with which an asset can be bought or sold without significantly affecting its price.

Ripple Labs – The company behind XRP, which has faced legal scrutiny over whether XRP is a security.

Regulatory Compliance – Meeting the legal and financial requirements set by government agencies.

Public Comment Period – A timeframe where stakeholders can submit opinions on an SEC proposal.

Market Manipulation – Practices that distort asset prices, a key concern for ETF approval.

Sources

Bitcoin.com – “Grayscale’s XRP ETF Under SEC Review: The Countdown Begins”

CoinDesk – “What an XRP ETF Could Mean for the Crypto Market”

Reuters – “SEC’s Crypto Stance and ETF Approvals”

CoinTelegraph – “Brazil’s Approval of Spot XRP ETF”

Bloomberg – “Institutional Interest in Crypto ETFs”