The crypto landscape is abuzz with excitement as REX Shares teams up with Osprey to file for a series of crypto-based exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC). This move could reshape the way institutional investors access digital assets like XRP, SOL, and DOGE.

REX Shares and Osprey Aim for Institutional Accessibility

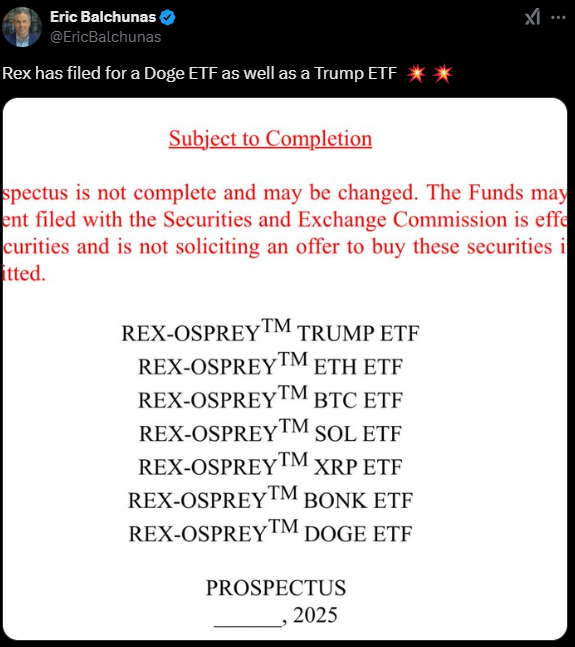

According to a report shared by Bloomberg analyst Eric Balchunas, REX Shares has submitted ETF applications targeting prominent cryptocurrencies, including XRP, SOL, DOGE, and the relatively new meme coin BONK. These ETFs aim to provide institutional investors with seamless exposure to these digital assets, bridging the gap between traditional finance and the crypto ecosystem.

In addition to these assets, the filings include ETFs for Bitcoin (BTC) and Ethereum (ETH), highlighting REX Shares’ ambition to offer a comprehensive range of investment vehicles.

The TRUMP Coin ETF: A Surprising Inclusion

Among the proposed products, the inclusion of a TRUMP meme coin ETF has drawn significant attention. This addition demonstrates a forward-looking approach to accommodating emerging and unconventional digital assets within the financial market.

Timing: A Strategic Advantage

The timing of these ETF filings aligns with recent shifts in SEC leadership. Following the resignation of SEC Chairman Gary Gensler and the appointment of Commissioner Mark Uyeda as interim chairman, the regulatory environment appears more open to crypto-friendly policies. Analysts suggest that this change could increase the likelihood of approval for ETFs centered on digital assets.

Implications for the Crypto Market

REX Shares’ initiative is poised to have a profound impact on the crypto sector. By offering secure and regulated pathways for institutional investment, these ETFs are expected to:

- Enhance the adoption of cryptocurrencies like XRP, SOL, and DOGE.

- Provide institutional investors with confidence and a structured entry into the crypto market.

- Foster broader acceptance of crypto assets in the traditional financial industry.

Industry experts believe that such ETF products could significantly boost market liquidity and legitimacy, paving the way for increased institutional participation.

A Milestone for Institutional Crypto Adoption

As the financial industry increasingly embraces digital assets, this move by REX Shares marks a pivotal step. With a focus on innovation and accessibility, these ETFs have the potential to revolutionize crypto investment, cementing digital assets as a staple in institutional portfolios. The Bit Journal will continue to monitor these developments closely.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!