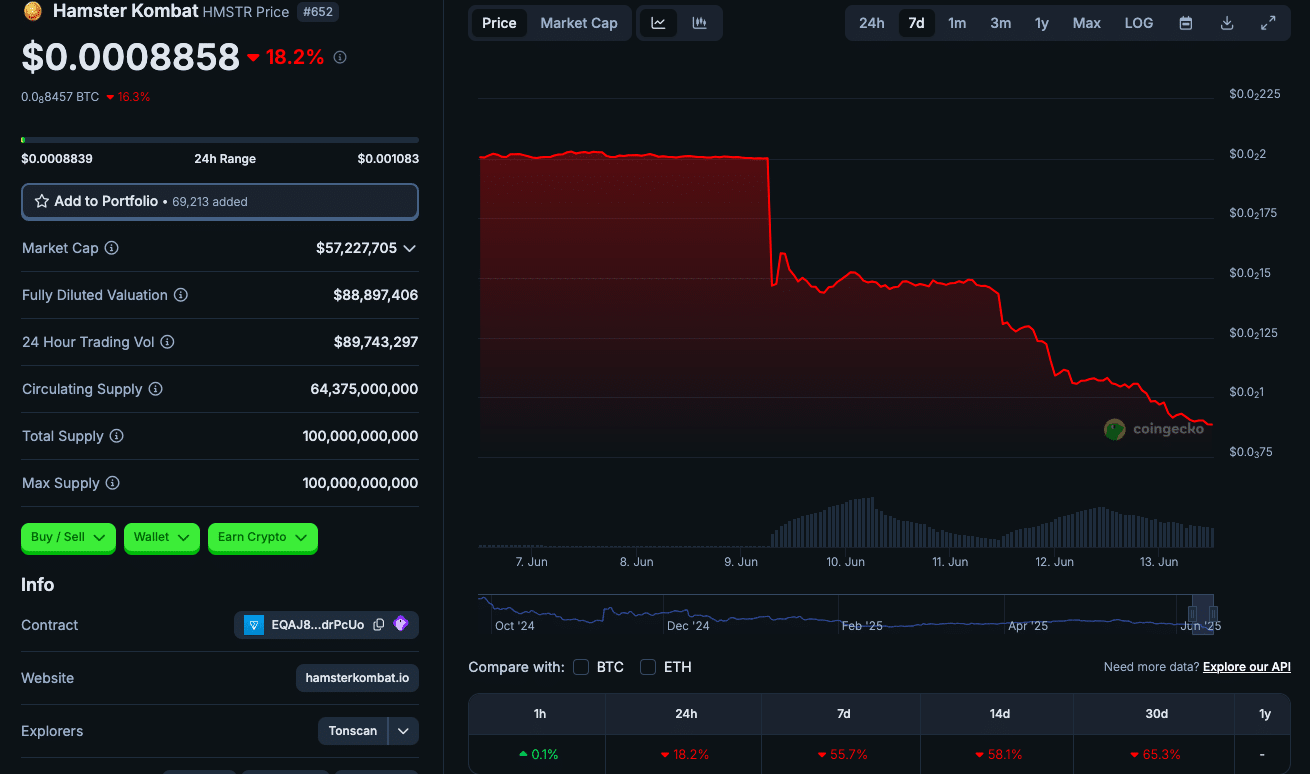

Hamster Kombat (HMSTR), the Telegram-based Tap-to-Earn sensation, has seen its token collapse by more than half over the past seven days. Once a hyped project with a staggering user base and viral appeal, HMSTR is now facing harsh market realities. The Hamster Kombat token is trading at just $0.0008858, down nearly 90% from its all-time high following a wave of selling pressure from airdrop recipients, whale exits, and collapsing user engagement.

This week’s double-digit losses underscore a growing sense that the project’s momentum has not only stalled but may be reversing entirely. While the broader crypto market remains relatively stable, HMSTR’s rapid deterioration is raising serious questions about its sustainability, tokenomics, and long-term viability.

Airdrop Frenzy Turns into Sell-Off Spiral

The scale of the airdrop distribution appears to have backfired. Over 131 million users reportedly received free HMSTR tokens, an unexpected figure by any measure. But rather than fueling engagement or long-term holding, the airdrop seems to have triggered mass dumping. Exchange wallets are rapidly swelling with incoming HMSTR deposits, indicating an exodus of tokens from private wallets to trading platforms.

Data from Nansen confirms this trend, showing an increase in exchange balances and a notable drop in funding rates for HMSTR perpetual futures. This suggests that short interest is surging, with traders betting on further declines. The sell pressure has overwhelmed available liquidity, creating a downward spiral that is proving hard to contain.

Part of the frustration stems from the structure of the airdrop itself. Users report that only a portion of their allocated tokens are immediately claimable, leading to disappointment and exit behavior. Instead of building a long-term user base, the airdrop appears to have incentivized opportunism and short-term profit-taking.

Whales Join the Exit Parade as Confidence Evaporates

On-chain analysis indicates that larger HMSTR holders, whales who were early backers or who accumulated during the initial price pump, have also started offloading their positions. This coordinated exit has created a cascading effect, with more than 56% in losses over the past seven days and an additional 18% decline in the past 24 hours alone.

At its peak, Hamster Kombat touted a user base of 300 million. But those numbers have since collapsed to just 13 million active users, marking a dramatic fall from grace. The project’s appeal was heavily dependent on gamified engagement and hype, both of which now appear to be fading.

Analysts like Crypto Philip have suggested that the Tap-to-Earn model, once heralded as the next evolution of Web3 gaming, may have reached saturation. In his words,

“We’ve moved from earning excitement to earning fatigue. The model is breaking under its own weight.”

Tokenomics Woes and TON Integration Troubles

Part of the issue lies in HMSTR’s token design. The total circulating supply has already ballooned to 64 billion, with more token unlocks expected in the coming weeks. Without robust demand to match supply, the economics are becoming increasingly untenable.

Moreover, users have reported ongoing technical glitches with TON and Telegram-based wallets, further eroding confidence. Transaction delays, sync failures, and wallet crashes have all been documented in community forums. These usability issues compound the frustration of users who are already disillusioned by the airdrop structure and price collapse.

Developers have been slow to address these complaints publicly, and no clear roadmap has been shared to explain how HMSTR intends to recover. The absence of strategic communication is creating a vacuum now being filled with bearish speculation.

Can HMSTR Recover, or Has the Tap-to-Earn Bubble Popped?

The future of the Hamster Kombat token remains highly uncertain. While some optimists hope for a rebound once lockdown schedules slow and panic selling subsides, the market mood is largely bearish. A stabilization in funding rates or a sudden spike in Telegram-based activity could trigger a short-term bounce, but there is little evidence so far of renewed buying interest.

The broader Tap-to-Earn category, once expected to drive the next wave of Web3 adoption, now faces a credibility test. The HMSTR meltdown could become a cautionary tale for projects that chase virality without sustainable economics or user retention strategies.

HMSTR may continue to drift downward and with Telegram’s crypto experiment under scrutiny, the stakes go far beyond a single token.

Conclusion

What was once a Telegram gaming sensation now teeters on collapse. The Hamster Kombat token has lost over half its value in a week, and nearly 90% since its high, amid rampant dumping and disappearing users. While some still hold out hope for a turnaround, the project appears unprepared for the economic and technical challenges ahead.

Unless HMSTR’s team can urgently address its tokenomics, utility, and wallet reliability, the slide may deepen and the Tap-to-Earn dream may fade into crypto history.

FAQ

What is causing the Hamster Kombat token to crash?

Mass selling by whale holders and airdrop recipients, combined with falling user engagement and poor tokenomics, have triggered the sharp decline.

How much has HMSTR fallen from its all-time high?

It is currently trading at $0.0009335—roughly 90% below its peak price of $0.01.

Why are users upset with the airdrop?

Only a portion of the tokens were immediately claimable, leading to disappointment and rapid sell-offs.

Are technical issues contributing to the price drop?

Reported bugs in TON and Telegram wallet integrations have added to user frustration, compounding the negative sentiment.

Is there a chance of recovery for HMSTR?

While a rebound is theoretically possible, it would require rapid intervention, improved communication, and major changes to the tokenomics model.

Glossary

Airdrop – The distribution of free crypto tokens to users, typically as a marketing or onboarding tool.

Whale – A large token holder whose trades can significantly impact market price.

Tap-to-Earn – A crypto gaming model where users earn tokens by engaging with an app, often through simple actions like tapping or playing.

Tokenomics – The economic structure of a crypto token, including supply, distribution, and incentive mechanisms.

Funding Rate – A periodic payment between long and short traders in perpetual futures markets, often used as a sentiment indicator.

Sources