The HBAR price 2025 story is heating up as Hedera (HBAR) enters a new bullish cycle. In recent weeks, HBAR has made news by exploding with a big 25% rise, leaving traders and investors excited for its next goals.

This spike is more than simply another pump; it is underpinned by increased DeFi activity, corporate relationships, and strong technical indications. Let’s look at how this dynamic is influencing predictions for the HBAR price in 2025, and what it could signify for market players.

Historical Context: Why Now for HBAR Price 2025?

To comprehend the HBAR pricing in 2025, we must examine Hedera’s path. Since its mainnet debut in 2019, Hedera has differentiated itself with the Hashgraph consensus, capable of over 10,000 TPS and a carbon-negative architecture. In 2021-2022, HBAR traded between $0.03-$0.15, then rose to ~$0.30 by late 2024, driven by increasing demand.

However, in early 2025, it fell to roughly $0.17 before commencing on the present surge. That preceding consolidation established the framework for what many experts now expect: a significant breakout in the HBAR price by 2025.

Breakout Analysis: What’s Fueling HBAR Price 2025

Coinpedia reported a significant 25% gain, reporting a breach over resistance at $0.19-$0.205, led by a 42% increase in DeFi TVL (to $215 million) and more business use, including adoption at the RAISE Summit 2025 with NVIDIA and Accenture. Ainvest reports that HBAR “has broken a significant downtrend, signaling a potential bullish wave,” with on-chain signs including MACD crossing and volume surges supporting a rise toward $0.40.

CCN says HBAR’s weekly trade volume surpassed $2 billion, indicating a potential 30% increase. All of these issues highlight why the debate about HBAR pricing 2025 is heating up.

Expert Views and Technical Setup

Analysts differ, but a bullish consensus is emerging. From StealTheX:

DigitalCoinPrice predicts a 2025 max of $0.33 (+115%) and a floor of $0.14.

Telegaon is more bullish: max of $0.78 (+415%), low of $0.32.

On social media, traders emphasize accumulation:

“HBAR’s current price range [is] ‘the final accumulation zone’ before a major move”, WSB Trader Rocko.

Bitget News cautions about RSI appearing overbought, with a potential pullback to $0.20–$0.185, but maintains that a re‑test at these levels could catalyze continuation toward $0.30 to $0.34.

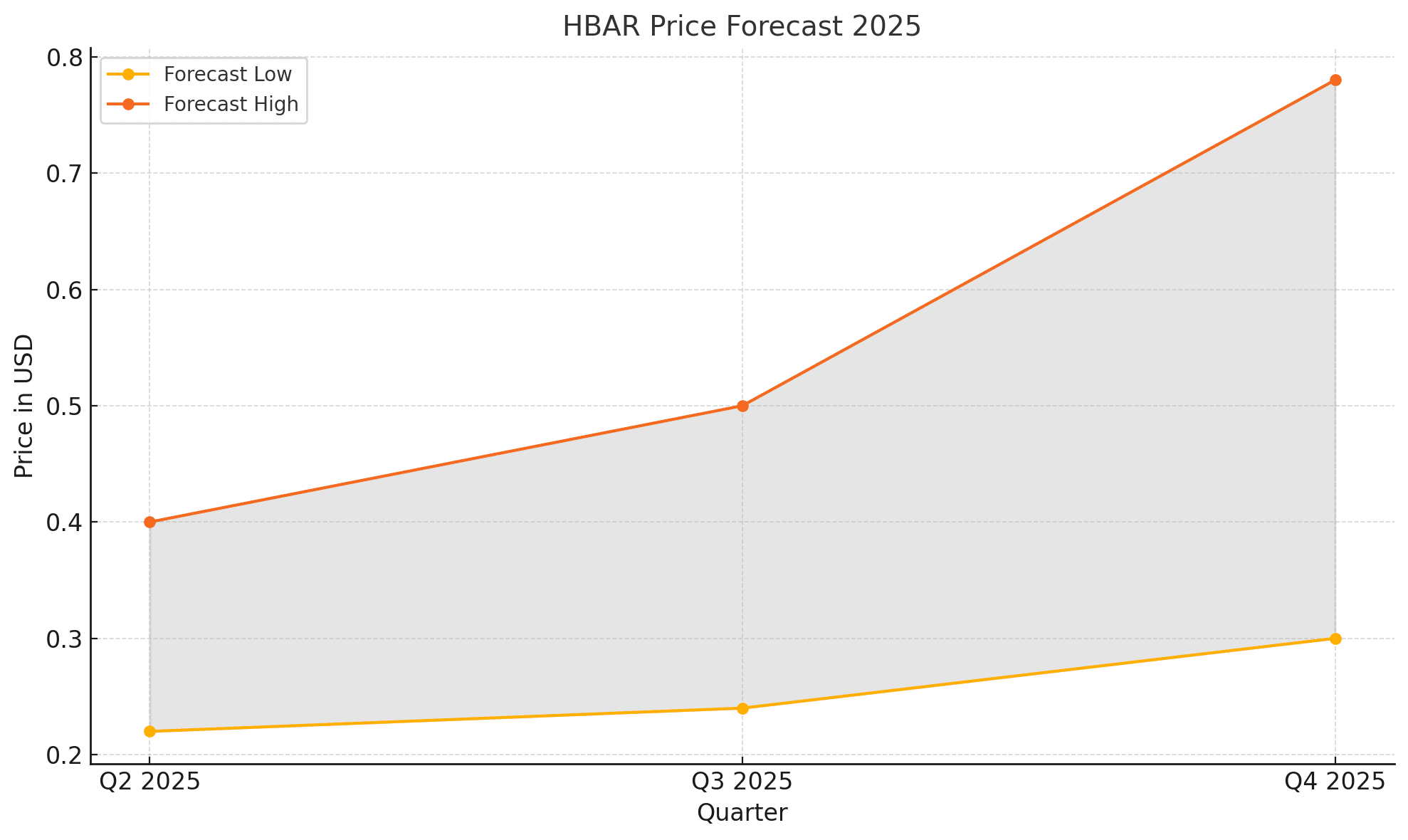

HBAR Price 2025 Table

| Date / Period | Forecast Low | Forecast High | Notes |

|---|---|---|---|

| Q2–Q3 2025 | $0.22 | $0.40 | Post-breakout rally |

| End 2025 (DigitalCoinPrice) | $0.14 | $0.33 | Conservative scenario |

| End 2025 (Telegaon) | $0.32 | $0.78 | Bullish scenario |

Predictions and Projections

Short‑term (7–30 days): A test of $0.30–$0.36 is likely if the current sentiment holds, especially if Bitcoin maintains strength .

Medium-term (End of 2025): Conservative scenarios target $0.33, with upside cases reaching $0.40+.

Long-term: If the enterprise DeFi stack holds and adoption continues, HBAR price in 2025 could close the year between $0.30–$0.78, depending on macro momentum.

HBAR Forecast 2025: Can It Sustain Momentum Through Q4?

The latest price breakout for HBAR has set the scenario for a possibly spectacular conclusion of 2025. With Q2 and Q3 forecasts ranging from $0.22 to $0.50, many investors are looking to see whether HBAR will keep its positive trend in Q4.

Technical indicators such as MACD and RSI are indicating strong rising trends, while increasing business adoption, including agreements with Accenture and development into AI ecosystems, is strengthening Hedera’s fundamentals.

According to Telegaon, HBAR may complete the year at $0.78 if current trends continue, representing a multi-fold rise from early 2025 prices. However, experts warn that if support around $0.22 is not maintained, a drop may occur. For both traders and long-term investors, Q4 2025 might be a watershed moment in HBAR price 2025 performance.

For Investors and Traders

Investors: HBAR is in the “accumulation zone” (~$0.22-$0.25), providing a favorable risk-reward ratio. Enterprise momentum and DeFi growth provide essential support. If you believe in the network’s usefulness, the HBAR price for 2025 seems optimistic until the end of the year.

Traders should keep an eye out for important support between $0.22 and $0.23. A bounce might indicate a quick advance to $0.30+. However, if the price falls below $0.185, the strategy should turn to defensive mode, keeping a careful eye on the RSI and MACD crosses.

Summary

The HBAR price forecast for 2025 is supported on quantifiable on-chain, technical, and business signals, rather than mere speculation. With breakout confirmation, expert support, and price goals ranging from $0.30 to $0.78, HBAR is a high-upside cryptocurrency for both short-term and long-term investors. Nonetheless, overbought dangers persist; cautious risk management is critical.

FAQs

Q1: What is pushing HBAR price 2025 upward?

A: DeFi TVL increases (~$215M), enterprise adoption (e.g., NVIDIA), and technical breakouts above $0.19–$0.205 resistance.

Q2: What short‑term price range should traders expect?

A: Between $0.22–$0.30+, depending on support levels and momentum hold.

Q3: Is it too late to buy HBAR?

A: Not if price holds above $0.22–$0.20. Many consider this a “final accumulation zone” before the next leg up .

Glossary

DeFi TVL: Total locked value in decentralized finance protocols.

MACD crossover: Moving average convergence/divergence indicating trend changes.

RSI: Relative Strength Index—a momentum oscillator that gauges overbought/oversold conditions.

Accumulation zone: Price area where investors are believed to be purchasing in bulk.