Helium, a blockchain-based network for the Internet of Things (IoT), experienced a remarkable 12% Helium price surge within just 24 hours on August 10, 2024. This unexpected leap has positioned Helium among the top gainers in the cryptocurrency market, drawing significant attention from investors and analysts alike.

Helium’s Sudden Surge: A Closer Look

On the morning of August 10, 2024, Helium’s price surged by 12%, an increase that caught the eye of many in the cryptocurrency space. This leap brought Helium to $6.5 per token, a price that marks a 10% rise from its previous value at the time of writing, according to data from crypto.news.

Trading volumes also saw a notable boost, increasing by 9% to hover around $29.7 million. Meanwhile, Helium’s market capitalization grew to $1.1 billion, securing its spot as the 68th largest cryptocurrency by market cap.

Despite this positive momentum, Helium’s price is still down 88% from its all-time high of $55.2, which was recorded in November 2021. However, the token has recovered significantly from its recent low of $3.65 on August 5, 2024. This recovery coincided with a broader market downturn, which resulted in over $1 billion in liquidations across the cryptocurrency market.

Factors Driving Helium’s Growth

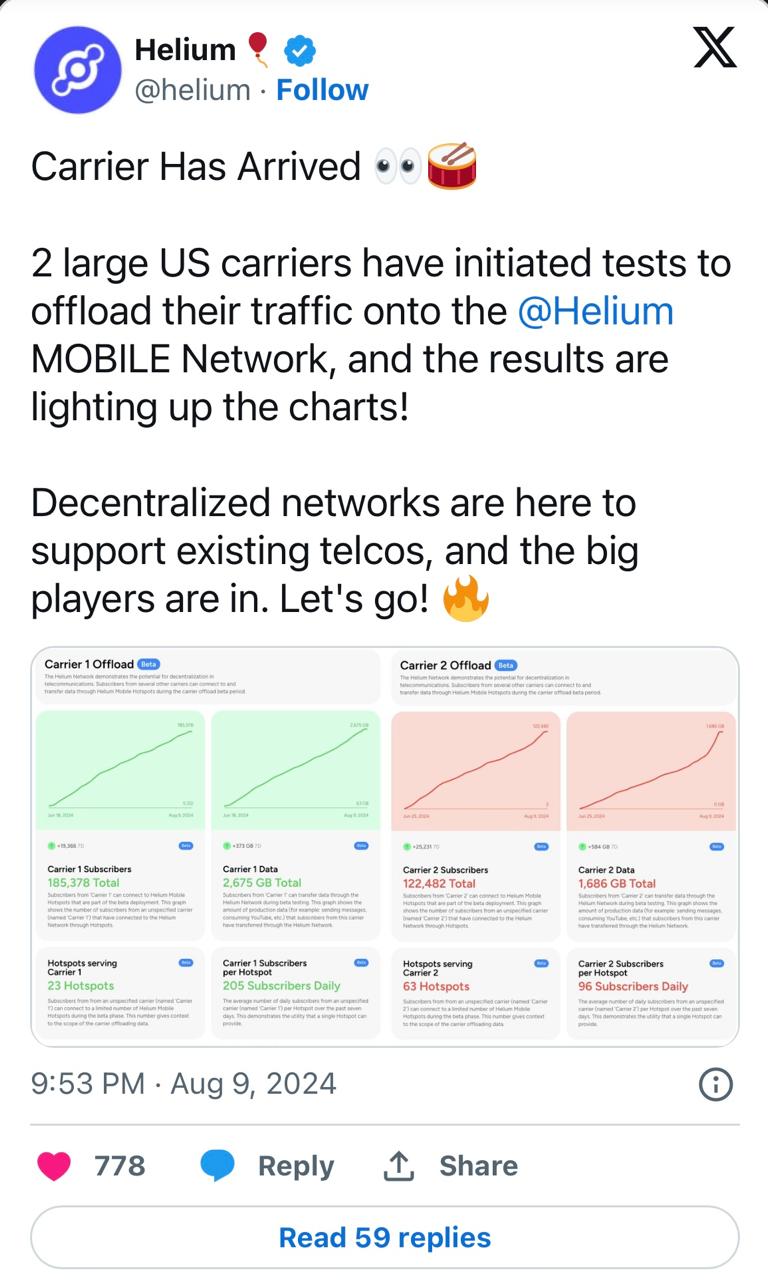

Several factors have contributed to Helium’s recent price surge. One of the most significant drivers was the announcement made on August 9, 2024, by Helium Inc., the company behind the Helium network. The company revealed that two major U.S. carriers had begun testing a new initiative to offload their mobile traffic onto Helium’s decentralized network. This testing phase involves approximately 307,860 subscribers from these carriers, marking a substantial vote of confidence in Helium’s technology.

“The involvement of these carriers underscores the growing recognition of decentralized infrastructure as a viable alternative to traditional telecom services,” said crypto analyst Marcus Fletcher. “This news has undoubtedly contributed to the recent surge in Helium’s price, as it demonstrates the network’s potential to scale and meet real-world demands.”

Helium’s blockchain network is designed to enable wireless communication for IoT devices. By allowing individuals to host network points using Hotspots, Helium provides a scalable and affordable alternative to traditional telecom services. This decentralized model has attracted significant attention, particularly in light of the growing demand for IoT connectivity.

Market Analysis

Helium’s recent price movement has also been analyzed through technical indicators. According to data, the token’s price has jumped above the upper Bollinger Band, which was positioned at $6.4100. The middle band was at $5.1526, and the lower band at $3.8953. This movement outside the typical upper limit of its trading range suggests strong bullish momentum.

However, some analysts caution that this surge could signal an overbought condition. The Relative Strength Index (RSI) for Helium is currently at 69, which is close to the threshold of 70 that typically indicates an overbought asset. If Helium’s RSI crosses this threshold, the market may see a retracement.

“While Helium’s current price movement is impressive, investors should remain cautious,” noted Javon Marks, a well-known crypto analyst, in an August 10 X post. “The RSI is nearing an overbought level, and we could see a correction soon. However, the long-term prospects for Helium remain strong, particularly if the network continues to gain traction with major carriers.”

Marks also pointed out that Helium has broken out of its secondary setup, which could lead to further price increases. He speculated that Helium price might rise to $52.76, representing a potential gain of over 651% from its current levels. This prediction has fueled optimism among investors, though it is important to note that such forecasts are speculative and should be approached with caution.

Helium Price Future in the Crypto Market

Helium price surge has placed it in the spotlight, highlighting its potential as a major player in the cryptocurrency market. The network’s innovative approach to IoT connectivity, combined with the recent involvement of major U.S. carriers, suggests that Helium could continue to grow in the coming months.

However, as with any investment, there are risks to consider. The current technical indicators suggest that Helium may be approaching an overbought condition, which could lead to a short-term correction. Nonetheless, the long-term outlook for Helium remains positive, particularly if the network can continue to demonstrate its value in real-world applications.

As Helium price continues to evolve, it will be interesting to see how the market responds and whether the network can maintain its momentum. For now, Helium remains a cryptocurrency to watch, with the potential for significant growth in the future. Keep following TheBITJournal for latest updates on Helium price.