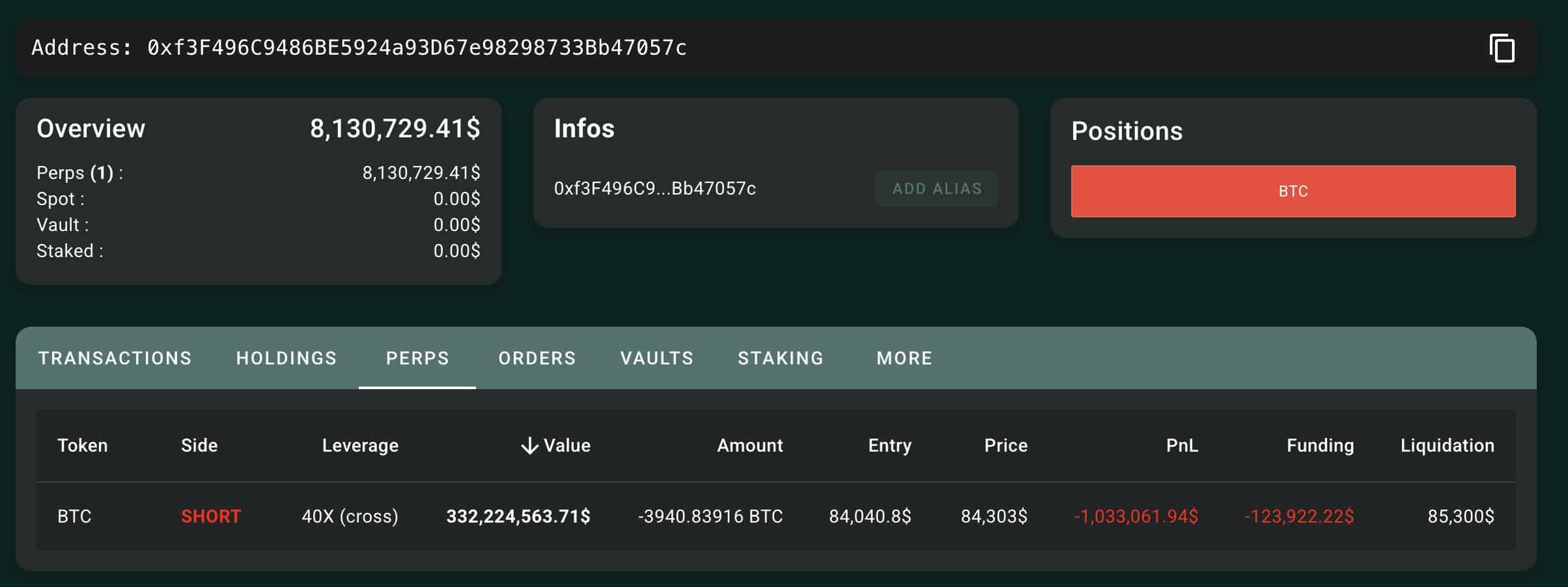

A crypto whale secured $3.9 million in profit after executing a high-leverage short position on Bitcoin (BTC). The trader built a position worth $332 million, leveraging up to 40x to maximize potential gains. Despite early losses, the investor navigated market volatility and ultimately closed in profit.

Whale’s Massive Bitcoin Short Position

A well-known crypto whale placed a significant bet against Bitcoin by opening a 3,940 BTC short position. Extreme leverage enabled the trader to face elevated risk levels while gaining access to upcoming substantial profits. The position had a worth of $332 million based on the $84,040.8 entry price and $85,300 liquidation price.

Source: Lookonchain/X

Executive losses topped $1 million as the market position headed in the wrong direction. A group of traders attempted to liquidate the whale by driving Bitcoin’s price above $84,690. A $5 million USDC contribution functioned to stop the trader from going bankrupt due to protection requirements.

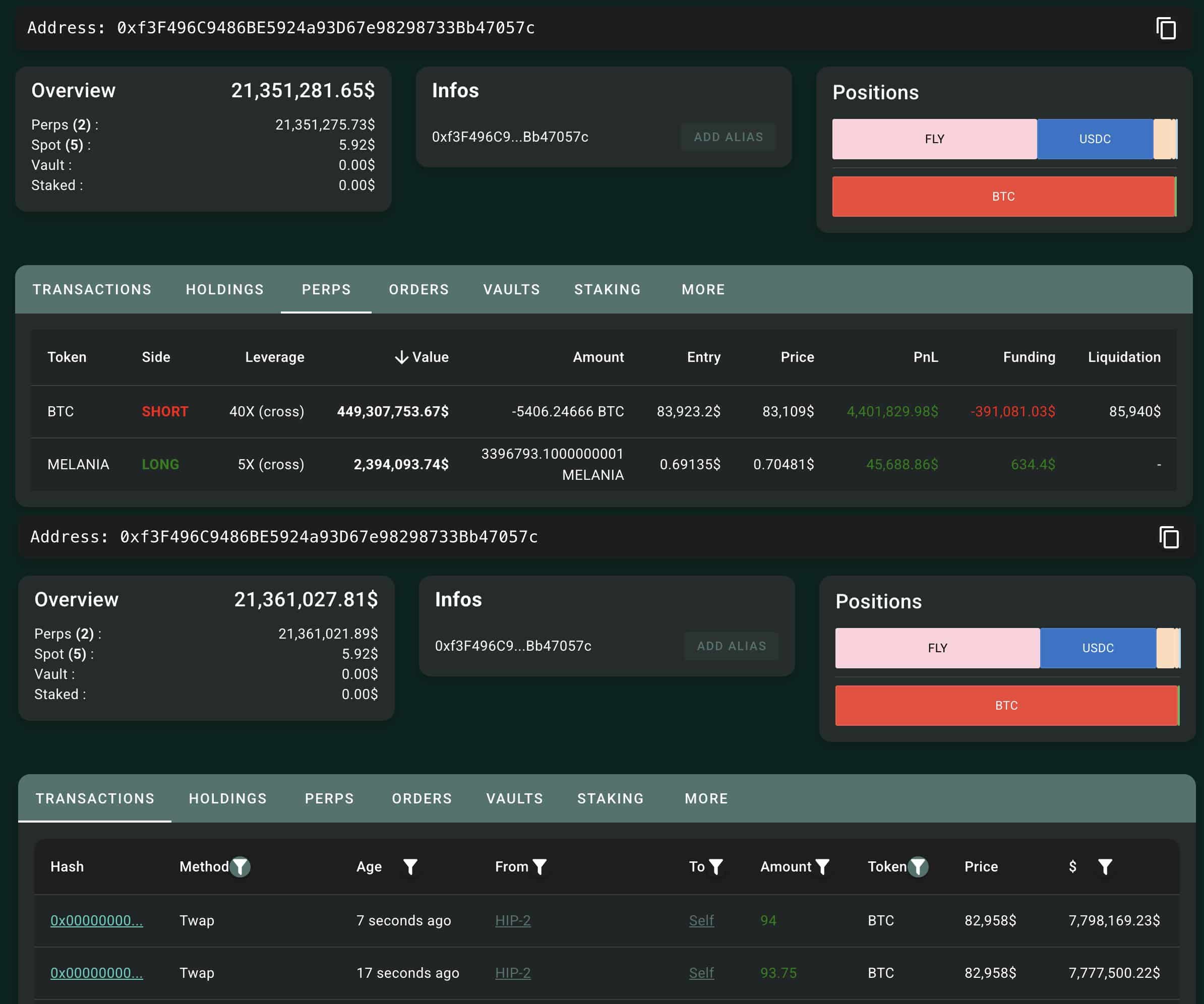

As market conditions stabilized, the whale continued increasing its position, bringing total exposure to 5,406 BTC, worth $449 million. The investor employed a time-weighted average price (TWAP) approach helped the investor execute profitable trades for their position. At the conclusion of this trade the whale received $4.4 million worth of unrealized profit.

Source: Lookonchain/X

Whale’s Trading History and Success Rate

The whale has shown a pattern of successful trading operations during the previous month. Lookonchain identified the trader who generated 100% returns and obtained $16.39 million profits through his trades. The market timing capabilities of investors have become a major point of fascination for members throughout the cryptocurrency field.

The whale achieved more than $9.37 million in total profits during the thirty-day period. Risk management and leverage strategies employed by the trader have been essential for their success. The high risks seem to have no effect on the whale as it continues executing dangerous trades successfully.

Multiple traders in the market space have studied the investment methods that the crypto whale is utilizing. Several market participants tried to cancel the financial moves of this whale but none achieved success in causing a financial liquidation. The investor’s strategic choices and infusion of new funds have protected them from major financial damage.

Whale’s New Bet on Solana-Based Meme Coin MELANIA

After closing the Bitcoin short position, the whale shifted focus to MELANIA, a meme coin on the Solana network. The investor took a $2.7 million long position while leveraging it 5 times. This trade presents a different risk profile compared to Bitcoin, given the volatility of meme coins.

The MELANIA trade started at an entry value of $0.7238, yet its liquidation would begin when the price reached $0.653. Liquidation conditions occur when the MELANIA price drops 9.78% below the initial entry price of $0.7238. Unlike the Bitcoin trade, there have been no coordinated efforts to push MELANIA’s price lower to force liquidation.

The whale demonstrated readiness for intense speculative crypto bets by investing in meme coins. While Bitcoin remains the primary trading instrument, this new position highlights an interest in speculative opportunities.

As of the time of writting Bitcoin price was trading in a bullish sentiment with at $83,266 highlighting a slight price increase of 0.49% in the last 24-hours.

FAQs

What is short-selling in crypto trading?

Short-selling involves borrowing an asset, selling it at a high price, and buying it back at a lower price. Traders profit from the price decline. However, short-selling carries high risks, especially when using leverage.

How did the whale avoid liquidation on Bitcoin?

The whale added $5 million in USDC to increase collateral and increase the liquidation price. This strategy prevented the position from being forced closed. By managing risk effectively, the trader remained in control despite market fluctuations.

What is the risk of trading with leverage?

Leverage amplifies potential gains and losses. If the market moves against the position, high leverage increases the risk of liquidation. Traders must manage collateral effectively to avoid losing their entire position.

Glossary

Short Position: A trade betting on the decline of an asset’s price.

Leverage: The use of borrowed funds to increase potential profits and risks.

Liquidation Price: The price level at which an exchange forcibly closes a leveraged position.

Time-Weighted Average Price (TWAP): A strategy that averages trade execution over time to minimize market impact.

Collateral: Funds deposited to support a leveraged position and prevent liquidation.

Meme Coin: A cryptocurrency often inspired by internet culture, known for high volatility and speculative trading.