The Ethereum ETF received an extraordinary $727 million in a single day, indicating a significant shift in institutional attitude. Analysts believe the spike reflects renewed confidence in crypto markets, particularly as spot Ethereum ETFs draw significant funds. This Ethereum ETF inflow hits a new record, indicating traditional finance’s expanding dominance over digital assets.

Historical Context: From Skepticism to Surge

The Ethereum ETF received an extraordinary $727 million in a single day, indicating a significant shift in institutional attitude. Analysts believe the spike reflects renewed confidence in crypto markets, particularly as spot Ethereum ETFs draw significant funds. This Ethereum ETF inflow hits a new record, indicating traditional finance’s expanding dominance over digital assets.

Analyzing the Ethereum ETF Inflow: What It Reveals

| Metric | Value |

|---|---|

| Single‐day Ethereum ETF inflow | $726.74 million |

| Largest weekly Ethereum ETF inflow | $907.99 million |

| Total cumulative ETF holdings | ~$6.48 billion |

| BlackRock ETHA share | ~$499 million |

This Ethereum ETF influx is more than just numbers; it reflects trust. Corporate treasuries are purchasing ETH aggressively. Bitget Wallet’s CMO Jamie Elkaleh stated that “Ethereum is emerging as the yield-generating infrastructure play,” citing staking returns (4-6%) and deflationary tokenomics. A different analyst stated that “BlackRock’s accumulation of ETH is not just about price upside, it’s a strategic position in what many see as the backbone of future on‑chain finance”.

Along with the Ethereum ETF influx, ETH futures open interest has risen to nearly $45 billion, up roughly 60% since late June. Additionally, corporate treasuries have acquired more than $5.33 billion in ETH, with SharpLink Gaming topping the way. This demonstrates that usage extends beyond ETFs and includes direct treasury holdings and derivatives.

Retail investor sentiment is catching up, too. Following the ETH surge, on-chain indications show significant short-position liquidations, indicating concern.

of missing out.

Expert Forecasts: What Comes Next?

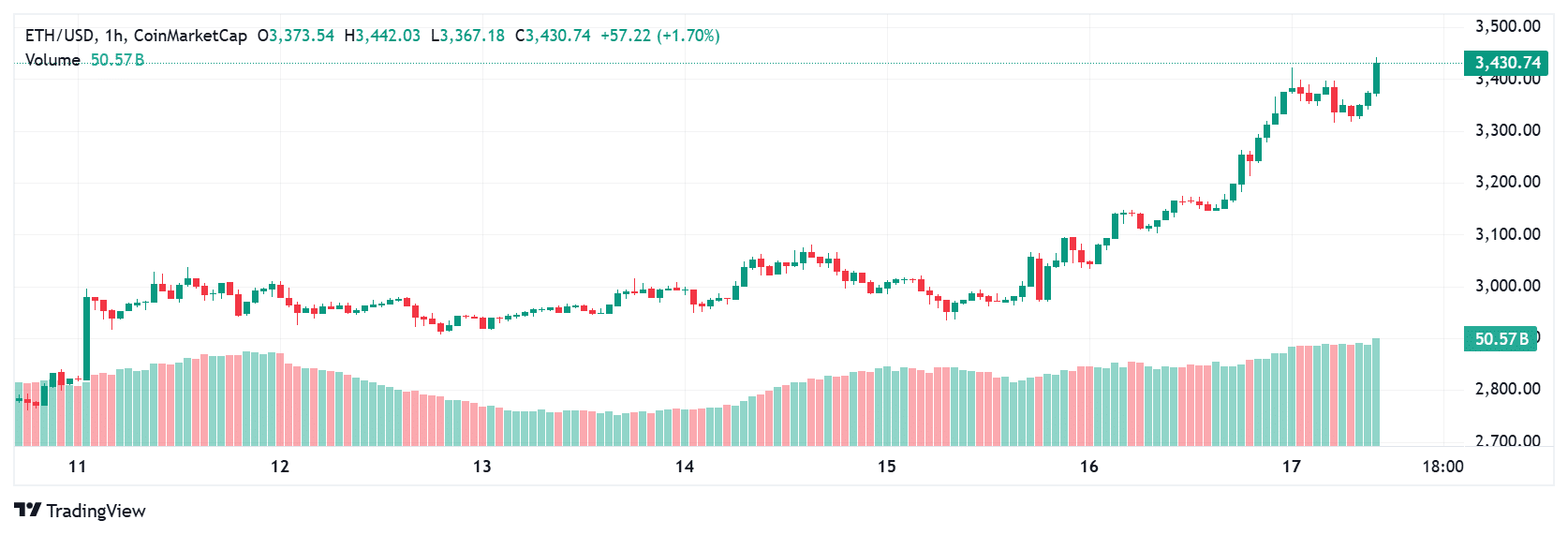

Analysts feel that this surge of Ethereum ETF inflows might signal the start of an altcoin season. With Bitcoin’s supremacy declining, altcoins are gaining traction. Technical experts predict near-term resistance at $3,450-3,500, which might extend to $3,650, with bullish scenarios chasing prior highs. Corporate treasury buildup and ETF inflows add gasoline to the flames.

For Traders and Investors

For investors and traders, the Ethereum ETF influx provides an opportunity, although prudence is still required. ETH’s growth is supported by several factors, including staking returns, deflationary supply, and diverse on-chain appeal. However, growing ETH futures leverage and developing regulatory clarity necessitate prudence. ETH’s position as a long-term asset is becoming clear as institutional adoption and inflows continue to grow.

Ethereum spot ETF inflows topped $727M on July 16

Weekly weekly inflows hit $908M, Ethereum’s largest ever

ETH futures open interest surpassed $45B, up 60% in weeks

Corporate treasuries added $5.33B in ETH, led by SharpLink Gaming

Conclusion

Based on the latest research, the record Ethereum ETF inflow signals a watershed moment for the cryptocurrency asset. Institutional investors, corporate treasuries, and technical momentum are combining to propel ETH past its speculative foundations. With staking income and deflationary tokenomics as tailwinds, ETH is establishing itself as a pillar of digital finance. However, continued monitoring is advised, since market volatility and regulatory intricacies may influence outcomes.

To know more expert reviews and crypto insights, visit our platform for the latest news and predictions.

FAQs

What drove the Ethereum ETF inflow?

A mix of institutional demand, staking yields, deflationary dynamics, and resurgence in ETF investor interest contributed to the record Ethereum ETF inflow.

Why is ETH seen as a long‑term asset?

Staking rewards, fee-burning via EIP‑1559, and utility in DeFi/NFT infrastructure strengthen ETH’s long-term case.

Are corporate treasuries buying ETH?

Yes—corporates like SharpLink Gaming have accumulated over $5.33B in ETH holdings recently.

Will inflows continue?

Analysts expect continued interest, especially if resistance at $3,450–3,500 is broken and macro conditions remain favorable.

Glossary

Ethereum ETF – A fund that holds physical ETH, enabling crypto exposure through brokerage platforms.

Spot Inflow – Net capital entering a fund during a given period.

Staking Yield – Annualized return from locking ETH in network validation.

Open Interest – Total outstanding futures contracts—indicative of institutional positioning.

Deflationary Tokenomics – Supply reduction mechanism (EIP‑1559 burns transaction fees).