The Hong Kong Securities and Futures Commission (SFC) has issued alerts against seven crypto trading platforms for illegally operating in the region without operational licenses. This move underscores the SFC’s ongoing efforts to protect investors and ensure regulatory compliance within the rapidly evolving cryptocurrency sector.

Hong Kong Securities and Futures Commission Alert List

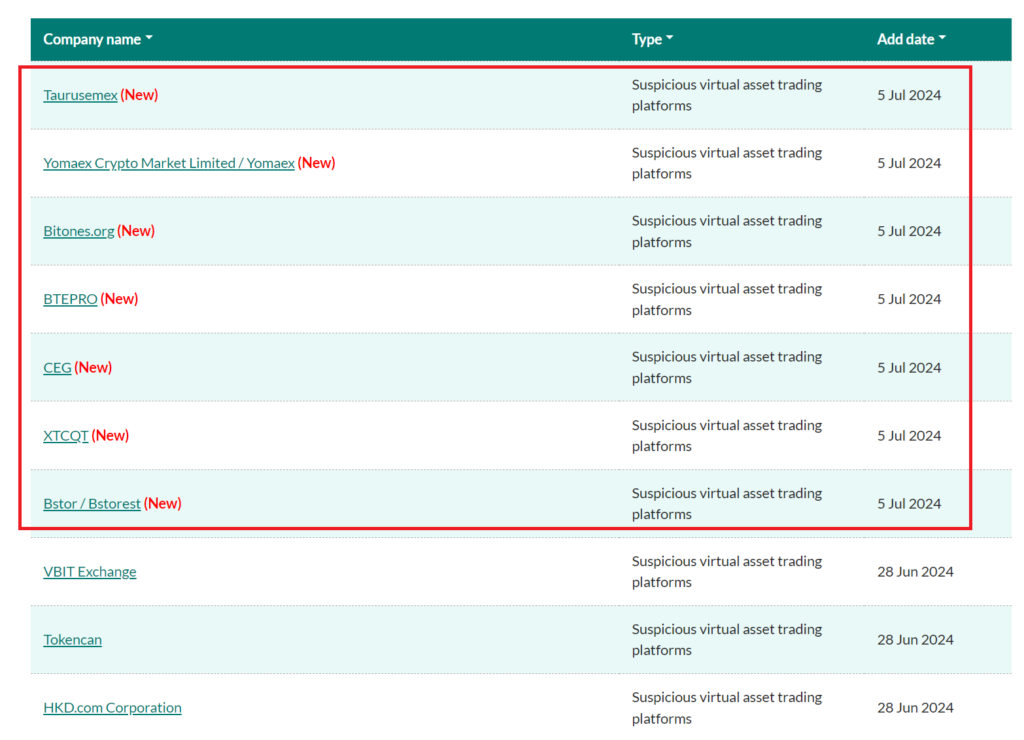

The Hong Kong Securities and Futures Commission maintains a public record of all registered, unregistered, and illegal crypto trading entities. This is to mitigate risks related to scams and fraud. The Alert List, which highlights exchanges that are either unlicensed or falsely associated with Hong Kong, saw the addition of seven exchanges on July 5. These recent additions bring the total number of flagged entities to 39 since the list’s inception in January 2020.

New Additions to the Alert List

The seven exchanges added to the Alert List include Taurusemex, Yomaex, Bitones.org, BTEPRO, CEG, XTCQT, and Bstorest. According to the warnings, all these exchanges are suspected of engaging in fraudulent activities. They have been accused of duping investors into believing they were registered with the Hong Kong Securities and Futures Commission. Many of these exchanges used extortion techniques, such as blocking withdrawals and demanding “fees” to resume operations.

“For Hong Kong investors’ safety, the Hong Kong SFC has been maintaining the alert list since January 2020, and it currently has 39 entries. In 2024 alone, 28 cryptocurrency exchanges were flagged,” states the SFC. This highlights the SFC’s proactive approach in safeguarding investor interests in the volatile crypto market.

Licensing and Regulatory Compliance

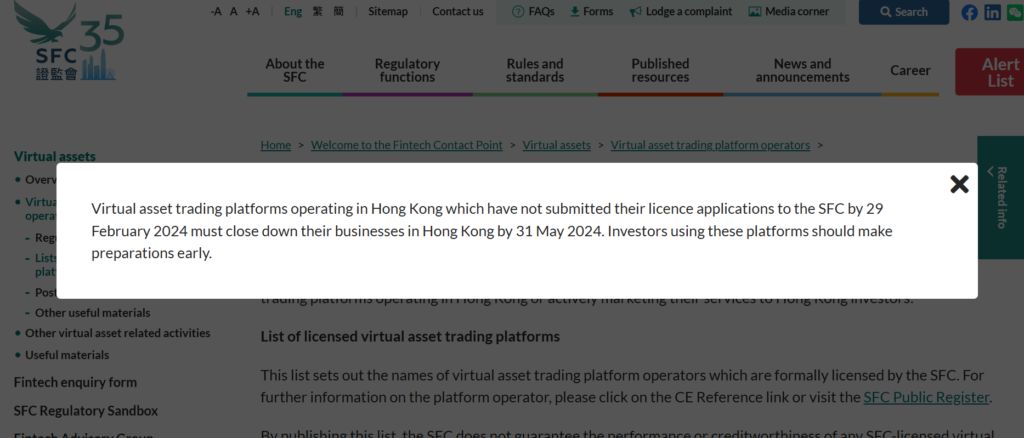

In an effort to further tighten regulatory compliance, the Hong Kong Securities and Futures Commission mandated that all crypto exchanges operating in the region apply for a license by May 31. Those that failed to comply were legally required to shut down. This stringent measure was part of Hong Kong’s aggressive steps to regulate crypto trading services since early 2024.

During this period, more than 22 cryptocurrency exchanges applied for licenses to maintain their presence in the region. However, many ultimately decided to withdraw their applications just before the deadline. This reflects the challenges and perhaps the stringent criteria imposed by the Hong Kong Securities and Futures Commission for licensing.

International Outreach for Investment

In addition to its regulatory efforts, Hong Kong government entities dedicated to attracting foreign investments have been actively promoting the region as a prime destination for technology and innovation. Recently, representatives from the Hong Kong Economic and Trade Office in Toronto, Invest Hong Kong, and StartmeupHK visited a tech conference in Toronto, Canada. The goal was to advertise Hong Kong’s offshore ready-to-move technology hub for Canadian crypto and Web3 startups.

This international outreach is part of Hong Kong’s broader strategy to position itself as a global leader in the cryptocurrency and fintech sectors. Hong Kong aims to attract top-tier investments and talent in these cutting-edge fields by ensuring robust regulatory frameworks and promoting its tech-friendly environment.

Conclusion

The Hong Kong Securities and Futures Commission’s actions highlight its commitment to maintaining a secure and transparent crypto trading environment. By flagging illegal exchanges and enforcing strict licensing requirements, the SFC aims to protect investors and uphold the integrity of the financial market.

The recent additions to the Alert List serve as a reminder of the ongoing risks in the crypto space and the importance of regulatory oversight. As Hong Kong continues to attract global investments and position itself as a technology hub, the role of the Hong Kong Securities and Futures Commission will remain crucial in ensuring a safe and compliant crypto ecosystem.