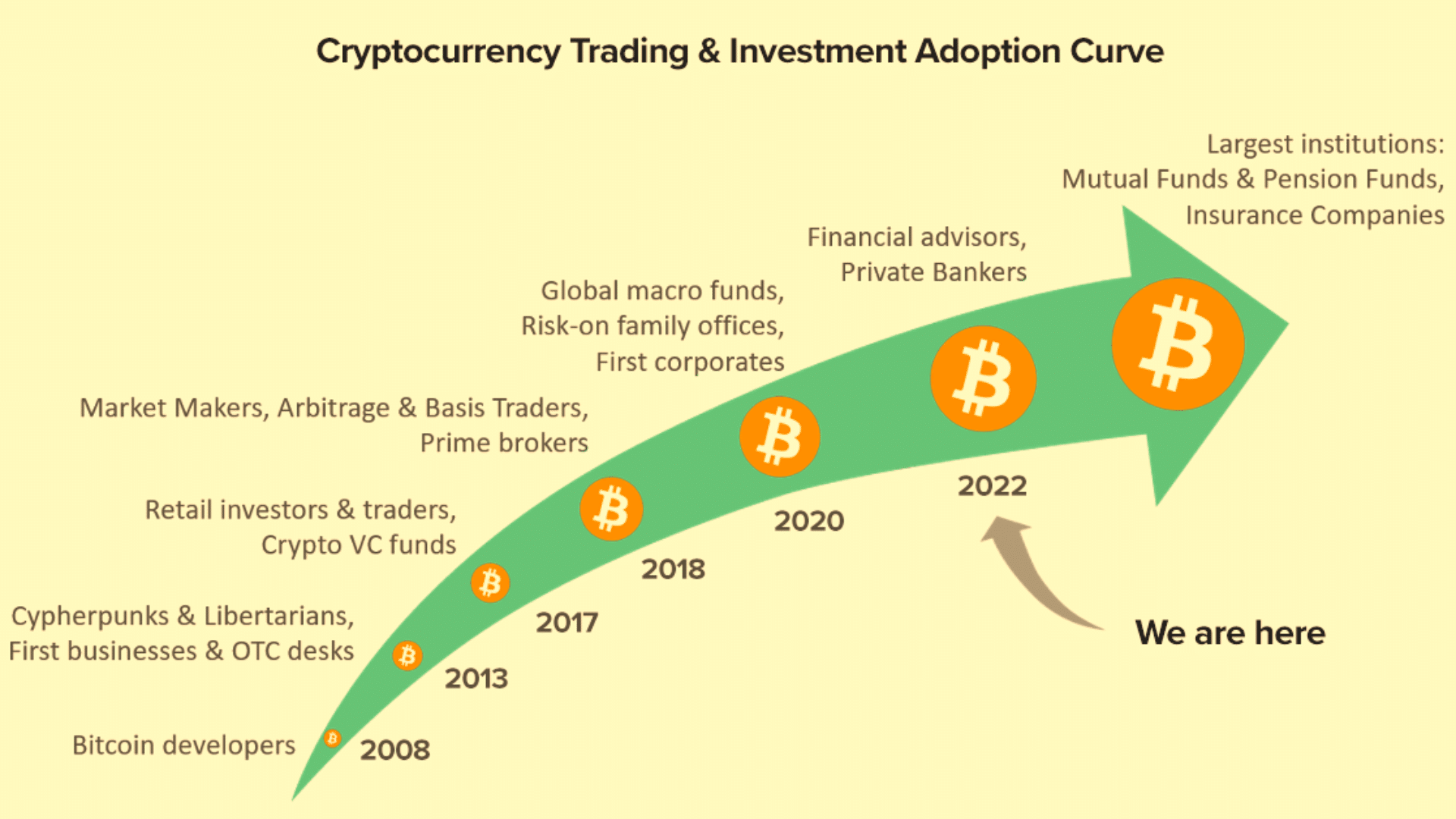

In recent years, Bitcoin investment strategies have emerged as a transformative force for companies seeking to diversify their assets and capitalize on the burgeoning digital economy. By integrating Bitcoin into their financial strategies, businesses are exploring new avenues for growth, risk management, and innovation.

The Rise of Corporate Bitcoin Adoption

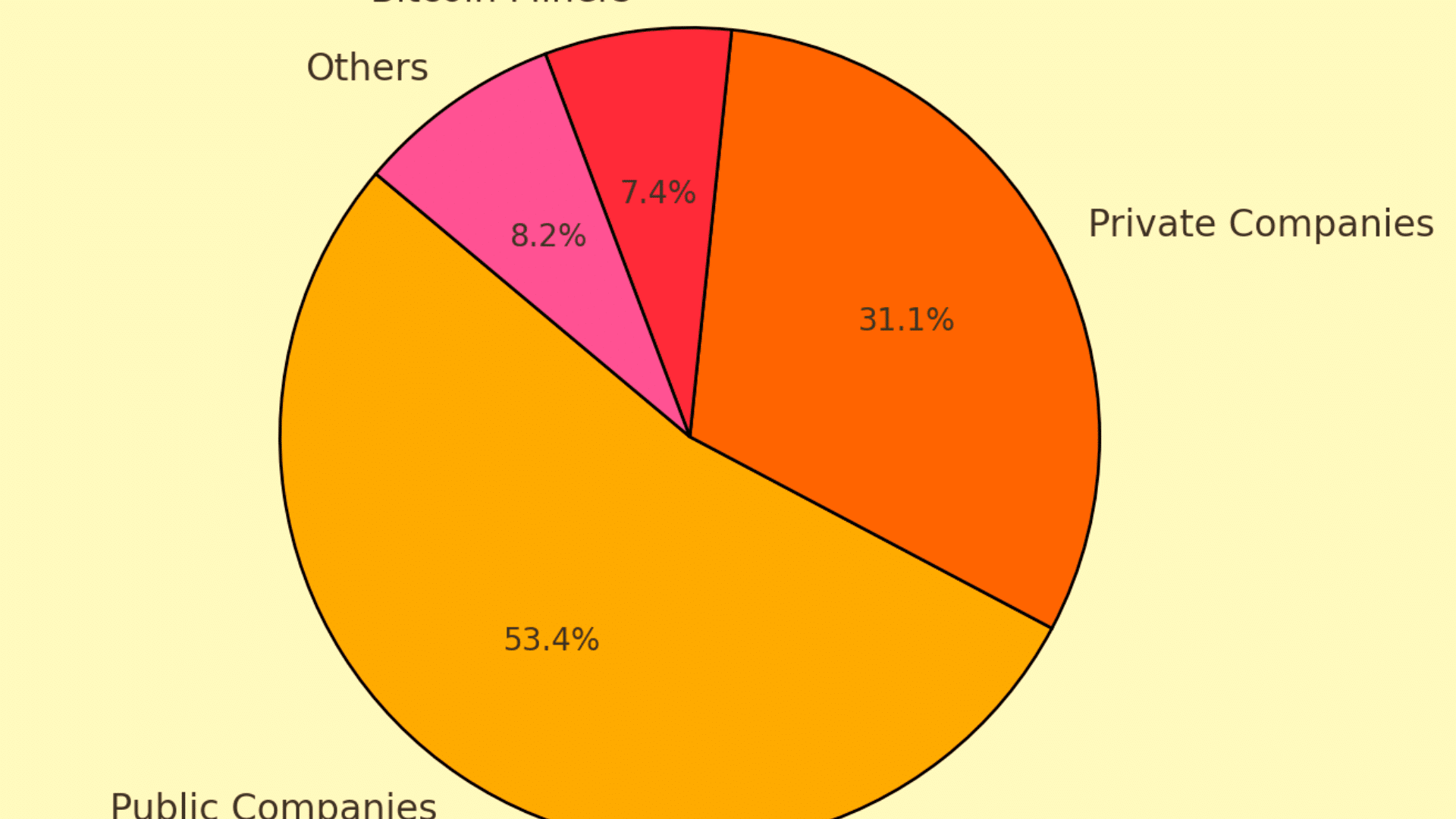

The corporate world’s interest in Bitcoin has surged, with numerous companies allocating portions of their treasury reserves to the cryptocurrency. This trend is driven by factors such as the desire for diversification, hedging against inflation, and the pursuit of higher returns in a low-interest-rate environment.

Strategy’s Bold Bitcoin Bet

A prominent example of corporate Bitcoin investment is Strategy (formerly MicroStrategy), a business intelligence firm that has made significant strides in this domain. Under the leadership of CEO Michael Saylor, Strategy has transformed its balance sheet by acquiring substantial amounts of Bitcoin. As of February 24, 2025, the company holds approximately 499,096 bitcoins, acquired for $27.95 billion at an average price of $62,473 per bitcoin.

To fund these acquisitions, Strategy has employed innovative financial instruments. Notably, the company announced the issuance of $500 million in 10% preferred stock, dubbed ‘Strife,’ to finance further Bitcoin purchases. This move underscores Strategy’s commitment to integrating Bitcoin into its corporate strategy.

Diversification Strategies: Beyond Direct Investment

While direct investment in Bitcoin is a common approach, companies are also exploring alternative strategies to gain exposure to the cryptocurrency market:

Crypto Custody Services: Financial institutions like Komainu, backed by Nomura, are expanding crypto custody services to institutional investors. This expansion reflects a growing institutional interest in Bitcoin and other digital assets.

Bitcoin-Backed Loans: Financial institutions are introducing Bitcoin-backed loan products, allowing companies to leverage their Bitcoin holdings without liquidating them. This strategy provides liquidity while maintaining exposure to potential Bitcoin appreciation.

Key Considerations for Corporate Bitcoin Investment

For companies contemplating Bitcoin investments, several critical factors should be meticulously evaluated:

Risk Management: Bitcoin’s notorious volatility necessitates robust risk management strategies. Companies should invest amounts they can afford to lose and implement measures to mitigate potential losses.

Regulatory Compliance: Navigating the complex and evolving regulatory landscape is crucial. Ensuring compliance with local and international laws is imperative to avoid legal pitfalls.

Accounting Practices: Proper accounting for digital assets is essential. Companies must adhere to relevant accounting standards and guidelines to accurately reflect Bitcoin holdings in their financial statements.

Potential Benefits of Bitcoin Investment

Integrating Bitcoin into corporate investment strategies can yield several advantages:

Inflation Hedge: Bitcoin is often viewed as a hedge against inflation, preserving purchasing power in times of currency devaluation.

Portfolio Diversification: Including Bitcoin can enhance portfolio diversification, potentially improving risk-adjusted returns.

Market Signaling: A company’s investment in Bitcoin can signal innovation and forward-thinking to investors and stakeholders, potentially enhancing its market reputation.

Challenges and Risks

Despite the potential benefits, companies must be cognizant of the inherent challenges and risks:

Market Volatility: Bitcoin’s price fluctuations can lead to significant valuation changes, impacting financial stability.

Security Concerns: Safeguarding digital assets against cyber threats requires robust security protocols and continuous monitoring.

Regulatory Uncertainty: Evolving regulations can affect the legality and reporting requirements of Bitcoin holdings, necessitating ongoing compliance efforts.

Conclusion

The integration of Bitcoin into corporate investment strategies presents both opportunities and challenges. Companies like Strategy have demonstrated the potential benefits of such investments, including portfolio diversification and hedging against economic uncertainties. However, businesses must approach Bitcoin investment with caution, implementing comprehensive risk management and ensuring strict regulatory compliance. As the digital asset landscape continues to evolve, companies that thoughtfully incorporate Bitcoin into their strategies may unlock new avenues for growth and innovation.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

Why are companies investing in Bitcoin?

Companies invest in Bitcoin to diversify their assets, hedge against inflation, and potentially achieve higher returns in a low-interest-rate environment.

What are the risks associated with corporate Bitcoin investment?

Risks include market volatility, security vulnerabilities, and regulatory uncertainties that could impact the valuation and legality of Bitcoin holdings.

How can companies mitigate the risks of Bitcoin investment?

Implementing robust risk management strategies, ensuring regulatory compliance, and employing secure custody solutions can help mitigate investment risks.

What is a Bitcoin-backed loan?

A Bitcoin-backed loan allows companies to use their Bitcoin holdings as collateral to obtain liquidity without selling their assets.

How does Bitcoin investment affect a company’s financial statements?

Bitcoin holdings are typically recorded as intangible assets, and companies must adhere to relevant accounting standards to accurately reflect their value.

Glossary

Bitcoin: A decentralized digital currency operating without a central authority, utilizing blockchain technology for secure transactions.

Blockchain: A distributed ledger technology that records transactions across a network of computers, ensuring transparency and security.

Custody Services: Financial services that securely hold digital assets on behalf of investors or institutions.

Diversification: An investment strategy that involves spreading investments across various assets to reduce risk.