The cryptocurrency market is known for its rapid price swings, making it one of the most predictive and riskiest investment opportunities available today. While many investors struggle to time the market and navigate uncertainty, crypto presales offer a safer, more strategic entry point.

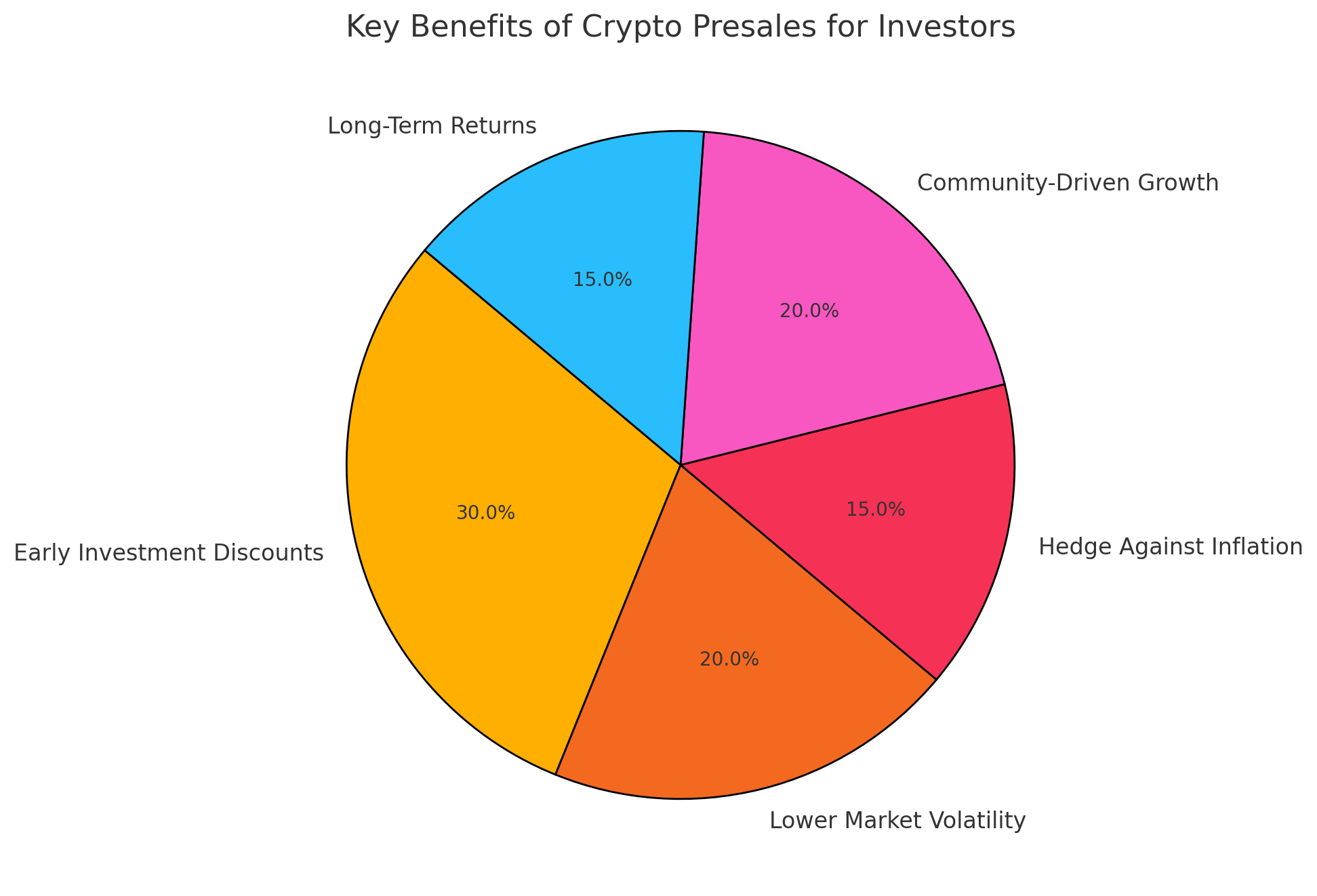

Presales allow investors to buy tokens at discounted prices before they launch on major exchanges, positioning them for long-term gains. They also serve as an inflation hedge, helping investors diversify their portfolios with digital assets that can appreciate in value.

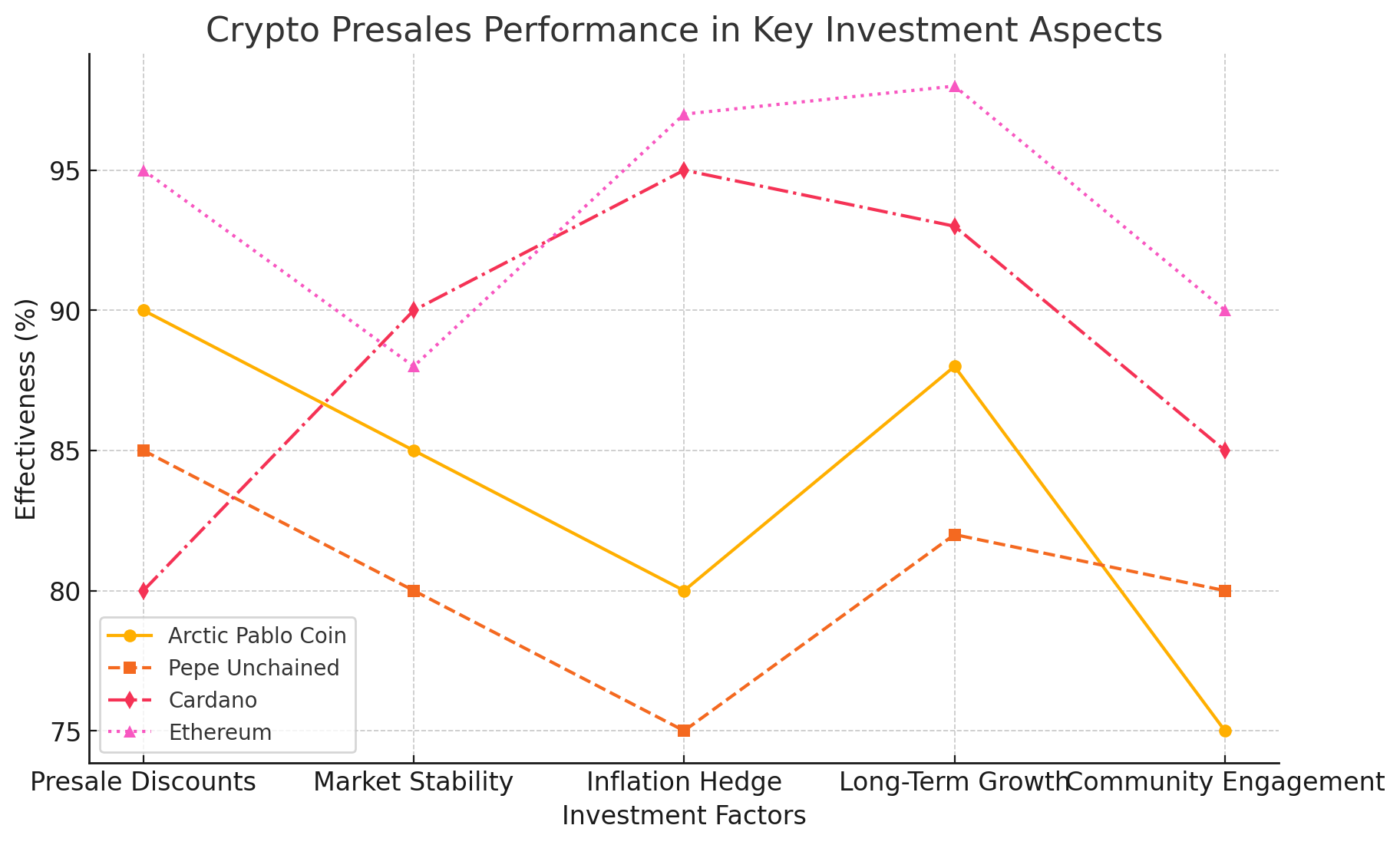

In this article, we’ll dive deep into why crypto presales are a reliable investment amid volatility, how they act as a hedge against inflation, and how investors can maximize their profits through long-term holding strategies. We’ll also explore real-world case studies of successful projects such as Arctic Pablo Coin, Pepe Unchained, Cardano, and Ethereum, proving that early investments in the right projects can lead to exponential growth.

Understanding Crypto Presales and Their Growing Popularity

A crypto presale is a fundraising event where a blockchain project offers its tokens to early investors before a public launch. This phase allows developers to raise capital, build a strong community, and establish liquidity while giving investors the opportunity to acquire tokens at a lower price.

Presales are structured in two key ways:

- Private Sales: Limited to venture capitalists, high-net-worth investors, or strategic partners.

- Public Presales: Open to retail investors, often conducted in multiple stages with tiered pricing benefits.

The appeal of presales lies in their ability to provide investors with discounted token prices, lower entry risk, and the chance to invest before mainstream adoption drives prices higher.

Why Crypto Presales Are a Safe Bet Amid Market Volatility

The crypto market’s volatility can be daunting, with prices fluctuating based on market sentiment, macroeconomic conditions, and regulatory news. However, investing in presales eliminates some of this uncertainty by allowing investors to secure assets before they are affected by market-driven price swings.

Arctic Pablo Coin is a prime example of a successful presale model.

- This deflationary meme coin integrates an automatic burn mechanism, meaning the token supply will decrease over time, increasing scarcity and value.

- Early investors in the Arctic Pablo presale gained access to tokens at the lowest possible price, allowing them to profit significantly as demand grew post-launch.

Similarly, Pepe Unchained has leveraged its presale to establish itself as a Layer 2 solution designed for meme coin enthusiasts.

- By investing early, presale participants received priority access to a new ecosystem focused on fast, low-cost transactions.

- The project’s early supporters have already seen price appreciation, proving that well-structured presales offer a lower-risk way to enter the crypto market before mainstream hype kicks in.

By securing tokens before they are publicly traded, investors protect themselves from the unpredictable price swings of the post-launch market while positioning themselves for higher long-term returns.

Crypto Presales as a Hedge Against Inflation

Inflation reduces the purchasing power of fiat currencies, prompting investors to seek alternative assets that can retain or increase value over time. Cryptocurrencies, particularly those with fixed supplies or deflationary mechanisms, have emerged as a popular hedge against inflation.

Crypto presales amplify this advantage by allowing investors to acquire assets early, often at lower costs, before their value increases.

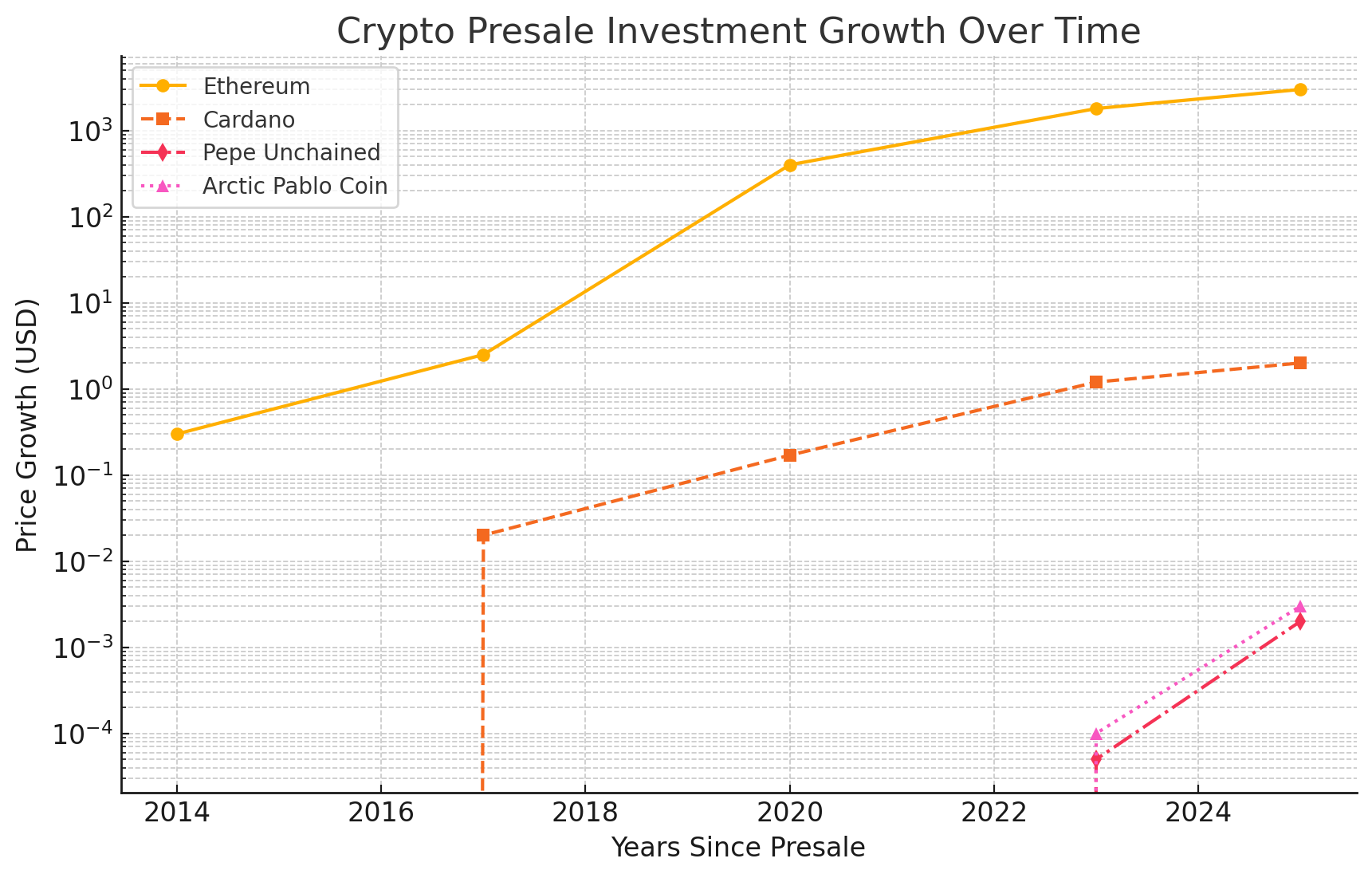

Cardano: A Case Study in Inflation Hedging

- Cardano (ADA) is a blockchain platform known for its scientific approach to development and energy efficiency.

- Unlike fiat currencies, which can be printed indefinitely, Cardano has a fixed supply, reducing the risks associated with inflation.

- Investors who bought into Cardano’s early presale in 2017 have seen substantial returns as the project evolved into one of the most respected in the blockchain space.

Ethereum, another major success story, also exemplifies why presales can serve as an inflation-resistant investment.

Ethereum: A Blueprint for Presale Success

- Ethereum initially sold its tokens in a presale for around $0.30 per ETH in 2014.

- Today, ETH trades in the thousands, making early presale participants some of the most successful investors in crypto history.

- Ethereum’s deflationary mechanism, introduced with EIP-1559, further strengthens its role as an inflation hedge, as part of its supply is burned with every transaction.

By investing in presales of projects with solid fundamentals and fixed supplies, investors can protect their assets from inflation while benefiting from long-term appreciation.

The Long-Term Investment Potential of Crypto Presales

While some traders chase short-term price fluctuations, presales offer a more strategic, long-term approach to investing. Key reasons to consider presales for long-term gains include:

- Early Access to High-Value Projects: Investors can enter the market before retail buyers, ensuring maximum growth potential.

- Bonus Incentives: Many presales offer staking rewards, airdrops, or additional token bonuses for early supporters.

- Community-Driven Growth: Projects with strong community engagement (like Pepe Unchained and Arctic Pablo Coin) benefit from viral adoption, increasing token value.

- Lower Risk, Higher Reward: By securing tokens before volatility-driven price swings, investors can mitigate risk while maximizing returns.

How to Invest in Crypto Presales Safely

While presales offer immense potential, not all projects are created equal. To invest wisely, follow these key strategies:

1. Conduct In-Depth Research

- Read the whitepaper to understand the project’s mission, technology, and roadmap.

- Verify the team’s background and ensure they have credible experience in blockchain development.

2. Evaluate Tokenomics and Supply

- Look at the total supply and distribution model and whether the project has deflationary mechanisms.

- Projects like Arctic Pablo Coin use token burns to increase scarcity, driving long-term value.

3. Assess Community Engagement

- Strong online communities (Reddit, Twitter, Telegram) indicate strong market demand.

- Projects with active discussions and growing user bases are more likely to succeed.

4. Diversify Your Investments

- Avoid putting all funds into a single presale—spread investments across different sectors like DeFi, gaming, and meme coins.

5. Ensure Smart Contract Security

- Look for projects with audited smart contracts to avoid rug pulls and security risks.

By following these steps, investors can confidently navigate the presale market and build a high-value portfolio.

Conclusion: Crypto Presales Are the Future of Smart Investing

In a world of market volatility and inflation concerns, crypto presales provide a secure, high-growth investment opportunity. Investors can protect themselves from post-launch price swings, hedge against inflation, and maximize long-term gains by participating in well-researched presales.

Success stories like Ethereum, Cardano, Pepe Unchained, and Arctic Pablo Coin prove that getting in early can lead to life-changing financial growth.

By investing in presales strategically and using best practices, crypto investors can position themselves for exponential profits in 2025 and beyond.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is a crypto presale, and how does it work?

A crypto presale is an early investment phase where a blockchain project offers its tokens to a select group of investors before launching on public exchanges. Investors can purchase tokens at discounted prices, often gaining exclusive bonuses and incentives. Presales help projects raise funds for development while offering early adopters the chance to buy at lower prices before demand increases.

2. Why are crypto presales considered a safer bet amid market volatility?

Crypto presales allow investors to buy tokens at a fixed, lower price, reducing exposure to post-launch price swings that commonly affect new tokens. Unlike public listings, where prices can skyrocket or crash due to hype and speculation, presales offer a controlled entry point, minimizing immediate risks.

For example, investors in Arctic Pablo Coin’s presale benefited from lower prices before the token’s deflationary mechanisms increased its value over time.

3. How do crypto presales act as a hedge against inflation?

Inflation reduces the purchasing power of fiat currencies, making cryptocurrencies with fixed or deflationary supplies an attractive alternative. Investing in presales of projects with controlled tokenomics (such as Ethereum and Cardano) ensures that investors hold assets with scarcity-driven value growth.

By getting in before mass adoption, presale investors can benefit from long-term appreciation as demand rises and supply remains fixed or decreases.

4. What are some of the most successful crypto presales in history?

Some notable success stories include:

- Ethereum (ETH): Investors who bought ETH at its presale price of $0.30 per token in 2014 saw its value soar above $4,000 at its peak.

- Cardano (ADA): Launched in 2017 at fractions of a cent, ADA’s value multiplied over 100x after its adoption grew.

- Pepe Unchained: A Layer 2 solution that improved transaction efficiency, making it a promising presale investment.

- Arctic Pablo Coin: A deflationary meme coin with an automatic burn mechanism that increased scarcity and price appreciation for early investors.

These cases prove that early participation in promising presales can yield massive long-term gains.

5. What factors should investors consider before joining a crypto presale?

To invest wisely in presales, consider the following:

- Project’s Whitepaper & Roadmap – Understand the project’s mission, development timeline, and use cases.

- Tokenomics – Check supply limits, distribution plans, staking rewards, and deflationary mechanisms.

- Team Credibility – Verify the team’s experience in blockchain development.

- Community Engagement – Strong online communities (Twitter, Reddit, Telegram) often indicate strong demand.

- Security & Smart Contract Audits – Ensure the project has undergone third-party audits to prevent rug pulls or fraud.

By following these steps, investors reduce risk and increase the likelihood of long-term profitability.

6. How can I maximize my gains from investing in crypto presales?

To ensure maximum returns from crypto presales, investors should:

- Buy early – The lower the entry price, the higher the potential for profits.

- Diversify investments – Spread funds across multiple presales to minimize risk.

- Hold long-term – Avoid panic-selling; projects like Ethereum and Cardano took years to reach their full potential.

- Stake or reinvest – Some presales offer staking rewards, allowing investors to earn passive income while waiting for price appreciation.

- Follow market trends – Stay updated on project developments, exchange listings, and upcoming partnerships.

Following these strategies can significantly boost an investor’s long-term crypto portfolio.

7. Are crypto presales risky, and how can I avoid scams?

While crypto presales offer high rewards, they also carry risks. To avoid scams and rug pulls, investors should:

- Only invest in projects with verified teams and transparent roadmaps.

- Check if a reputable cybersecurity firm audits the smart contract.

- Avoid “too good to be true” promises, such as extreme ROI guarantees.

- Look for established presale platforms (e.g., Launchpads, IDOs, and IEOs on reputable exchanges).

- Join community discussions to assess real investor sentiment before committing funds.

Glossary of Key Terms

Crypto Presale – An early fundraising event where a blockchain project offers its tokens at discounted prices before they are publicly launched on major exchanges.

Private Sale – A presale phase where tokens are sold to select investors, such as venture capitalists or institutional buyers, often at a lower price than public presales.

Public Presale – A phase where retail investors can purchase tokens before the official launch, typically in different stages with tiered pricing.

Tokenomics – The economic model of a cryptocurrency, including aspects such as token supply, distribution, inflation/deflation mechanisms, and staking rewards.

Deflationary Mechanism – A feature in some cryptocurrencies where tokens are permanently removed from circulation (burned) to reduce supply and increase value over time.

Hedge Against Inflation – A financial strategy where investors purchase assets (like crypto) to protect against the declining value of fiat currency due to inflation.

Smart Contract Audit – A review of a blockchain project’s smart contracts by cybersecurity firms to check for security vulnerabilities and ensure code integrity.

Initial Coin Offering (ICO) – A method of fundraising where new cryptocurrencies sell tokens to investors before launching on exchanges.

Layer 2 Solution – A blockchain scaling method that processes transactions off the main blockchain to increase efficiency and reduce fees, such as what Pepe Unchained aims to achieve.

Market Volatility – The degree of variation in cryptocurrency prices over time, driven by market sentiment, investor behavior, and regulatory updates.

Sources and References

Cardano’s Whitepaper and Early Investment Strategy – Cardano.org

SEC Regulations on Cryptocurrency – U.S. Securities and Exchange Commission

Understanding Tokenomics and Deflationary Cryptocurrencies – CoinDesk

Crypto Presales and Investment Strategies – Cointelegraph

Market Volatility & Crypto Risk Analysis – Investopedia

How Crypto Projects Raise Funds – CryptoSlate

Smart Contract Security and Audits – CertiK Security