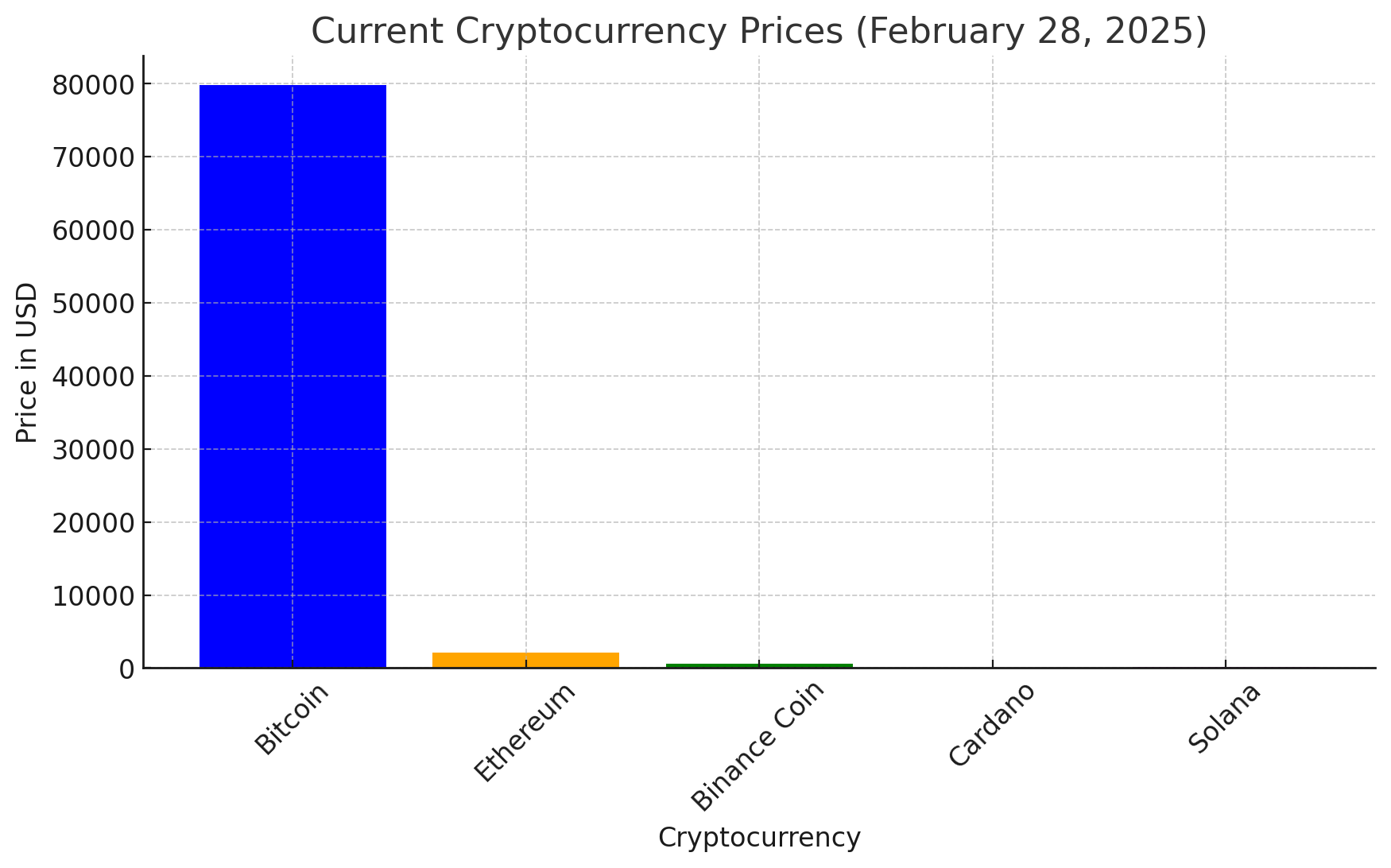

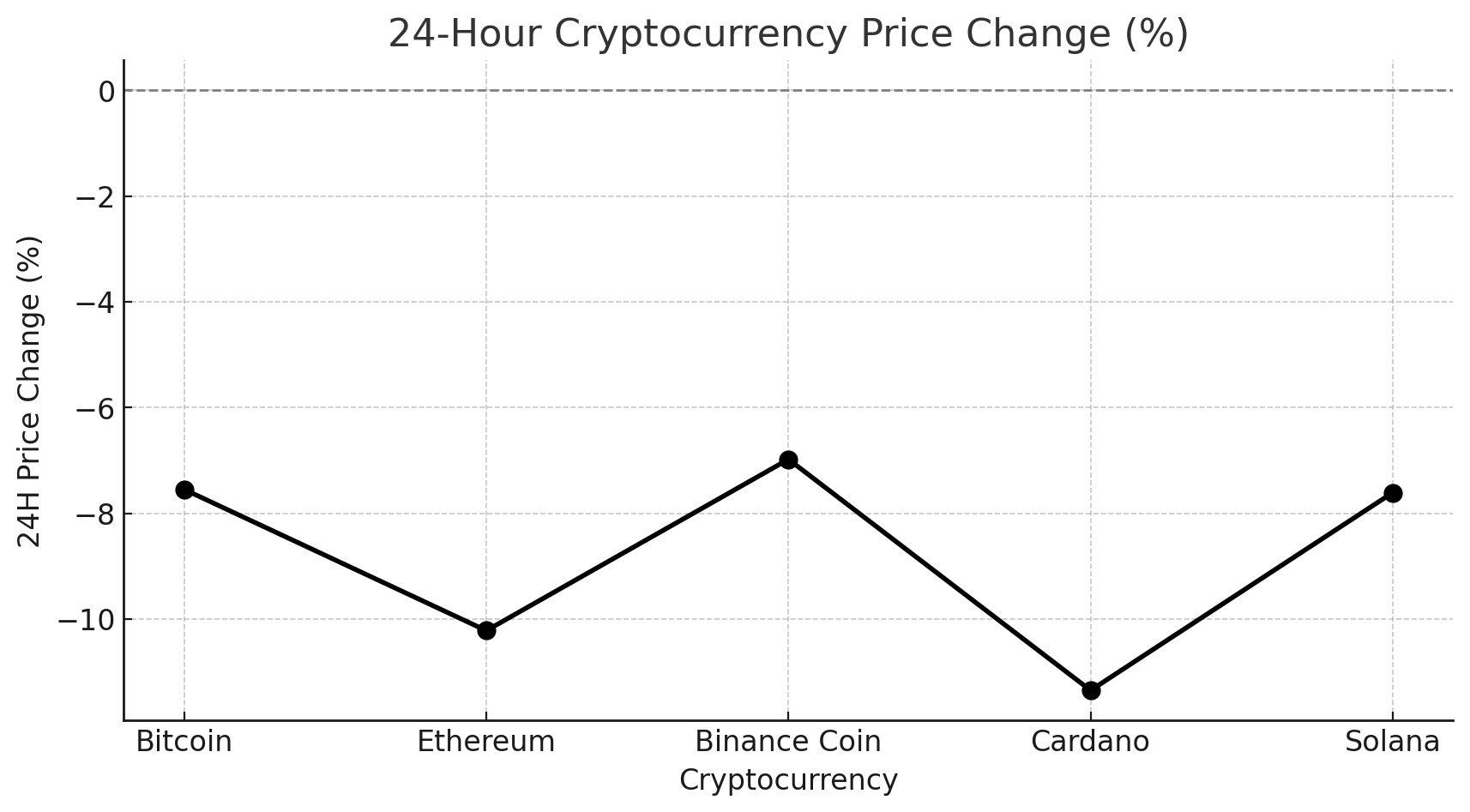

The crypto market is experiencing notable volatility, with significant declines observed across major digital assets. Bitcoin (BTC), the leading cryptocurrency, has fallen below the $80,000 threshold, trading at approximately $79,809, a decrease of 7.55% from the previous close. Ethereum (ETH) is priced at $2,126.84, reflecting a 10.22% drop, while Binance Coin (BNB) stands at $572.03, down 6.98%. Other prominent cryptocurrencies, such as Cardano (ADA) and Solana (SOL), have also experienced declines of 11.35% and 7.61%, respectively.

| Cryptocurrency | Price (USD) | 24-Hour Change (%) |

|---|---|---|

| Bitcoin (BTC) | $79,809 | -7.55% |

| Ethereum (ETH) | $2,126.84 | -10.22% |

| Binance Coin (BNB) | $572.03 | -6.98% |

| Cardano (ADA) | $0.597536 | -11.35% |

| Solana (SOL) | $130.90 | -7.61% |

Factors Contributing to the Crypto Market Downturn

Several elements have converged to influence the current bearish trend in the cryptocurrency market:

1. Regulatory Uncertainty

The U.S. Securities and Exchange Commission (SEC) recently dismissed its lawsuit against Coinbase, indicating a potential shift in regulatory stance under President Donald Trump’s administration. While this move suggests a more crypto-friendly environment, it also introduces uncertainty as investors await concrete regulatory frameworks. An executive order has established a working group to propose digital asset regulations, but the market remains cautious pending definitive outcomes.

2. Security Breaches

A significant security incident involved a $1.5 billion hack of the Dubai-based exchange Bybit, reportedly orchestrated by North Korean hackers. This breach has undermined investor confidence, leading to increased market sell-offs. Such high-profile hacks often prompt concerns about the overall security of digital assets, contributing to market volatility.

3. Macroeconomic Factors

Global economic concerns, including proposed U.S. tariffs and inflationary pressures, have impacted investor sentiment. President Trump’s indication of a 25% levy on imports from Canada and Mexico has added to crypto market jitters, influencing not only traditional financial markets but also the cryptocurrency sector.

Duration of the Current Market Conditions

Predicting the exact duration of the current market downturn is challenging due to the interplay of various dynamic factors. However, several insights can be considered:

Market Corrections: Analysts often view such downturns as “healthy corrections” following periods of rapid growth. Joel Kruger of LMAX Group notes that the recent decline is milder compared to past crashes, suggesting a potential stabilization in the near term.

Regulatory Developments: The establishment of a working group to propose digital asset regulations indicates that clearer guidelines may emerge soon. Positive regulatory clarity could bolster investor confidence and potentially reverse bearish trends.

Upcoming Events: The anticipated Bitcoin halving event in April 2025 is historically associated with price increases due to the reduction in new supply. This event could serve as a catalyst for market recovery.

Optimistic and Bullish Predictions

Despite the current downturn, several experts maintain a positive long-term outlook for the crypto market:

Standard Chartered: Analysts predict that Bitcoin could reach $500,000 before President Trump leaves office, driven by increased institutional adoption and favorable regulatory developments.

Galaxy Digital: Forecasts suggest that Bitcoin may surpass $150,000 and potentially reach $185,000 by the end of 2025, influenced by corporate and nation-state adoption.

Bitwise Investments: Projections indicate that Bitcoin, Ethereum, and Solana will hit new all-time highs, with Bitcoin trading above $200,000 in 2025.

Strategies for Investors and Early Adopters

In light of the current crypto market conditions, investors and early adopters might consider the following approaches:

1. Maintain Composure and Avoid Emotional Decisions

Market volatility is inherent in the cryptocurrency space. Panic selling during downturns can lead to realized losses. Historically, markets have rebounded after corrections, rewarding those who maintain a long-term perspective.

2. Employ Dollar-Cost Averaging (DCA)

Investing a fixed amount at regular intervals can mitigate the impact of short-term price fluctuations. This strategy reduces the risk associated with lump-sum investments during volatile periods.

3. Diversify Holdings

Spreading investments across various cryptocurrencies and related assets can reduce exposure to the poor performance of a single asset. Diversification can enhance the potential for returns while mitigating risks.

4. Monitor Institutional and Regulatory Developments

Staying informed about institutional movements and regulatory changes can provide insights into market trends. Positive developments in these areas often precede market upswings.

5. Prioritize Security

Utilizing hardware wallets and ensuring robust security measures can protect assets from potential breaches, especially in light of recent exchange hacks.

Conclusion

The current downturn in the crypto market is influenced by a combination of regulatory uncertainties, security incidents, and macroeconomic factors. While short-term volatility presents challenges, the long-term outlook remains optimistic, supported by upcoming events like the Bitcoin halving and potential regulatory clarity. Investors are advised to stay informed, and employ strategic investment approaches.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

1. How long will the crypto market stay bearish?

The duration of a bearish phase in crypto depends on several factors, including regulatory developments, macroeconomic conditions, and investor sentiment. Historically, major downturns have lasted several months to a year, often recovering around key events like the Bitcoin halving.

2. What is causing the current crypto market crash?

The recent decline is attributed to regulatory uncertainty, security breaches (e.g., the $1.5 billion Bybit hack), macroeconomic factors, and investor profit-taking. Crypto market corrections are common after a significant rally.

3. Will Bitcoin recover soon?

Many analysts believe Bitcoin will recover, especially with institutional adoption, regulatory clarity, and the upcoming Bitcoin halving in 2025. According to expert forecasts, price targets for Bitcoin range from $150,000 to $500,000 by 2025.

4. Is this a good time to buy crypto?

If you are a long-term investor, buying during dips (using a Dollar-Cost Averaging strategy) can be beneficial. However, short-term traders should monitor the market carefully, as volatility remains high.

5. What strategies should investors use during a bear market?

Investors should diversify their portfolios, use secure storage (hardware wallets), track institutional activity, and follow macroeconomic trends. Patience is key, as past bear markets have preceded major bull runs.

Glossary of Key Crypto Terms

Bear Market

A prolonged period of declining asset prices, often marked by fear and reduced investor confidence.

Bitcoin Halving

A programmed event that occurs every four years, reducing the mining reward by half. Historically, Bitcoin halvings have preceded major bull runs.

Crypto Market Correction

A temporary decline in asset prices following a strong uptrend. Corrections are normal and often provide buying opportunities.

Dollar-Cost Averaging (DCA)

An investment strategy where investors buy assets at regular intervals reduces short-term volatility’s impact.

Institutional Adoption

The involvement of large financial institutions, corporations, and hedge funds in the crypto market, often influencing prices and liquidity.

Whale Activity

Refers to large-scale transactions by big investors (whales) who can impact market movements.

Regulatory Uncertainty

A situation where governments and regulators have not established clear guidelines for cryptocurrencies, leading to market fluctuations.

Altcoins

Any cryptocurrency other than Bitcoin (e.g., Ethereum, Solana, Cardano).

Liquidity Crisis

When there are not enough buyers or sellers in the crypto market, causing price instability and increased volatility.

Sources