Nothing says “global economic strategy” like impulsive tweets, panic-induced policy reversals, and a good old-fashioned blame game between superpowers.

Act I: When Trump Thought US China Tariff Wars Were “Good and Easy to Win”

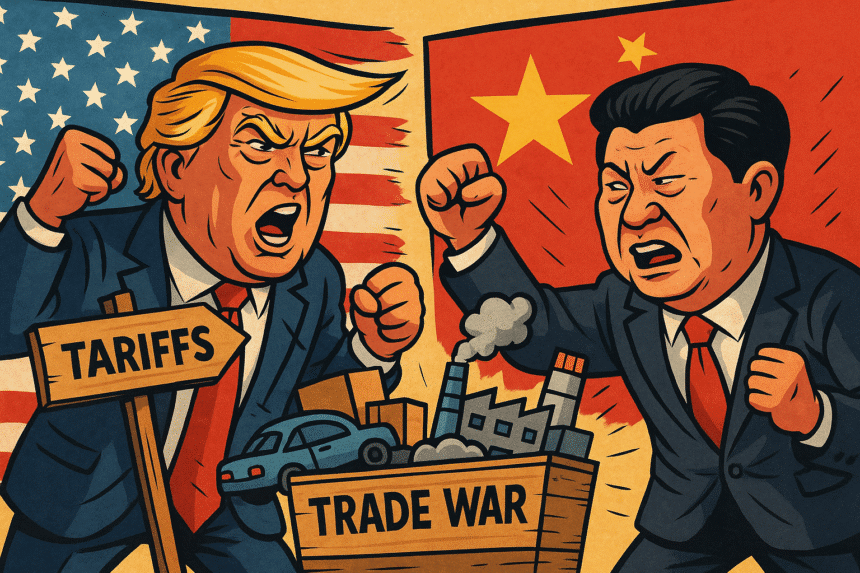

In a moment of infinite wisdom and economic subtlety, then-President Donald J. Trump famously declared that “trade wars are good and easy to win.” This bold claim was immediately followed by a multiyear international pricing bloodbath that economists would later describe as “not great” and “somehow worse than expected.”

Armed with a tariff wand and a Twitter account, Trump kicked off the trade war in 2018 by slapping tariffs on $34 billion worth of Chinese imports. His logic? The U.S. had a trade deficit with China — and instead of, say, addressing domestic production or supply chain efficiency, it made perfect sense to just tax stuff Americans needed to buy.

Because what better way to “beat China” than to raise the prices of microwaves, lawnmowers, and yoga pants for your own citizens?

The Art of the Trade Deal (Or Whatever That Was)

As tariffs escalated from $34 billion to a casual $550 billion, both countries engaged in a tit-for-tat showdown that felt more like a petty breakup than geopolitical chess.

China responded with its own tariffs, especially on American agriculture, because apparently, soybeans and pork were the real villains in this saga. U.S. farmers, caught in the crossfire, faced collapsing export markets while being told to hold on because “patriotism is profitable” (spoiler: it isn’t when you’re bankrupt).

Enter Trump’s brilliant solution: taxpayer-funded bailouts for farmers hurt by… well, his own policies. It was essentially the government taxing Americans, then using that tax money to compensate Americans who got screwed by the government. Economic innovation!

Wait, Who’s Actually Winning This?

Let’s do the scoreboard.

U.S. consumer prices? Up.

Chinese exports? Still strong.

American farmers? Subsidized into silence.

U.S. companies? Crying in their accounting spreadsheets.

Global investors? Hiding under desks.

China, for its part, showed the kind of stoic patience only a 5,000-year-old civilization could muster. Rather than panic, they calmly shifted trade partners, secured deals with Europe, and helped globalize their currency. Meanwhile, America was debating whether tariffs on dishwashers would “teach China a lesson.”

And the trade deficit? Yeah… that grew. Oops.

“Maximum Pressure” Was Just a Fancy Term for Confusion

To keep the drama spicy, Trump often called his tariff strategy “maximum pressure” — which in practice meant maximum unpredictability. Policies would be announced one day, reversed the next, then reinstated two weeks later “if China doesn’t behave.” It was less economics and more toddler-at-a-candy-aisle energy.

Markets whiplashed. Businesses couldn’t plan beyond next Tuesday. And analysts developed migraines trying to interpret tweets as policy.

At one point, Trump even declared himself the “Chosen One” to fix trade. Economists chose instead to drink.

The Phase One Deal: A Paper Tiger in a Power Suit

In January 2020, after two years of economic dodgeball, the U.S. and China signed the now-legendary “Phase One” trade agreement. Headlines declared it a breakthrough. The reality? It was basically an awkward handshake with homework attached.

China agreed to buy an extra $200 billion in U.S. goods over two years — a target they hilariously missed by a wide margin. But in fairness, this was during a global pandemic, so we’ll generously give them a C+ for effort.

Meanwhile, the U.S. agreed not to raise tariffs any further. That’s right — the great American win was… not making things worse.

It’s like lighting your kitchen on fire and then awarding yourself a Nobel for promising not to throw gasoline on it again.

Fast-Forward to 2024–2025: Guess Who’s Still Paying for This?

Here’s the plot twist no one asked for: the tariffs are still here.

Despite multiple administration changes, lawsuits, lobbying efforts, and basic economic sense, most of Trump’s tariffs remain intact in 2025. Because if there’s one thing the U.S. government excels at, it’s being really bad at admitting mistakes.

U.S. businesses continue to pay billions in extra costs. Consumers are still wondering why toasters cost 40% more. And the government is stuck in a bizarre political limbo where removing tariffs looks weak, but keeping them looks dumb.

So naturally, they’ve opted to do nothing — a decision that takes zero courage and zero effort. Bipartisan excellence!

Meanwhile, China Was Playing 4D Chess

While the U.S. dabbled in economic cosplay, China quietly built stronger trade ties with Asia, Africa, and Europe. They expanded their Belt and Road Initiative, invested in rare earth minerals, and rolled out the digital yuan — all while pretending to be “deeply hurt” by American tariffs.

In reality, China had long planned for supply chain diversification. U.S. pressure just accelerated it. American companies? Not so much. Many are still trying to figure out if Vietnam makes semiconductors yet.

The Backtrack Heard ‘Round the Globe

Recently, the U.S. has started to “review” the tariffs — code for “we don’t know how to get out of this mess without looking like we started it.” Whispers of easing tariffs have sparked optimism in markets, but no one’s holding their breath. After all, the last six “reviews” produced about as much policy change as a frozen pizza.

Every administration wants to look tough on China, but no one wants to be the one to say, “Yeah, so, about those tariffs — maybe they were kinda dumb?” Because nothing says weakness like acknowledging economic facts.

Lessons Learned (Or Completely Ignored)

What did the world learn from this never-ending tariff telenovela?

Trade wars aren’t easy. Or good. Or winnable.

Weaponizing tariffs hurts your own economy. A lot.

Policy by tweet is about as reliable as a Magic 8 Ball.

China plays the long game. America plays cable news cycles.

And perhaps most importantly: there are no winners in a trade war. Just people stuck paying more for electronics, food, and furniture.

Final Thoughts: “Strategic Ambiguity” or Just Economic Karaoke?

The US China tariff war will go down in history as one of the most ambitious self-owns in modern economic memory. It had everything — drama, suspense, bailouts, empty victories, and a cast of characters who clearly hadn’t read past page 3 of their Econ 101 textbook.

What began as a flex turned into a multi-trillion-dollar punchline. And while the world waits for the next trade policy “pivot,” global investors are just hoping the next administration bases strategy on research… not rage-tweeting.

Because at the end of the day, the only thing worse than a trade war is realizing you’ve been fighting yourself the entire time.

Glossary of Terms (Tariff War Edition)

Tariff

A fancy word for “tax on stuff you import,” used by governments to sound strategic while charging their own people more for TVs and tires.

Trade Deficit

When one country buys more stuff from another country than it sells back. Apparently, this is offensive enough to start economic warfare.

Trade War

An international flex-off where both countries try to punish each other economically and somehow end up mostly hurting themselves.

TGE (Tweet-Generated Economics)

Not a real term, but based on actual events. See: U.S. trade policy announcements, 2018–2020.

Phase One Deal

The diplomatic equivalent of “let’s agree to pretend we fixed things” — a vague agreement signed by both parties after years of chaos.

Subsidy

When a government gives money to people it just hurt with its own policies. Also known as “self-rescue funding.”

Belt and Road Initiative

China’s global infrastructure strategy, aka “you ignored us, so we built trade routes with everyone else.”

Supply Chain Diversification

China: “Let’s trade with Africa and Europe too.”

U.S.: “Why is nothing made in Ohio anymore?”

Backtracking

The noble art of reversing a terrible decision while pretending it was always part of the plan.

Economic Patriotism

Telling people to pay more for goods “for the good of the country” — often by people who outsource their own manufacturing.

Frequently Asked Questions (FAQs)

1. What was the US–China tariff war actually about?

It started as an attempt to fix the trade imbalance between the U.S. and China. It ended as a multi-year economic soap opera where both sides suffered, and neither side could convincingly say they “won.”

2. Did tariffs actually reduce the U.S. trade deficit?

Nope. In fact, the trade deficit increased during the tariff war. So, the main goal of the policy failed — but on the bright side, we paid more for iPhones.

3. Who really paid for the tariffs?

American consumers and businesses. Despite the rhetoric, China didn’t write any checks to the U.S. Treasury. It’s like punching your reflection and calling it a victory.

4. What was the Phase One deal, and did it solve anything?

The Phase One deal was a symbolic agreement signed in 2020 that mostly paused the bleeding. China agreed to buy U.S. goods (and didn’t), and the U.S. agreed not to make things worse (for a while).

5. Why are the tariffs still in place years later?

Because no one wants to be the one who admits it was a bad idea. Tariff removal = political vulnerability. So the status quo continues, mostly out of inertia and pride.

6. How did China respond to U.S. pressure?

China quietly restructured global trade relationships, found new export markets, and built its own financial infrastructure while the U.S. kept tweeting threats. In short: they adapted.

7. Will another trade war happen in the future?

Only if governments continue using tariffs as political flexes rather than thoughtful tools. So… yes. Probably.

Disclaimer

This article is a work of satire and sarcasm, intended purely for entertainment and commentary purposes. While it references real political events, public figures, and policies, it does so with exaggerated humor and a strong dose of irony.

No offense is intended toward any individuals, nations, political parties, or global economic institutions (yes, even the ones that definitely deserve a light roast). All characters and events depicted are presented in a tongue-in-cheek manner and should not be interpreted as objective reporting, professional analysis, or foreign policy advice.

If you’re here for hard-hitting geopolitics, please consult a think tank. If you’re here for a laugh at the expense of global drama — welcome, you’re in the right place.

No actual flowers, tariffs, or diplomatic relationships were harmed in the making of this article.