In a monumental decision that will undoubtedly alter the trajectory of digital assets, President Donald Trump has officially introduced the U.S. Crypto Strategic Reserve. This initiative seeks to reinforce the country’s standing in the burgeoning field of cryptocurrency. As part of this effort, the White House will hold its first Crypto Summit on March 7, 2025, uniting critical industry players and decision makers.

Establishing the U.S. Crypto Strategic Reserve

On March 2, 2025, President Trump unveiled plans for the U.S. Crypto Strategic Reserve, signaling a significant shift in federal cryptocurrency policy. The reserve is set to include major digital assets such as Bitcoin (BTC), Ethereum (ETH), Ripple’s XRP, Solana (SOL), and Cardano (ADA). This initiative aligns with the administration’s goal to position the United States as the “crypto capital of the world.” Trump emphasized the strategic importance of this move, stating,

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration.”

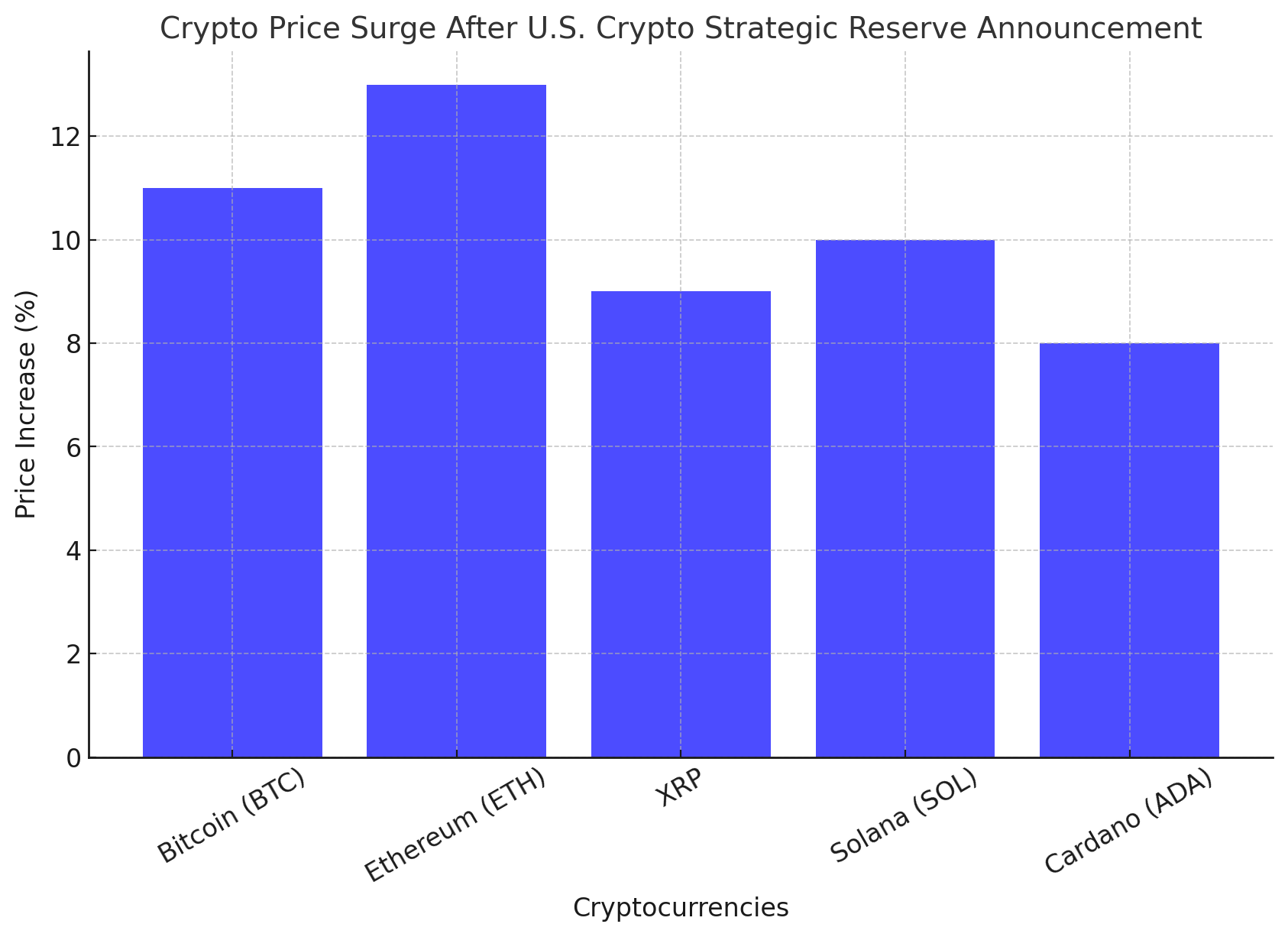

Market Reactions: A Surge in Cryptocurrency Values

The announcement had an immediate impact on cryptocurrency markets. Bitcoin’s price surged by over 11%, reaching approximately $94,000, while Ethereum saw a 13% increase, climbing to around $2,500. Other included cryptocurrencies, like XRP, Solana, and Cardano, also experienced notable gains. However, these gains were short-lived, with prices retracting to pre-announcement levels by the following day.

The Upcoming White House Crypto Summit: Objectives and Attendees

The White House has scheduled a Crypto Summit on March 7, 2025 to further discuss and develop this initiative. The summit aims to bring together prominent industry leaders and policymakers to deliberate on the future of digital assets in the U.S. David Sacks, appointed as the White House AI and Crypto Czar in December 2024, will chair the event. Confirmed attendees include:

- Brad Garlinghouse: CEO of Ripple, representing XRP.

- Michael Saylor: Executive Chairman of Strategy, known for his bullish stance on Bitcoin.

- Sergey Nazarov: Co-founder of Chainlink, a decentralized oracle network.

- JP Richardson: CEO of Exodus, a leading self-custodial crypto wallet provider.

- Matt Huang: Co-founder of Paradigm, a crypto investment firm.

The crypto summit’s agenda includes establishing clear regulatory guidelines, expanding oversight of stablecoins, and promoting blockchain development to position the U.S. as a leader in digital finance.

Diverse Perspectives: Support and Criticism

The establishment of the Crypto Strategic Reserve has elicited mixed reactions. Proponents argue that it signifies a progressive step towards embracing digital assets, potentially attracting massive investment inflows from financial institutions. Federico Brokate, head of U.S. business at 21Shares, remarked,

“This move signals a shift toward active participation in the crypto economy by the U.S. government.”

Conversely, critics express concerns over the volatility of cryptocurrencies and the potential misuse of taxpayer funds. Economist Stephen Cecchetti from Brandeis International Business School labeled the idea as “absurd,” highlighting its risky nature. Additionally, there are apprehensions about possible conflicts of interest, given the administration’s close ties with the crypto industry. Notably, David Sacks, the appointed Crypto Czar, has prior investments in the sector, although he claimed to have divested before his government role.

The Final Verdict

The U.S. Crypto Strategic Reserve positions the United States alongside other nations exploring digital asset reserves. Countries like China and the United Kingdom are also considering similar initiatives, reflecting a global trend towards integrating cryptocurrencies into national financial systems.

The upcoming White House Crypto Summit is expected to address these concerns and outline a strategic framework for integrating cryptocurrencies into the national financial system. The outcomes of this crypto summit could have profound implications for the future of digital assets in the United States and beyond.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the U.S. Crypto Strategic Reserve?

The U.S. Crypto Strategic Reserve is a proposed government-held stockpile of select cryptocurrencies, including Bitcoin, Ethereum, XRP, Solana, and Cardano, aiming to strengthen the nation’s position in the digital asset market.

Why is the White House hosting a Crypto Summit?

The crypto summit aims to bring together industry leaders and policymakers to discuss regulatory frameworks, innovation, and the integration of cryptocurrencies into the U.S. financial system.

Who are some of the confirmed attendees for the crypto summit?

Confirmed attendees include Ripple CEO Brad Garlinghouse, Strategy Executive Chairman Michael Saylor, Chainlink Co-founder Sergey Nazarov, Exodus CEO JP Richardson, and Paradigm Co-founder Matt Huang.

What are the potential benefits of the Crypto Strategic Reserve?

Proponents believe it could attract significant institutional investments, provide greater regulatory clarity, and position the U.S. as a leader in digital asset innovation.

What concerns have been raised about the reserve?

Critics highlight the volatility of cryptocurrencies, potential misuse of taxpayer funds, and possible conflicts of interest within the administration.

Glossary

Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

Ethereum (ETH): A decentralized platform that enables smart contracts and decentralized applications (dApps).

Altcoin: Any cryptocurrency other than Bitcoin. Examples include Ethereum, Ripple (XRP), and Litecoin.

Blockchain: A decentralized digital ledger that records all transactions across a network of computers. Each block contains a list of transactions, and blocks are linked together in chronological order.

Consensus Mechanism: A process used in blockchain systems to achieve agreement on a single data value or a single state of the network among distributed processes or systems. Common mechanisms include Proof of Work (PoW) and Proof of Stake (PoS).