Shiba Inu spent the last week in a narrow range, yet the blockchain told a louder story. Two deep-pocketed wallets accumulated 10.4 trillion SHIB, about $110 million, between June 29 and 30, according to on-chain data parsed by CoinDesk Analytics.

At the same time, the token printed an “inside-week” candle, a pattern in which the latest weekly high and low sit entirely inside the previous week’s range, often a prelude to a volatility burst. The coincidence of whale demand and technical compression has traders asking whether Shiba Inu price today can finally punch through resistance at $0.00001220.

SHIB Whale Footsteps Grow Louder

Blockchain sleuths first flagged the accumulation wave early on June 29, when a freshly funded address lifted 6.1 trillion SHIB in three transactions. A second wallet followed within hours, grabbing another 4.3 trillion. Together they now control just over 1 percent of circulating supply, placing them among the ten largest non-exchange holders. CoinDesk notes that the buys arrived after SHIB had fallen 27 percent from its May swing high, suggesting opportunistic value-hunting rather than momentum chasing.

Exchange data confirm the flow: reserves on major centralized venues dropped roughly nine trillion tokens during the same window, hinting that the purchases moved straight into cold storage. Shrinking exchange floats historically correlate with upward follow-through once sentiment flips.

Compression on the Chart

The inside-week setup reinforces that narrative. After failing to break below support at $0.00001050, SHIB’s weekly candle closed with a high of $0.00001198 and a low of $0.00001147, both inside the prior week’s band. Such tight action often ends in an explosive move as order-book liquidity thins. For bulls, the trigger sits just above $0.00001220; a close above that level would mark the first higher high on a weekly basis since April.

Bears, however, point to a looming death-cross on the longer-term chart: the 50-week moving average is within striking distance of falling beneath the 200-week line, a signal that preceded major draw-downs in 2022.

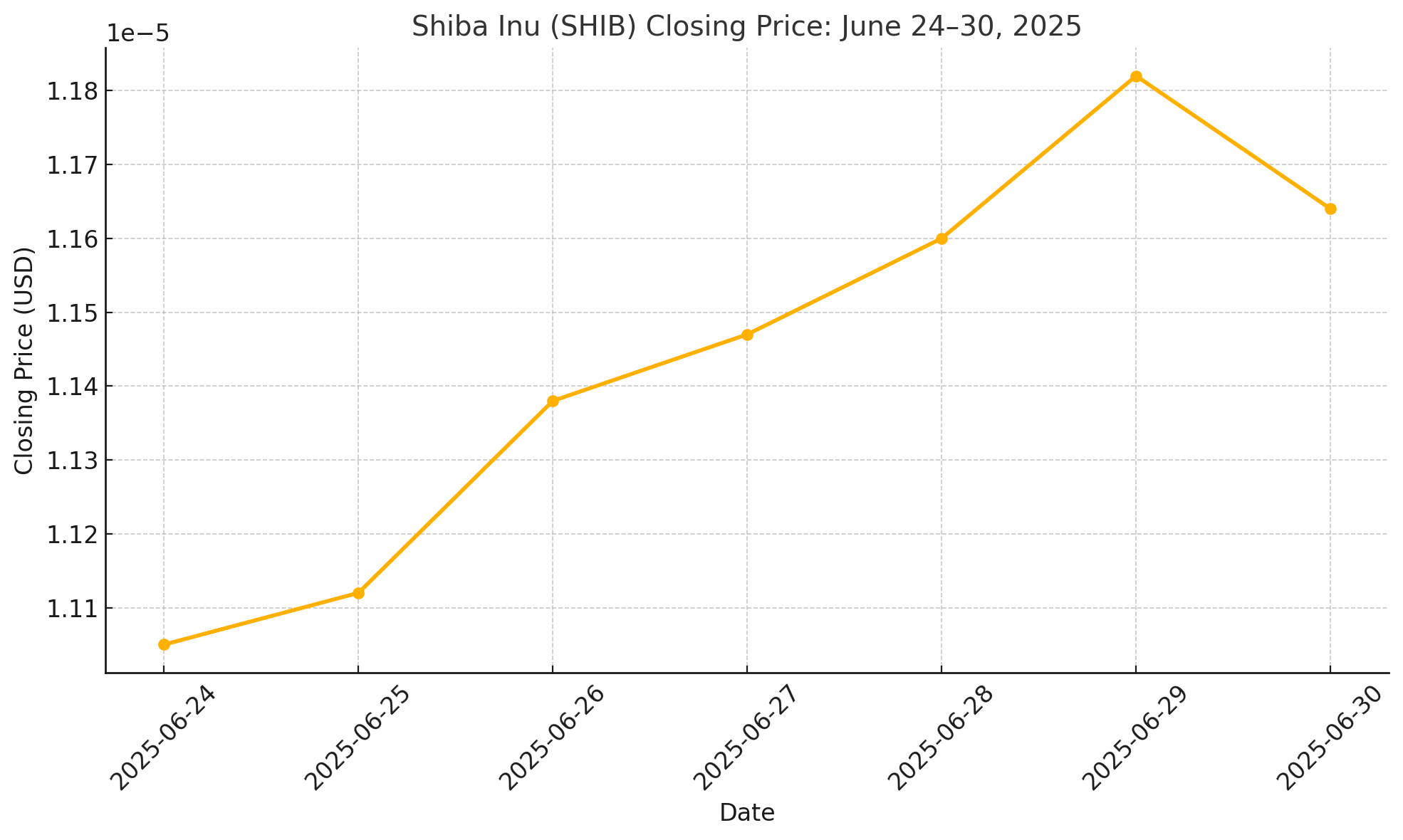

Shiba Inu price today: seven-day snapshot

| Date (2025) | Open | High | Low | Close |

|---|---|---|---|---|

| Jun 24 | 0.00001120 | 0.00001135 | 0.00001090 | 0.00001105 |

| Jun 25 | 0.00001105 | 0.00001140 | 0.00001080 | 0.00001112 |

| Jun 26 | 0.00001112 | 0.00001160 | 0.00001085 | 0.00001138 |

| Jun 27 | 0.00001138 | 0.00001170 | 0.00001115 | 0.00001147 |

| Jun 28 (Pi2Day) | 0.00001147 | 0.00001185 | 0.00001130 | 0.00001160 |

| Jun 29 (whale buys) | 0.00001160 | 0.00001198 | 0.00001140 | 0.00001182 |

| Jun 30 | 0.00001182 | 0.00001195 | 0.00001160 | 0.00001164 |

Table compiled from TradingView hourly closes; values rounded to nearest 1 × 10⁻⁸ USD.

The tightest intraday spread—just 3.8 percent—occurred on June 30, underscoring how little speculative capital is needed to jolt price once the current equilibrium breaks. Traders, therefore, watch the Shiba Inu price today for any high-volume thrust outside the $0.00001147-$0.00001198 corridor.

On-chain Undercurrents

IntoTheBlock’s “large-holders net-flow” metric flipped positive for the first time in six weeks, while retail transaction counts fell, signaling that whales rather than crowds are dictating tape action. Meanwhile, token burns on Shibarium rose 175 percent week-over-week, removing 1.2 billion SHIB from circulation. Although burn totals remain tiny next to the 589-trillion supply, each spike tightens float at the margin and can accelerate breakouts that whales spark.

Catalysts that Could Decide Direction

Weekly close (July 7): A settlement above $0.00001220 would validate the bullish thesis that the inside-week pattern marks a trend reversal.

Shibarium throughput: Daily transactions approaching five million would materially lift burn rates, fortifying supply-side pressure.

Macro beta: SHIB’s correlation to ether has slipped to 0.42; independent catalysts such as whale flows or ecosystem news therefore carry more weight than broad-market swings.

Death-cross watch: Should Shiba Inu price today drift under $0.00001070, the moving-average crossover turns real, potentially unleashing algorithmic sell programs.

Scenario Analysis

| Scenario | Trigger | Target | Probability* |

|---|---|---|---|

| Bull breakout | Weekly close > $0.00001220 | $0.00001450 (May high) | 45 % |

| Extended range | No close outside $0.00001130-$0.00001220 | $0.00001100-$0.00001200 chop | 35 % |

| Bear breakdown | Close < $0.00001070 (death-cross) | $0.00000920 (2024 base) | 20 % |

*Estimates based on options-implied volatility and order-book depth.

Outlook: Coiled Spring or Trap?

The battle lines are clear. Whale wallets have restocked, exchange supply is shrinking, and an inside-week candle signals that energy is bottled up. Yet the shadow of a death-cross and still-muted retail interest warns against complacency. In previous cycles, the side that won was the one backed by flows, not tweets. Watching Shiba Inu price today around the $0.00001220 pivot, and tracking whether whales keep adding or cash out, will reveal whether bulls finally wrest control or whether bears remain in command.

FAQs

1. Why is Shiba Inu price today not moving much despite whale activity?

Whale accumulation is rising, but price remains compressed due to low retail volume and technical resistance near $0.00001220.

2. What is an inside-week candle in technical analysis?

An inside-week candle forms when a week’s high and low fall within the previous week’s range, signaling a potential volatility breakout.

3. How much SHIB did whales buy recently?

Two wallets accumulated 10.4 trillion SHIB (≈ $110 million), shifting tokens off exchanges and tightening available supply.

Glossary of Key Terms

Shiba Inu (SHIB): A meme-based cryptocurrency and token on the Ethereum blockchain known for its community-driven ecosystem.

Whale: A wallet or entity that holds a significant amount of cryptocurrency capable of influencing market movements.

Inside-Week Candle: A candlestick pattern where the current week’s price range is completely within the prior week’s range, suggesting an upcoming breakout.

Death Cross: A bearish chart pattern where a short-term moving average crosses below a long-term average, often signaling downward momentum.

Shibarium: Shiba Inu’s Layer-2 blockchain that helps scale transactions and enables SHIB token burns through usage fees.

SHIB Burn: The permanent removal of SHIB tokens from circulation, often executed through transaction fees or burn events.

Exchange Reserves: The amount of SHIB held on centralized exchanges, with lower reserves typically indicating less immediate sell pressure.