Digital asset service provider BitGo has integrated support for the Stacks blockchain to enhance Bitcoin functionality. According to Stacks’ ecosystem investor lead, this development indicates the rising institutional demand for BTC. Officials say the integration aims to provide institutional investors with new avenues for generating Bitcoin rewards, showcasing the growing institutional BTC demand.

BitGo’s integration of the Bitcoin layer-2 (L2) network Stacks is expected to enable its users to earn Bitcoin (BTC) rewards through “stacking.” This process allows STX holders to generate native BTC yield directly in their wallets, bypassing the need to lend or expose their assets to additional risks. This integration is seen as a critical step towards making Bitcoin a more productive asset, aligning with the rising institutional BTC demand.

Institutional BTC Demand Spurs New Integrations

According to Kyle Ellicott, the ecosystem investor lead at Stacks, this integration highlights the increasing institutional BTC demand. Ellicott stated, “Allowing institutions to earn native Bitcoin yield with their STX is a huge step for Bitcoin as part of BitGo’s goal to put institutional capital to work with DeFi and staking. Making Bitcoin a productive asset is crucial for Bitcoin to succeed long term as rails for a decentralized economy.”

The partnership between BitGo and Stacks could offer Bitcoin holders a new way to interact with decentralized finance protocols. This is particularly beneficial for those who have been hesitant to engage with DeFi due to the risks associated with smart contracts and proof-of-stake protocols. The move underscores the growing institutional demand for BTC, which is driving innovation and new partnerships in the cryptocurrency space.

Expanding Bitcoin’s DeFi Horizons

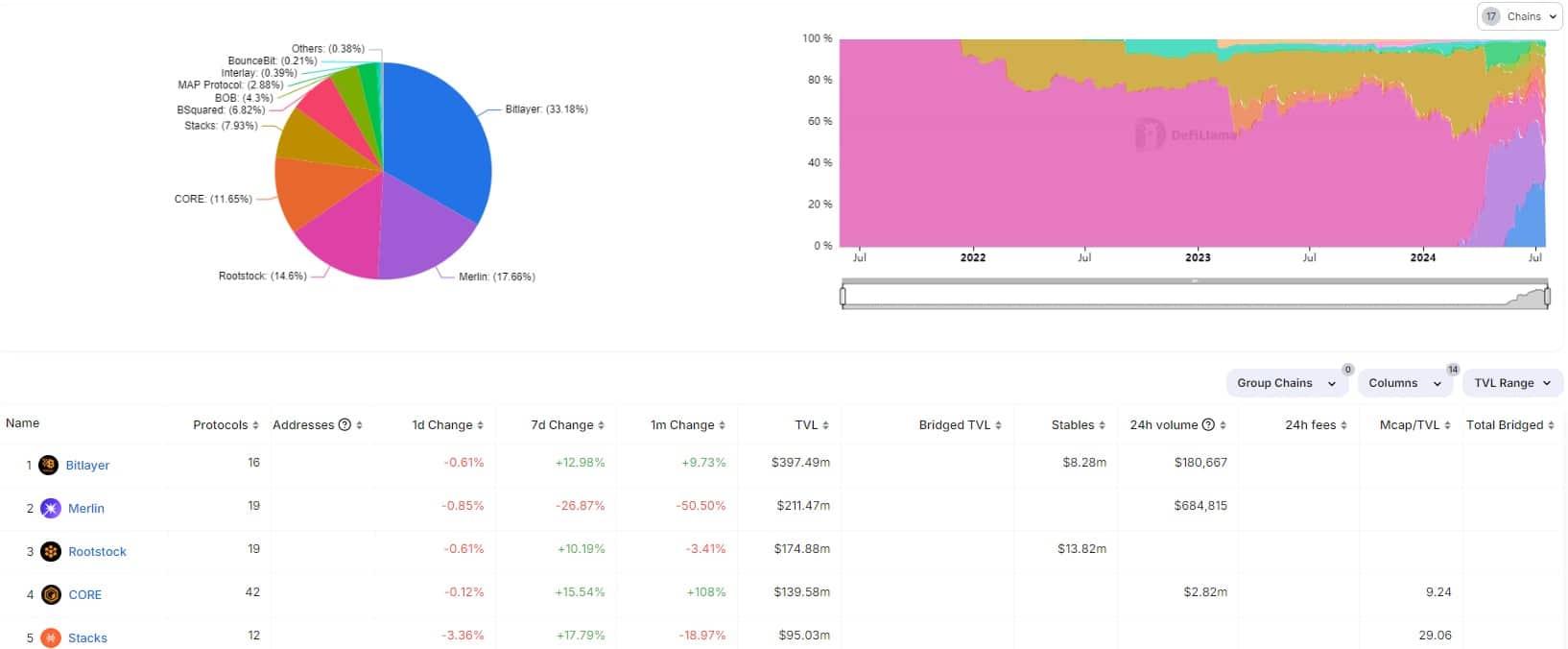

Stacks, known as Bitcoin’s smart contract layer, ranks as the fifth-largest Bitcoin layer-2 solution, with over $95 million in total value locked, accounting for a 7.9% market share among all Bitcoin layer-2 solutions, according to DefiLlama. This integration is part of the broader trend of increasing institutional BTC demand, as more financial entities seek to leverage Bitcoin’s potential within the DeFi space.

BitGo will support the new Stacks token standard, sBTC, and will become a “Signer” on the network, contributing to block production and consensus. This support will facilitate deposits and withdrawals for sBTC, as well as the conversion of BTC to sBTC across layer 1s and layer 2s. Other sBTC signers include prominent names such as Figment, Blockdaemon, Near Foundation, Luganodes, and Chorus One.

Enhancing Bitcoin’s Programmability

The integration comes as Stacks is preparing for the full release of sBTC, a non-custodial, 1:1 Bitcoin-backed asset designed to enhance the programmability of the Bitcoin network. This move is anticipated to make it easier for developers to build DeFi applications on Bitcoin, further driving the institutional BTC demand. Stacks’ sBTC aims to leverage Bitcoin’s security and reliability to boost DeFi adoption.

Stacks is also on the verge of activating its Nakamoto Release, which is expected to pave the way for sBTC and 100% Bitcoin finality. The release was initiated on April 22, with full activation expected to occur on August 28, according to Stacks’ roadmap. This development is a significant milestone in the context of growing institutional BTC demand, as it promises to bring new functionality and security to Bitcoin DeFi.

A Renaissance for Bitcoin DeFi

The partnership between BitGo and Stacks marks a new chapter for Bitcoin DeFi, or BTCFi. This emerging movement aims to add more utility to the Bitcoin network, driven by the increasing institutional BTC demand. According to Ellicott, “Stacks will inherit 100% of Bitcoin’s security budget, making transactions as irreversible as Bitcoin and enabling sBTC to facilitate decentralized BTC movement into the L2. This release will begin another renaissance of new Bitcoin builders, technical upgrades, and growth in user interest, providing a promising spotlight for the future of Bitcoin DeFi.”

Bitcoin DeFi is introducing innovative products to the crypto space, including the first-ever Bitcoin-backed synthetic dollar with yield-generating capabilities. One notable example is Hermetica’s Bitcoin-based synthetic dollar, USDh, debuting in June with a 25% annual yield derived from future funding rates. This highlights the potential and growing interest in Bitcoin DeFi, fueled by the rising institutional BTC demand.

Conclusion

BitGo’s integration of Stacks for Bitcoin rewards underscores the increasing institutional BTC demand and marks a significant step forward for Bitcoin’s role in decentralized finance. This partnership provides new opportunities for institutional investors to earn Bitcoin rewards and paves the way for further innovations in Bitcoin DeFi. As the market evolves, the institutional BTC demand continues to drive new developments, promising a dynamic future for the cryptocurrency ecosystem.